Connecticut Buy Sell Clauses and Related Material

Description

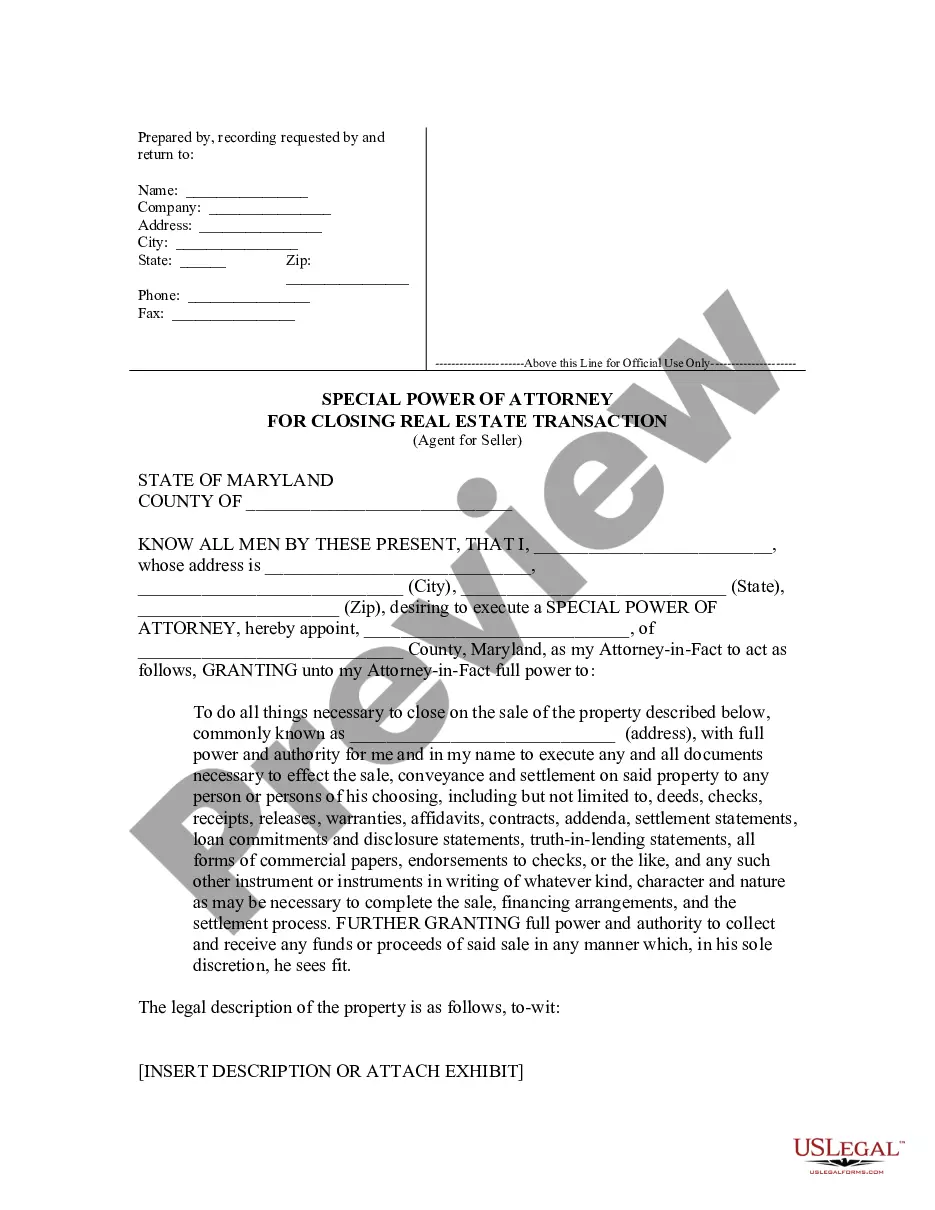

How to fill out Buy Sell Clauses And Related Material?

If you want to total, download, or print authorized file templates, use US Legal Forms, the biggest selection of authorized varieties, that can be found on-line. Use the site`s basic and handy look for to find the papers you will need. Various templates for enterprise and individual reasons are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to find the Connecticut Buy Sell Clauses and Related Material in a few mouse clicks.

When you are currently a US Legal Forms consumer, log in in your profile and click on the Download option to obtain the Connecticut Buy Sell Clauses and Related Material. Also you can accessibility varieties you earlier acquired within the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for your correct metropolis/land.

- Step 2. Take advantage of the Preview option to check out the form`s content material. Don`t neglect to read the information.

- Step 3. When you are unsatisfied with all the type, utilize the Look for field on top of the screen to locate other versions in the authorized type template.

- Step 4. When you have identified the shape you will need, select the Acquire now option. Pick the pricing program you prefer and include your accreditations to register for an profile.

- Step 5. Approach the transaction. You can use your credit card or PayPal profile to complete the transaction.

- Step 6. Select the file format in the authorized type and download it on your product.

- Step 7. Comprehensive, revise and print or sign the Connecticut Buy Sell Clauses and Related Material.

Each authorized file template you buy is your own property permanently. You possess acces to each type you acquired within your acccount. Click the My Forms segment and select a type to print or download once more.

Remain competitive and download, and print the Connecticut Buy Sell Clauses and Related Material with US Legal Forms. There are many specialist and condition-distinct varieties you can utilize for your enterprise or individual needs.

Form popularity

FAQ

There are no additional sales taxes imposed by local jurisdictions in Connecticut. While the general sales and use tax rate is 6.35%, other rates are imposed under Connecticut law as follows: 1%

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.

The following pieces of information should be spelled out in a buy and sell agreement: a list of triggering buyout events, including death, permanent disability, bankruptcy or retirement, etc. a list of partners or owners involved and their current equity stakes. a recent valuation of the company's overall equity.

To be able to sell real property securities to the general public in Connecticut, whether for yourself or as someone else's agent, not only do you need a real estate license, but you also need an endorsement (additional permission) from the Connecticut Real Estate Commission authorizing you as a real property ...

Connecticut is one of the few states that only has a statewide sales tax rate. There are no local sales tax rates, which means that collecting sales tax is easy. No matter if you live in Connecticut or out of state, charge a flat 6.35% in sales tax to your customers in Connecticut.

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.

Use tax applies to the purchase or lease of assets such as furniture, equipment, machines, instruments and computers. It also applies to the purchase of goods such as office supplies, paper, stationery items, certain publications, packaged software, and books which are used by the business.

Enacted to fill a $1.5 billion budget gap Lamont inherited in 2019, the surcharge brings the total sales tax on restaurant meals and prepared foods in grocery stores to 7.35 percent. It raises about $70 million a year.