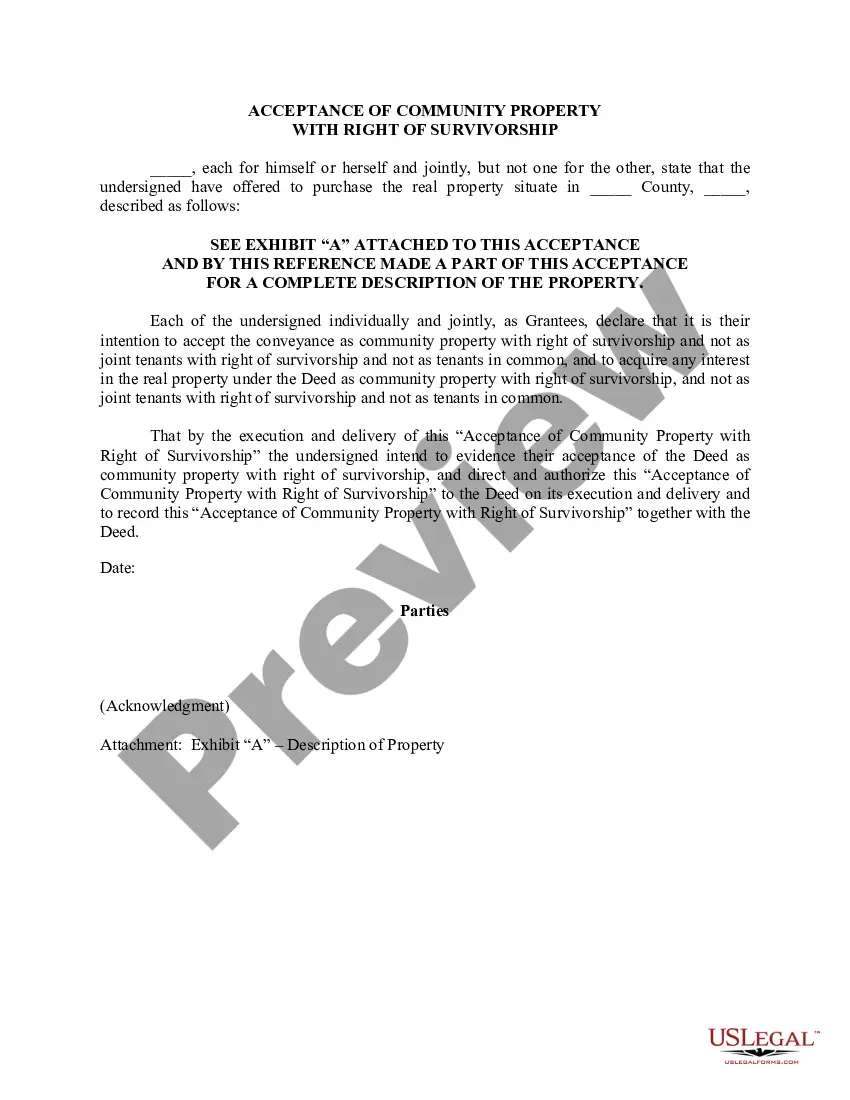

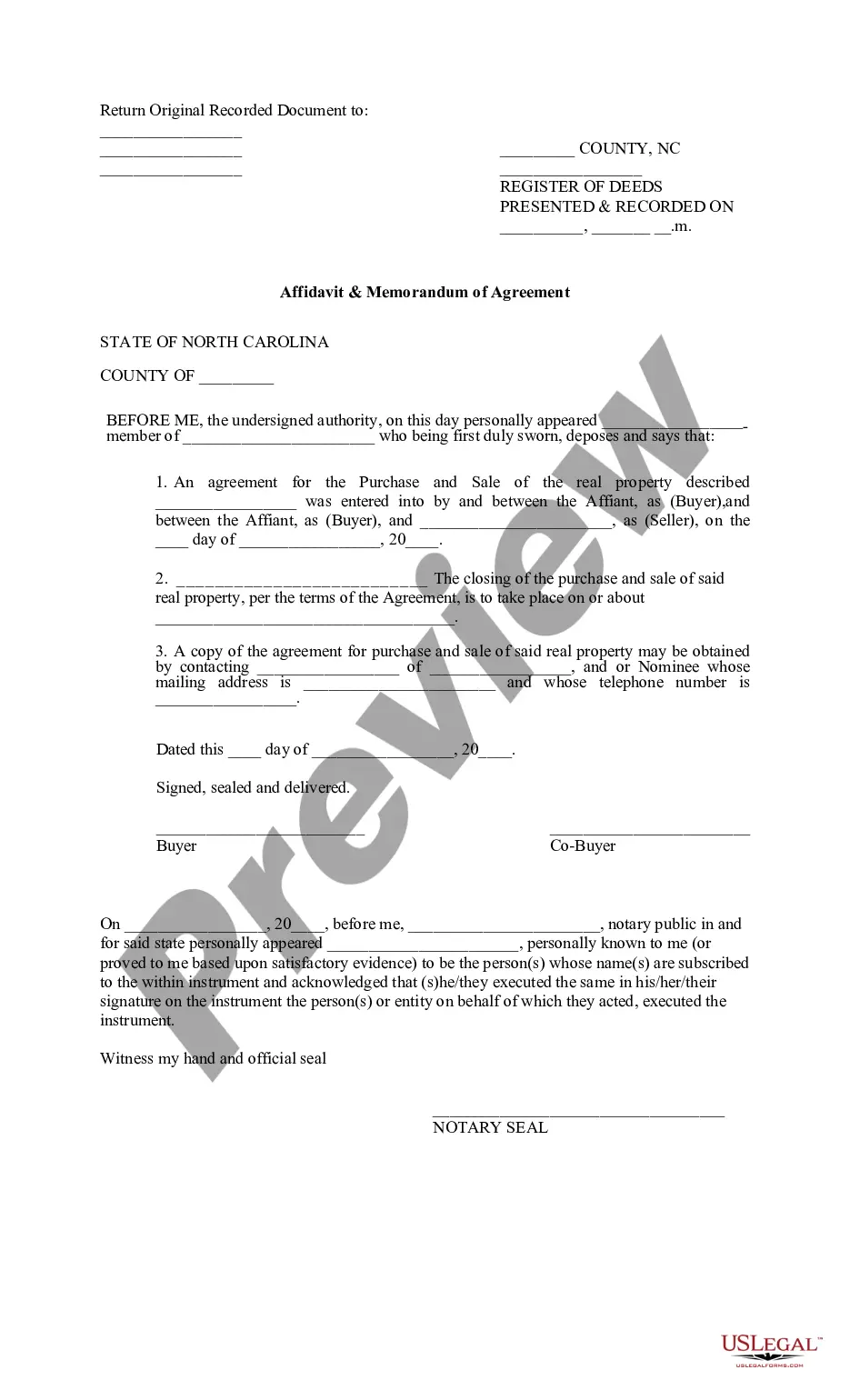

Connecticut Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

Choosing the best legitimate record design could be a struggle. Needless to say, there are plenty of themes accessible on the Internet, but how can you discover the legitimate type you need? Use the US Legal Forms site. The service provides thousands of themes, such as the Connecticut Deed (Including Acceptance of Community Property with Right of Survivorship), which you can use for company and private requirements. Each of the varieties are inspected by pros and meet up with state and federal needs.

If you are currently authorized, log in to the bank account and then click the Acquire switch to obtain the Connecticut Deed (Including Acceptance of Community Property with Right of Survivorship). Make use of bank account to look with the legitimate varieties you might have acquired formerly. Visit the My Forms tab of your respective bank account and obtain an additional copy of the record you need.

If you are a new consumer of US Legal Forms, here are basic guidelines so that you can adhere to:

- Initially, be sure you have selected the appropriate type for the area/area. It is possible to look through the form making use of the Preview switch and read the form information to make sure this is basically the best for you.

- When the type will not meet up with your preferences, use the Seach field to discover the appropriate type.

- When you are certain the form is acceptable, click the Get now switch to obtain the type.

- Select the costs program you want and enter the required information and facts. Make your bank account and pay money for the order utilizing your PayPal bank account or charge card.

- Choose the submit structure and acquire the legitimate record design to the device.

- Total, change and print and indication the received Connecticut Deed (Including Acceptance of Community Property with Right of Survivorship).

US Legal Forms may be the most significant local library of legitimate varieties for which you can discover various record themes. Use the service to acquire skillfully-made paperwork that adhere to condition needs.

Form popularity

FAQ

A survivorship deed is a deed conveying title to real estate into the names of two or more persons as joint tenants with rights of survivorship. Upon the death of one owner, the property passes to and vests in the name of the surviving owner or owners.

Transfer-on-Death Deeds for Real Estate Connecticut does not allow real estate to be transferred with transfer-on-death deeds.

A survivorship requirement means that a beneficiary cannot inherit from you unless he or she lives for a certain period of time longer than you do. In general, it's a good idea to include a survivorship clause in your will or trust.

In Ohio, a survivorship deed creates a ?joint tenancy? between two or more owners. It ensures that the interest rights of a property will be passed to the surviving owner(s) in the event of the other tenant's death automatically.

Disadvantages of joint tenants with right of survivorship JTWROS accounts involving real estate may require all owners to consent to selling the property. Frozen bank accounts. In some cases, the probate court can freeze bank accounts until the estate is settled.

The biggest advantage to setting up a right of survivorship is avoiding the lengthy probate process after death. It usually allows property to transfer immediately without third-party interference.

If you die intestate in Connecticut, what your spouse inherits depends on whether or not you have living parents or descendants. If you don't, your spouse inherits everything. If you have living parents, and a surviving spouse, your spouse will inherit the first $100,000 of intestate property.

Survivorship deeds are common estate planning tools?and for good reason. With a survivorship deed, when one co-owner passes away, the property title transfers to the surviving co-owners without the need for probate, which can be a time-consuming and somewhat complicated process.