Connecticut Assignment and Conveyance of Net Profits Interest

Description

How to fill out Assignment And Conveyance Of Net Profits Interest?

Choosing the right legal papers design might be a battle. Needless to say, there are plenty of themes available on the net, but how do you get the legal form you want? Use the US Legal Forms site. The support offers 1000s of themes, for example the Connecticut Assignment and Conveyance of Net Profits Interest, which can be used for enterprise and private requirements. All the kinds are checked by specialists and satisfy federal and state needs.

When you are previously authorized, log in in your bank account and then click the Download option to get the Connecticut Assignment and Conveyance of Net Profits Interest. Use your bank account to search through the legal kinds you may have bought formerly. Check out the My Forms tab of your bank account and acquire yet another version in the papers you want.

When you are a whole new consumer of US Legal Forms, listed below are easy guidelines that you should adhere to:

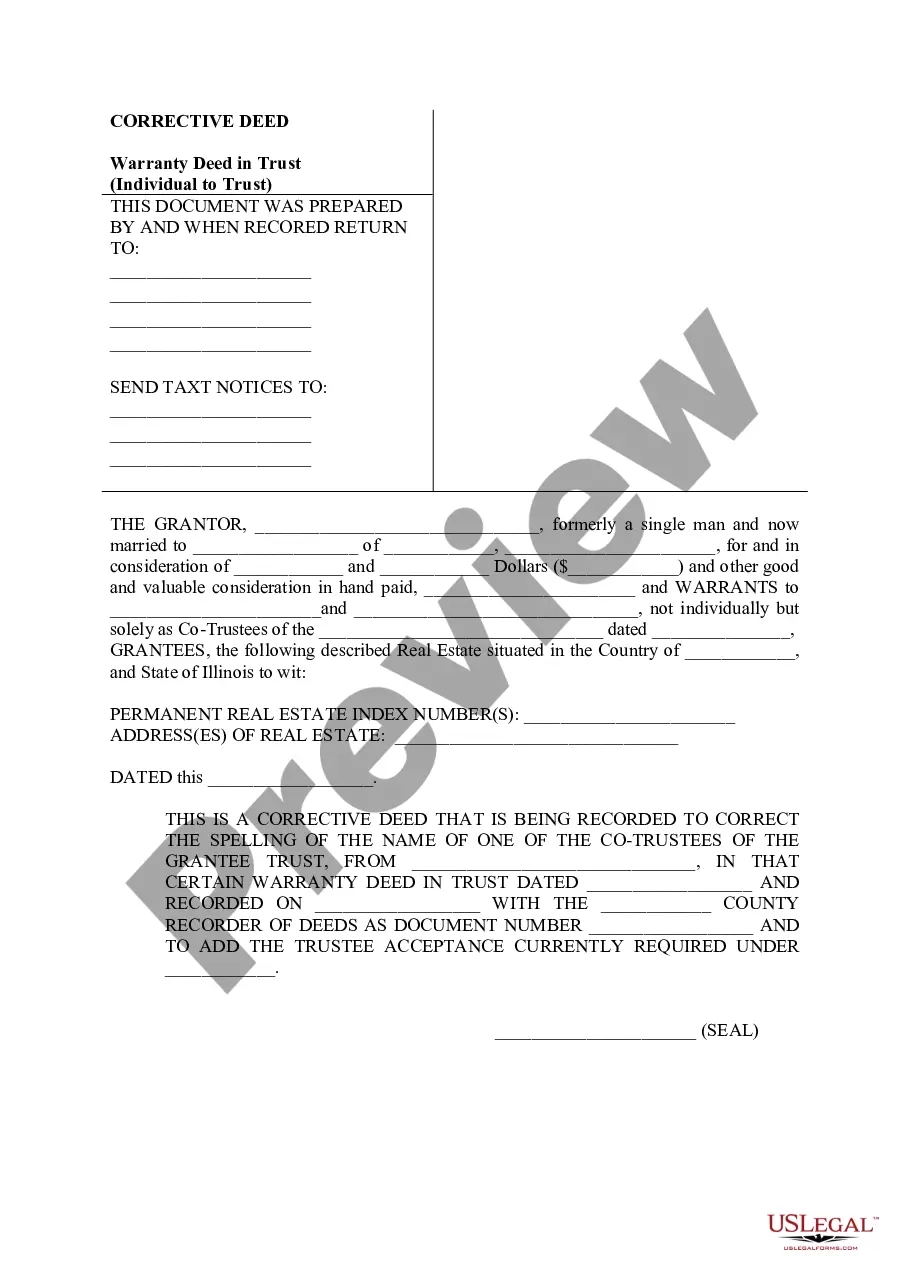

- First, make certain you have chosen the correct form to your city/area. You may check out the shape making use of the Review option and study the shape description to ensure it is the right one for you.

- In case the form is not going to satisfy your expectations, take advantage of the Seach industry to find the right form.

- When you are positive that the shape is acceptable, go through the Purchase now option to get the form.

- Select the costs plan you need and enter the necessary info. Build your bank account and pay money for the transaction utilizing your PayPal bank account or charge card.

- Choose the data file file format and download the legal papers design in your system.

- Total, revise and print out and sign the received Connecticut Assignment and Conveyance of Net Profits Interest.

US Legal Forms is definitely the biggest catalogue of legal kinds for which you can find a variety of papers themes. Use the service to download skillfully-manufactured papers that adhere to condition needs.