Connecticut Letter for Account Paid in Full

Description

How to fill out Letter For Account Paid In Full?

You might spend hours online trying to locate the legal document template that fulfills the state and federal requirements you need. US Legal Forms provides thousands of legal forms that are vetted by professionals.

You can obtain or create the Connecticut Letter for Account Paid in Full from their services. If you possess a US Legal Forms account, you can Log In and hit the Obtain button. After that, you can complete, edit, print, or sign the Connecticut Letter for Account Paid in Full.

Every legal document template you obtain is yours permanently. To access another version of the purchased form, navigate to the My documents section and click the corresponding button. If you're using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for your area/city that you choose. Review the form details to confirm you have selected the right form. If available, utilize the Preview button to browse through the document template as well.

- If you wish to get another version of the form, use the Search field to find the template that matches your needs and requirements.

- Once you have located the template you want, click Buy now to continue.

- Select the pricing plan you prefer, input your credentials, and sign up for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

- Choose the format of the document and download it to your device.

- Make modifications to your document if necessary. You can complete, edit, sign, and print the Connecticut Letter for Account Paid in Full.

- Access and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

You should mail your Connecticut tax payments to the address specified on the tax form you are using. Different forms may have different mailing addresses, so it is crucial to check. If you need assistance with the process or require a Connecticut Letter for Account Paid in Full for your records, US Legal Forms offers resources to help you navigate these requirements.

A refund offset notice in Connecticut informs you that your state tax refund is being applied to a debt you owe. This could include unpaid taxes or other debts to the state. It is essential to address these issues promptly to avoid further complications. If you need documentation, a Connecticut Letter for Account Paid in Full can clarify your financial standing.

For Connecticut state taxes, you should make your check payable to the 'Connecticut Department of Revenue Services'. This ensures that your payment is processed correctly and efficiently. If you have questions about your tax payments or need a Connecticut Letter for Account Paid in Full, consider using US Legal Forms for guidance.

The mailing address for the IRS in Connecticut depends on the type of form you are submitting. Typically, you can send your tax returns to the IRS address specific to your filing type. Make sure to check the IRS website for the most accurate information. If you require a Connecticut Letter for Account Paid in Full for your records, US Legal Forms offers templates to help you.

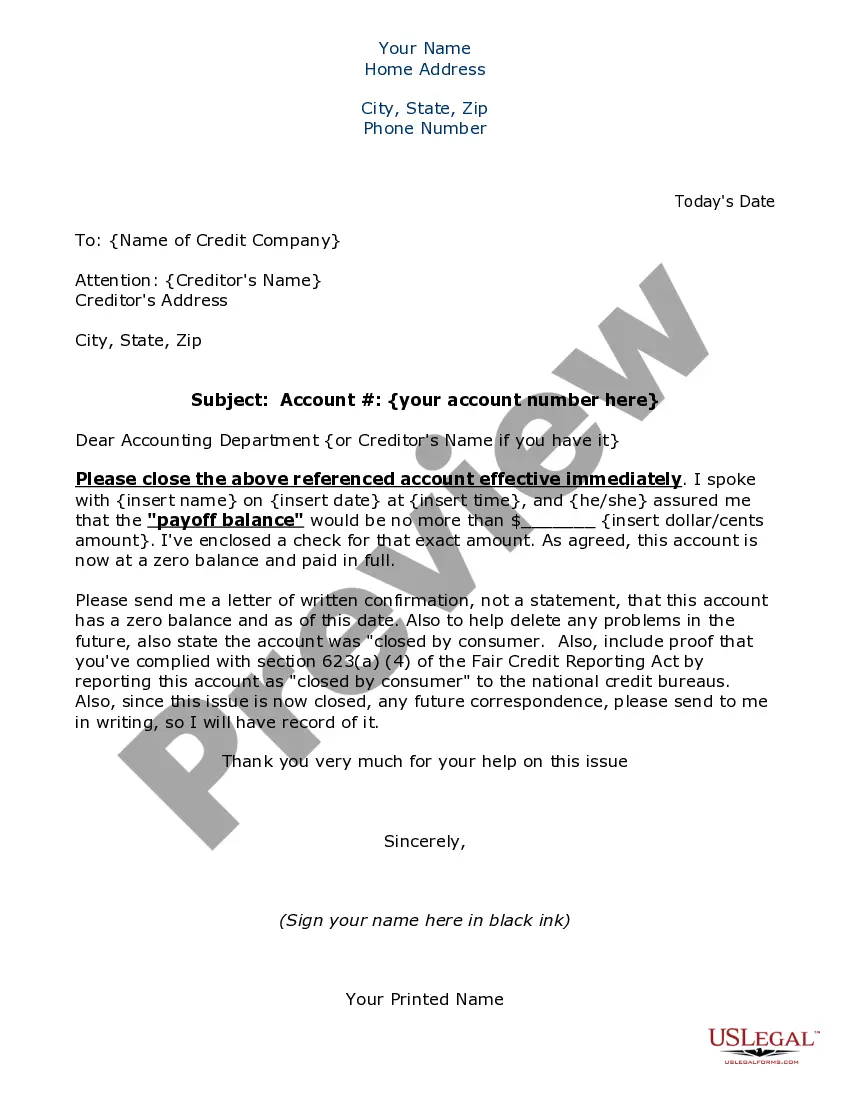

To get a paid-in-full letter, reach out to your creditor and formally request the Connecticut Letter for Account Paid in Full. It is helpful to provide any receipts or documentation that confirm your payment. If you want a straightforward approach, US Legal Forms offers easy-to-use templates that can guide you through the process efficiently.

When a debt is paid in full, the lender is obligated to provide you with a Connecticut Letter for Account Paid in Full. This letter serves as proof that you have settled your obligation, which can be important for your credit history. Additionally, it clears any lingering doubts about the debt, ensuring that you have a clean slate moving forward.

To obtain your Connecticut Letter for Account Paid in Full, start by contacting the creditor to request the letter. Ensure you have documentation of your payment, as this will help expedite the process. If you encounter difficulties, consider using platforms like US Legal Forms, which provide templates and guidance to assist you in drafting your request.

To request a paid-in full letter, reach out to your creditor or service provider. Be polite and provide the necessary details, such as your account number and payment information. If you want to ensure your request is formal and clear, explore the templates available on US Legal Forms for guidance on how to structure your request effectively.

'Paid in full' means that all obligations related to a certain account have been satisfied. This indicates that no further payments are due, and the account has been closed or settled. Understanding this term is crucial for maintaining clear financial records, and if you need a formal statement, consider requesting a Connecticut Letter for Account Paid in Full.

When writing a paid-in full letter, start with a clear subject line and include both your and the recipient's information. State that the account has been paid in full, include the payment date, and provide the account number for reference. For a well-structured letter, you might find it helpful to use a Connecticut Letter for Account Paid in Full template from US Legal Forms.