Connecticut Petition for Creation of Historic District

Description

How to fill out Petition For Creation Of Historic District?

You can invest several hours on the web attempting to find the legal document design which fits the federal and state specifications you want. US Legal Forms provides thousands of legal varieties that are evaluated by pros. You can actually down load or print out the Connecticut Petition for Creation of Historic District from my services.

If you already have a US Legal Forms profile, you may log in and then click the Acquire option. After that, you may full, edit, print out, or indication the Connecticut Petition for Creation of Historic District. Each and every legal document design you buy is yours for a long time. To have an additional backup of any obtained kind, proceed to the My Forms tab and then click the related option.

Should you use the US Legal Forms site the first time, adhere to the basic guidelines under:

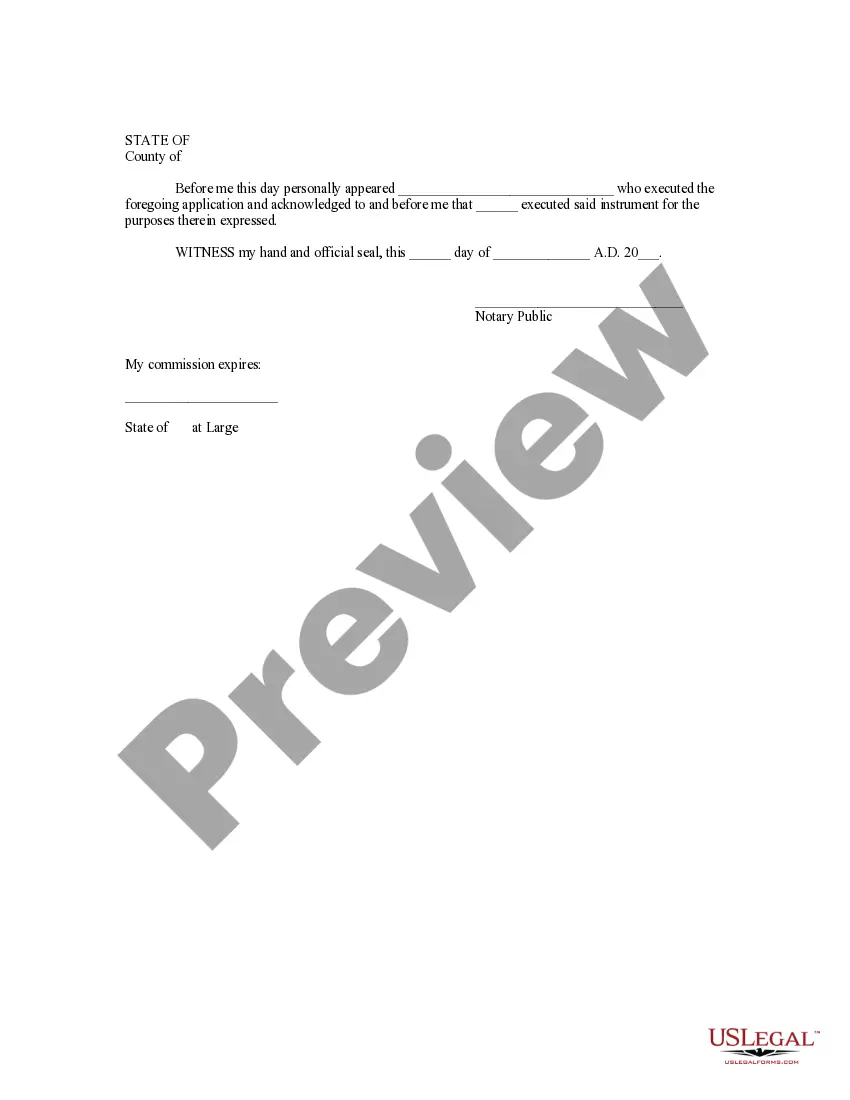

- Initial, make certain you have chosen the correct document design to the county/area of your choice. Browse the kind description to ensure you have picked the proper kind. If offered, take advantage of the Review option to appear from the document design at the same time.

- In order to get an additional variation of the kind, take advantage of the Lookup industry to discover the design that fits your needs and specifications.

- When you have located the design you want, click on Purchase now to carry on.

- Pick the rates plan you want, type in your accreditations, and sign up for a merchant account on US Legal Forms.

- Full the purchase. You can utilize your bank card or PayPal profile to pay for the legal kind.

- Pick the formatting of the document and down load it for your gadget.

- Make changes for your document if needed. You can full, edit and indication and print out Connecticut Petition for Creation of Historic District.

Acquire and print out thousands of document themes utilizing the US Legal Forms Internet site, which offers the greatest selection of legal varieties. Use specialist and condition-certain themes to take on your business or individual needs.

Form popularity

FAQ

CONNECTICUT HISTORICAL COMMISSION It has 12 members appointed by the governor and is in the Department of Education for administrative purposes only. The commission is responsible for a wide spectrum of activities related to its mission of protecting and preserving Connecticut's heritage.

22-118 §408 (effective ). In addition, eligibility for the property tax credit is expanded to all adults within current income limits ($109,500 for single filers and $130,500 for joint filers). Previously, the property tax credit was limited to only those over the age of 65 or those with dependents.

The Federal Historic Preservation Tax Incentives program encourages private sector investment in the rehabilitation and re-use of historic buildings. It creates jobs and is one of the nation's most successful and cost-effective community revitalization programs.

Overview. In October 2019, Governor Gavin Newsom signed Senate Bill 451 into law. This incredibly important bill created a statewide historic rehabilitation tax credit, providing a new financial incentive for the rehabilitation of historic buildings. The program is anticipated to go into effect in 2022.

Credit Details Production Expenses or CostsPotential Tax Credit$100,000?$500,00010%$500,000?$1,000,00015%$1,000,000 or more30%

Overview. The Historic Homes Rehabilitation Tax Credit Program provides a 30% tax credit up to $30,000 for historic restoration and rehabilitation of one to four unit historic homes. A minimum expenditure of $15,000 is required. All work must meet the Secretary of the Interior Standards for Historic Rehabilitation.