This is the accounting form used in an accounting of a law firm on the complaint of a former partner. It includes assets, liabilities, total liabilities, net assets, and a computation of the former partner's share.

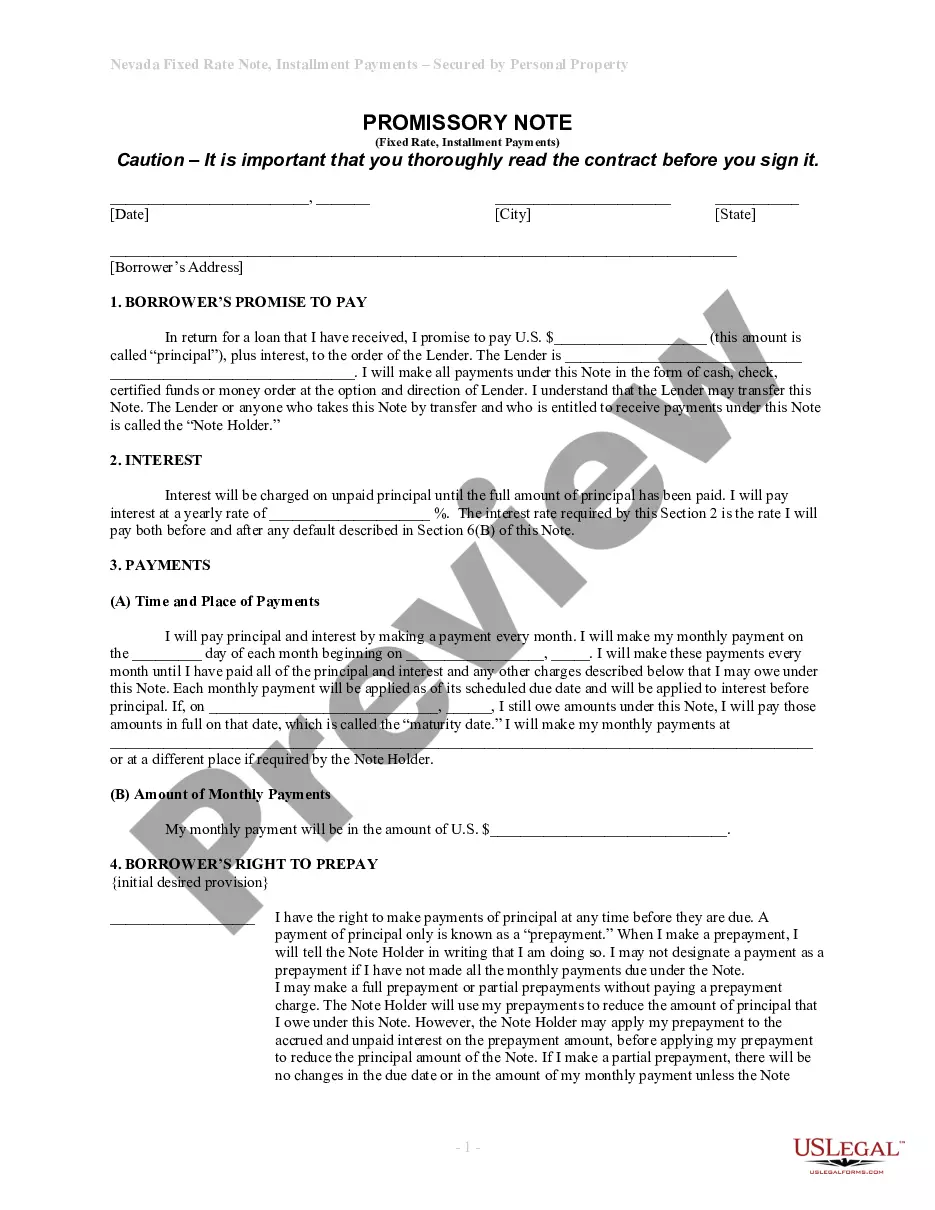

Connecticut Form of Accounting Index

Description

How to fill out Form Of Accounting Index?

Locating the suitable authentic document template may prove challenging. Naturally, numerous templates are accessible on the web, but how can you secure the genuine form that you require.

Utilize the US Legal Forms website. This platform provides an extensive collection of templates, including the Connecticut Form of Accounting Index, suitable for both business and personal use. All forms are evaluated by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Acquire button to access the Connecticut Form of Accounting Index. Use your account to review the legitimate forms you may have purchased in the past. Navigate to the My documents section of your account to obtain another copy of the documents you require.

US Legal Forms is the largest repository of legitimate documents where you can discover various document templates. Utilize the service to acquire properly crafted files that adhere to state regulations.

- First, ensure you have selected the correct form for your city/state. You can inspect the form using the Review button and read the form description to confirm it meets your needs.

- If the form does not meet your criteria, utilize the Search field to find the appropriate document.

- Once you are certain that the form is suitable, click the Buy now button to purchase the form.

- Choose the payment plan you prefer and input the necessary information. Create your account and complete the order using your PayPal account or credit card.

- Select the file format and download the legitimate document template to your device.

- Complete, modify, print, and sign the acquired Connecticut Form of Accounting Index.

Form popularity

FAQ

The Connecticut accountability index evaluates schools on a range of performance metrics, which informs education policy and funding decisions. It typically assesses student growth in academic achievement, attendance rates, and graduation rates. By referring to the Connecticut Form of Accounting Index, stakeholders can gain a clearer understanding of how financial resources impact school performance and accountability.

An accountability index is a tool that measures and compares school performance based on various factors, including student achievement and progress. This index helps educational stakeholders identify strengths and weaknesses within school systems. The Connecticut Form of Accounting Index plays a crucial role in providing the financial data needed to support these accountability measures.

The best ranked high school in Connecticut often changes year to year, but schools such as the Weston High School frequently appear at the top. Academic excellence, extracurricular activities, and parent involvement contribute to these rankings. To navigate differences in high school performances, the Connecticut Form of Accounting Index offers vital financial insights that can support decision-making for future investments in education.

The Uniform Chart of Accounts in Connecticut serves as a standardized framework for financial reporting and accounting. This system enhances transparency and consistency in how schools and municipalities manage their funds. Utilizing tools like the Connecticut Form of Accounting Index can help organizations align their accounting practices with state standards.

Determining the town with the best school system in Connecticut can vary based on different criteria. However, towns like New Canaan and Westport often rank high due to their academic performance and resources. The Connecticut Form of Accounting Index can provide insightful data on school funding, helping you understand how towns allocate their educational budgets.

No, your Connecticut tax registration number is not the same as your Employer Identification Number (EIN). The tax registration number is specifically for state tax purposes, while the EIN is used for federal identification. Understanding these distinctions can enhance your knowledge of the Connecticut Form of Accounting Index. If you need clarity on tax identification, uslegalforms offers tools to simplify complex topics.

Calculating your Connecticut Adjusted Gross Income (AGI) involves starting with your total income and then making specific deductions as required by state guidelines. This figure is crucial for your state tax return and directly affects your tax responsibilities. Using the Connecticut Form of Accounting Index can streamline this calculation and ensure accuracy. For additional help, check out resources available through uslegalforms.

The CT Form or 131 is a key document used in Connecticut for reporting certain tax information. It is specifically designed for taxpayers who need to file an income tax return while also taking advantage of specific credits and deductions. Understanding the Connecticut Form of Accounting Index can significantly simplify your filing process. If you have questions or need assistance, uslegalforms provides resources to help you navigate this form.

Filing for a tax extension is straightforward. Complete the appropriate extension form for your state, such as the Connecticut Form CT-1040 EXT, before the deadline. Using platforms like US Legal Forms makes this process easier, providing accurate resources to help you along the way. Always refer to the Connecticut Form of Accounting Index to confirm you're following the correct procedures.

To file an extension for your taxes in Connecticut, complete Form CT-1040 EXT and submit it to the state by the original due date of your return. This extension allows you to file later without facing immediate penalties. When using US Legal Forms, you can easily access this form and ensure all details are correctly filled out. Stay informed with the Connecticut Form of Accounting Index for any updates or changes.