Connecticut Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

If you wish to compile, download, or print authentic document templates, utilize US Legal Forms, the premier repository of official forms available online.

Take advantage of the site's convenient and user-friendly search features to locate the documents you need. Various templates for commercial and personal purposes are categorized by groups and offers or keywords.

Utilize US Legal Forms to obtain the Connecticut Liquidation of Partnership with Sale of Assets and Assumption of Liabilities with just a few clicks.

Every legal document template you acquire is yours indefinitely. You can access every form you've obtained in your account. Check the My documents section and select a document to print or download again.

Stay competitive by downloading and printing the Connecticut Liquidation of Partnership with Sale of Assets and Assumption of Liabilities using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Once you are currently a US Legal Forms member, Log Into your account and click the Obtain button to retrieve the Connecticut Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

- You can also access forms you have previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you've selected the form relevant to the correct city/state.

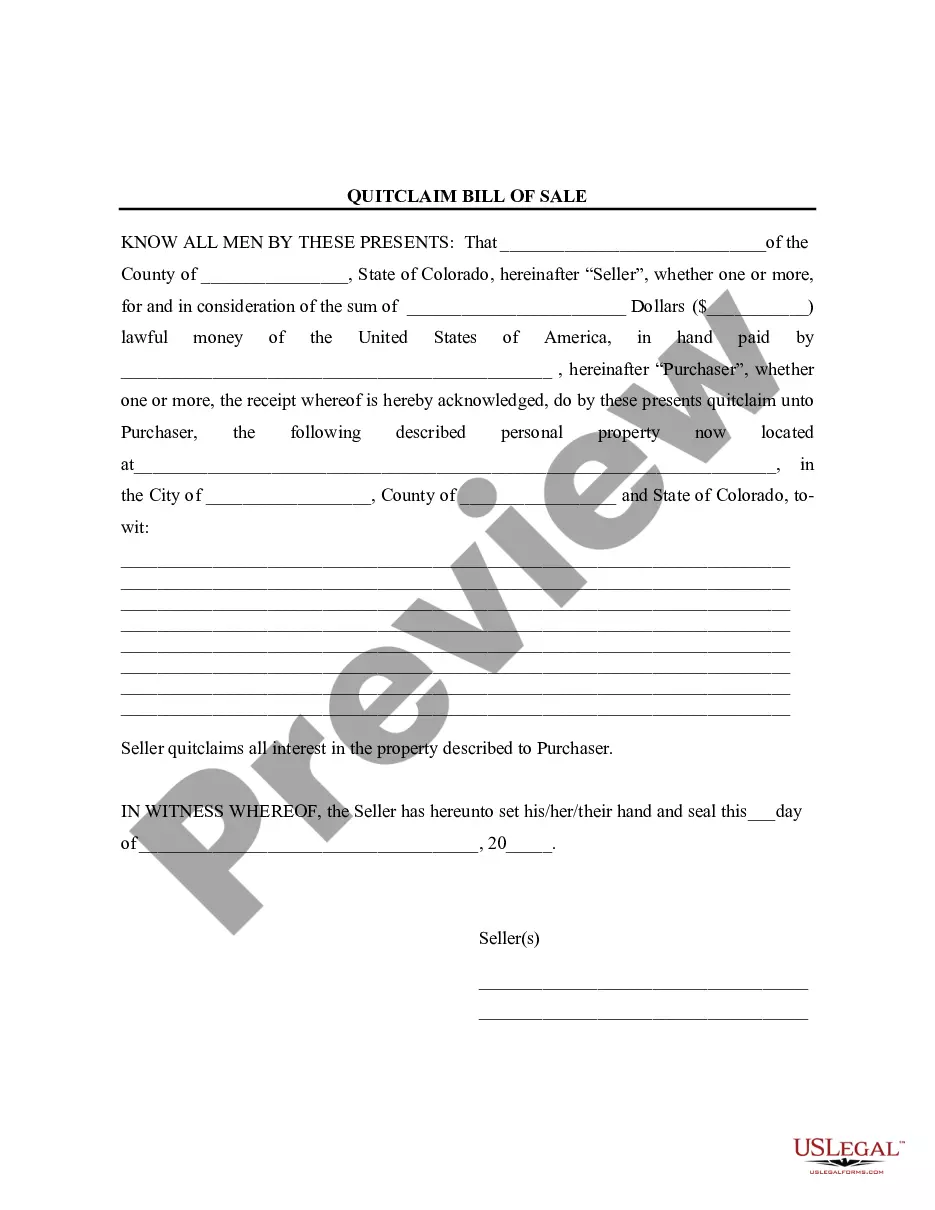

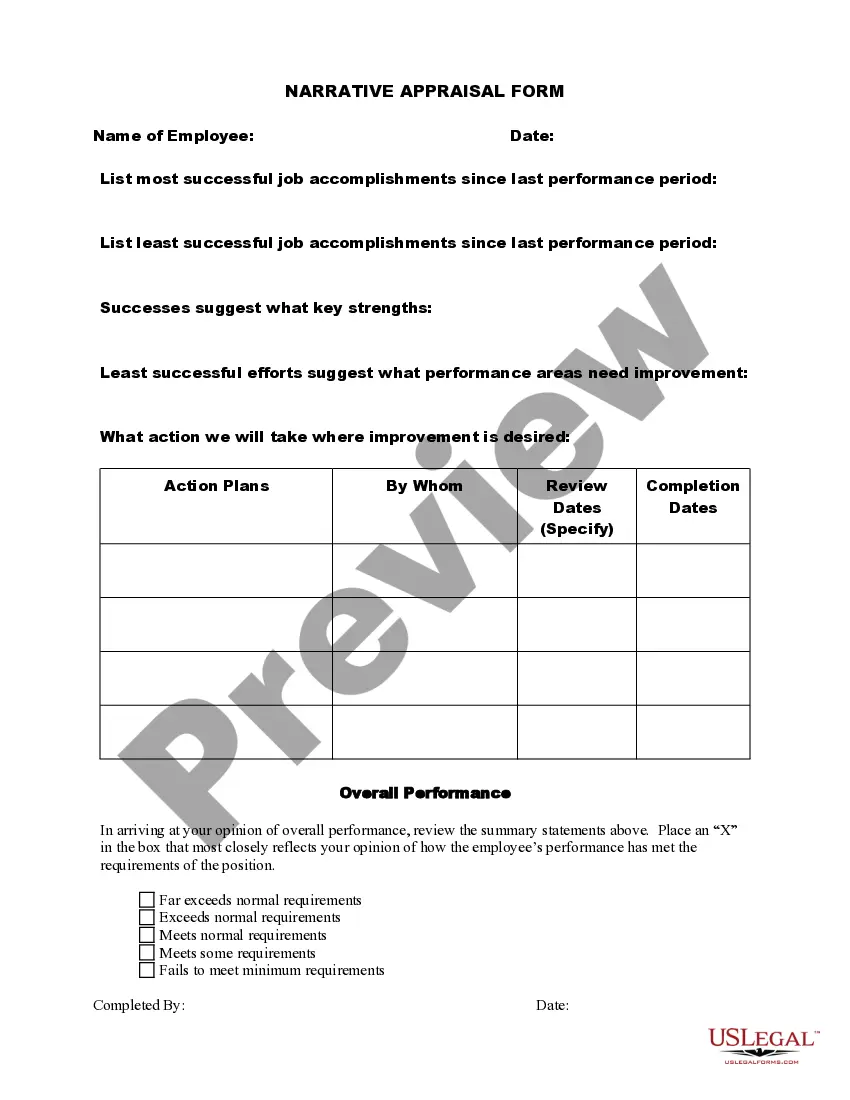

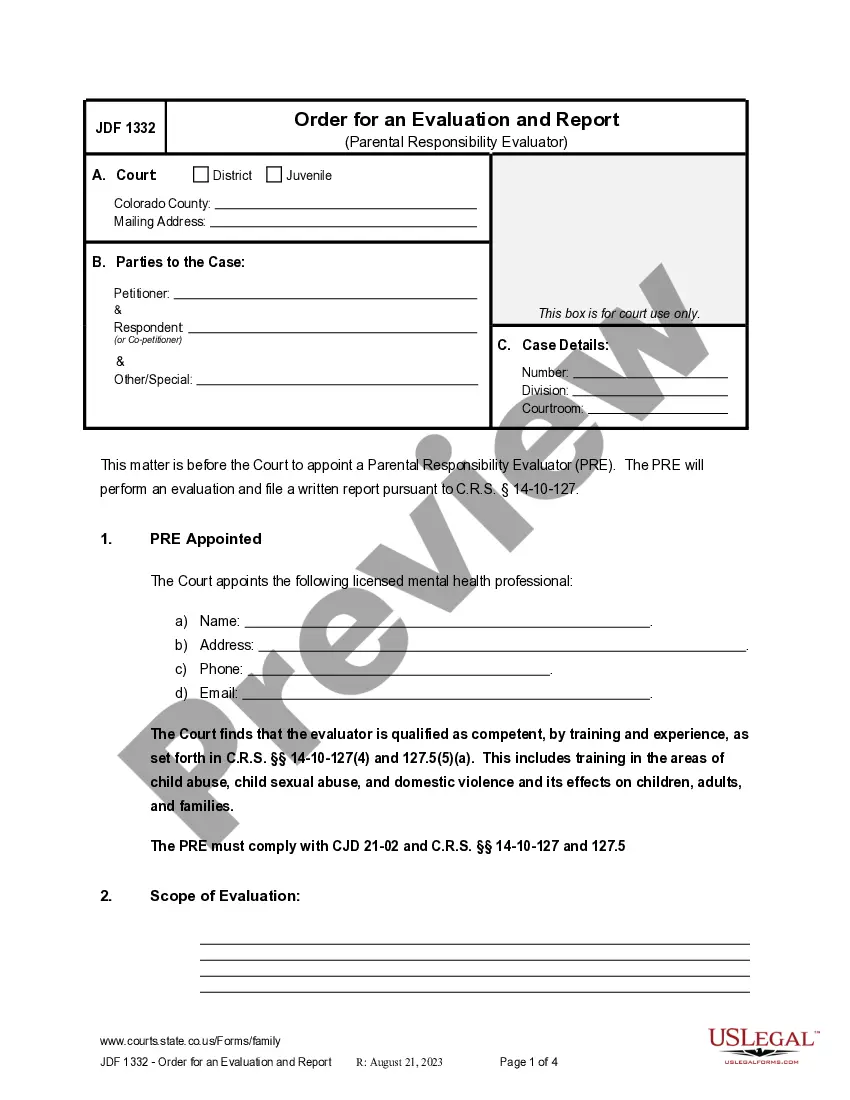

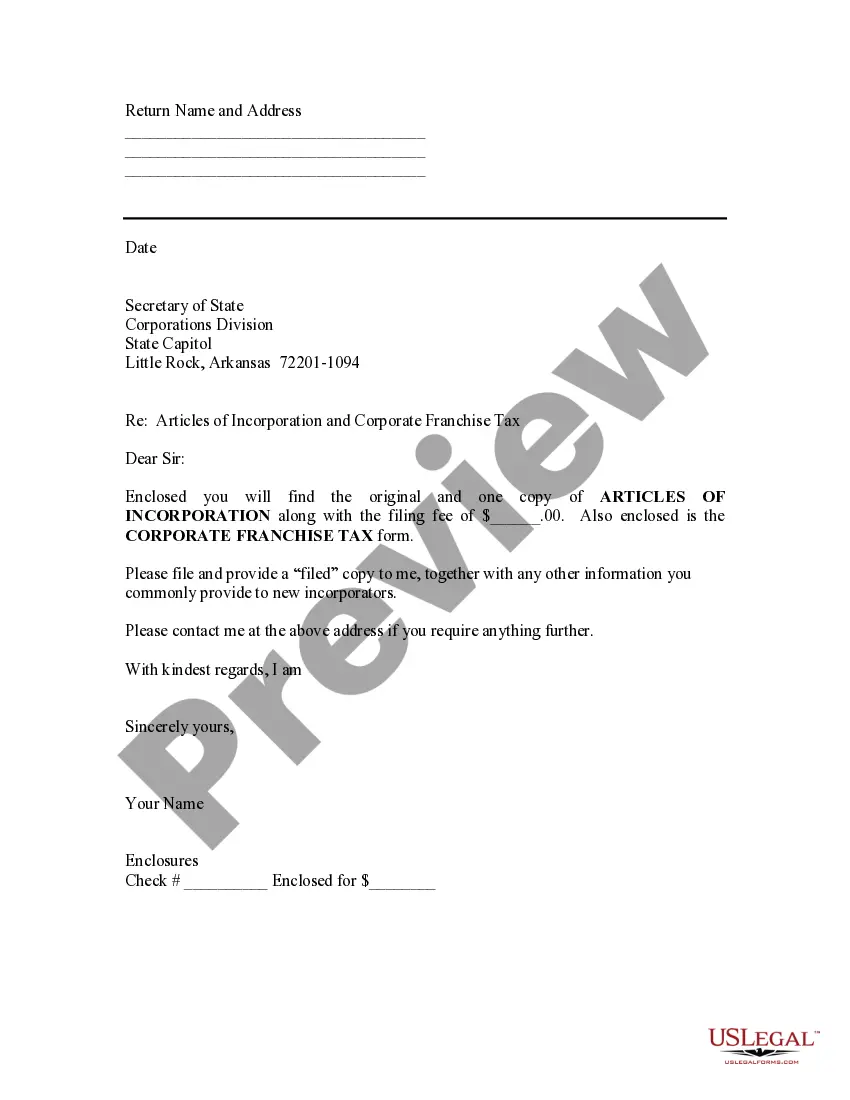

- Step 2. Utilize the Preview option to review the contents of the form. Remember to read the description.

- Step 3. If you are unsatisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you desire, click the Acquire now button. Choose your preferred payment plan and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Connecticut Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

Form popularity

FAQ

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

A partner may recognize both gain and loss on the sale of a partnership interest in the situation where a partner's share of the unrealized gain in hot assets is greater than his total gain or loss on the sale of his partnership interest.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

Generally, a partnership interest is considered a capital gain and thus gain or loss through the sale of such interest would be considered a capital gain or capital loss.

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.

What is the partner's basis in property received in liquidation of his interest? When a partnership distributes property in a liquidating distribution, the recipient partner's outside basis reduced by any amount of cash included in the distribution is allocated to the distributed property.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

How to sell your share of a partnership?Step 1: Review the partnership agreement which outlines how partners would address certain business situations, such as selling.Step 2: Meet with your partner(s) in order to take a vote on how to dissolve the partnership and sell your assets.More items...

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.