New Hampshire Repossession Services Agreement for Automobiles

Description

How to fill out Repossession Services Agreement For Automobiles?

Are you presently in a position that requires documents for both professional and personal reasons nearly every day.

There is a multitude of valid document templates accessible online, but finding reliable versions isn't easy.

US Legal Forms provides thousands of form templates, including the New Hampshire Repossession Services Agreement for Automobiles, which can be tailored to meet state and federal regulations.

Once you acquire the right form, click on Get now.

Select the pricing plan you prefer, fill out the necessary details to set up your account, and purchase an order using your PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Repossession Services Agreement for Automobiles template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

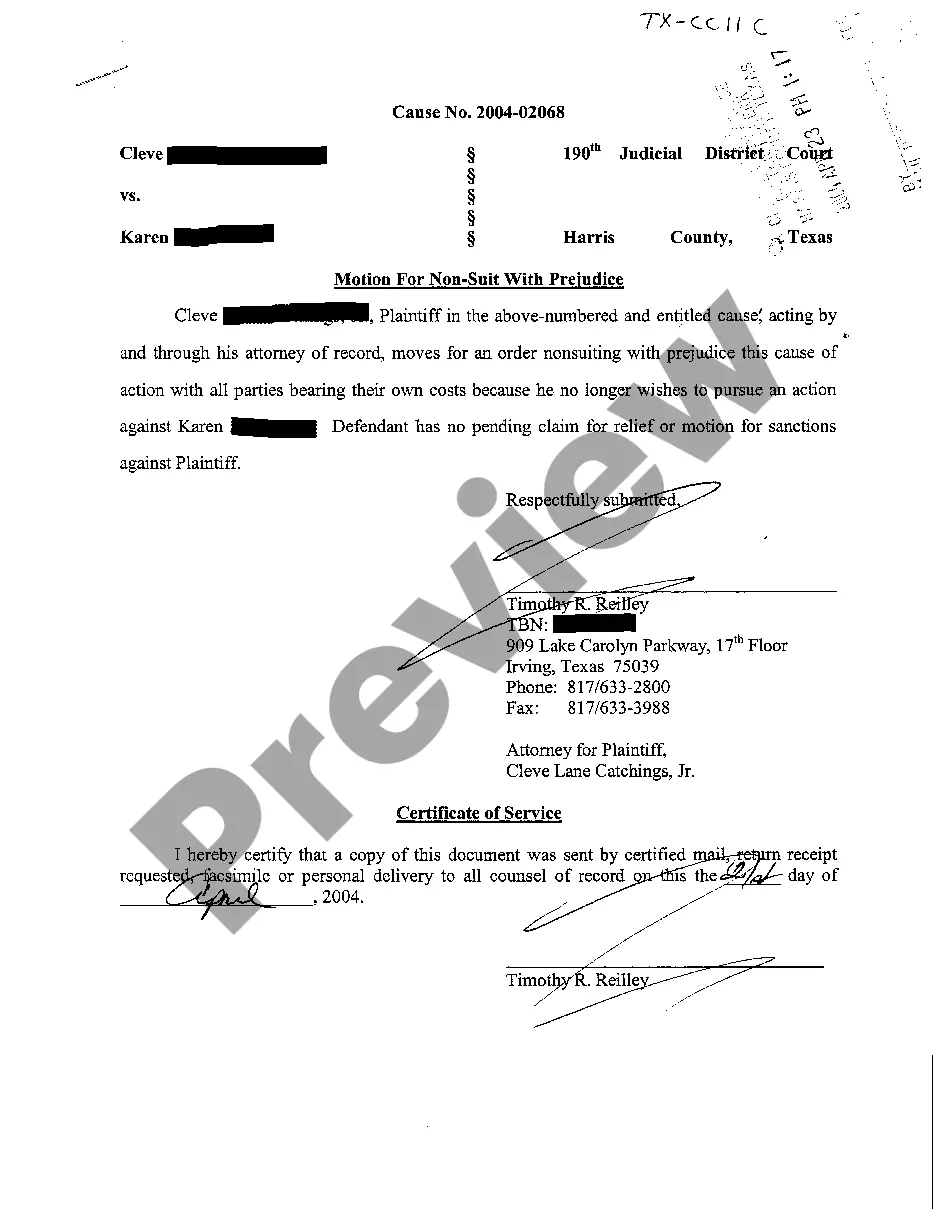

- Use the Preview button to view the form.

- Read the description to ensure you have chosen the correct document.

- If the form isn't what you're looking for, utilize the Search field to find the document that fits your needs.

Form popularity

FAQ

What is Repossession? The contractual right of repossession is a process where a creditor can legally take possession of a specific asset or property if a debtor fails to meet their obligations on a contract. This right of repossession exists in many different sorts of agreements and transactions.

A way to avoid a vehicle repossession is by making a payment plan with the creditor. This is a good course of action if you don't have the money to pay at the moment, but you will have funds in the future. To do this, you will need to contact your creditor and ask to make such arrangements.

Unlike some states which give the contractor an absolute right to repair, in New Hampshire a homeowner can simply reject the contractor's settlement offer and file a lawsuit.

If you've paid more than a third of the agreement, or if the goods are stored on private land or inside your home, your creditor will need a court order before they can repossess them.

The lender will have to give you at least 14 days' notice if it's planning to repossess your car, and it will give you the chance to remedy the default.

If you have paid more than one-third of the purchase price, a lender cannot repossess the car without taking legal action.

In order to repossess the vehicle an original court order with the stamp of the court needs to be present. If approached by anyone without a court order, it would be best to scrutinize all documentation very closely. Usually a sheriff of the court would have to hand over such a court order.

Generally, most lenders start the repossession process once you're in default usually at least 90 days past due on a payment. When the loan is actually considered in default can depend on the language in your loan contract.

There is a way to avoid your car on finance being repossessed and any subsequent debt, known as a voluntary termination. Under Section 99 of the Consumer Credit Act, consumers are allowed to voluntarily terminate their agreement if they are unable to repay.

When and how your car can be repossessed in South AfricaThe process of repossession. In accordance with the National Credit Act, the first step of a vehicle repossession is receiving a letter of demand.Auction agency.Making a payment plan.Voluntary surrender.Selling your car.Debt counselling.