North Carolina Repossession Services Agreement for Automobiles

Description

How to fill out Repossession Services Agreement For Automobiles?

Finding the appropriate legal document template can be a challenge. Of course, there are numerous templates available online, but how can you locate the specific legal form you require.

Utilize the US Legal Forms website. The service provides a vast array of templates, including the North Carolina Repossession Services Agreement for Automobiles, which can be used for both business and personal purposes. Each of the forms is reviewed by professionals and complies with both state and federal regulations.

If you are already registered, Log In to your account and click the Obtain button to access the North Carolina Repossession Services Agreement for Automobiles. Use your account to browse the legal forms you have previously purchased. Go to the My documents tab in your account to retrieve another copy of the document you require.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the North Carolina Repossession Services Agreement for Automobiles you have acquired. US Legal Forms is the largest library of legal forms where you can find a selection of document templates. Use this service to download professionally crafted documents that adhere to state regulations.

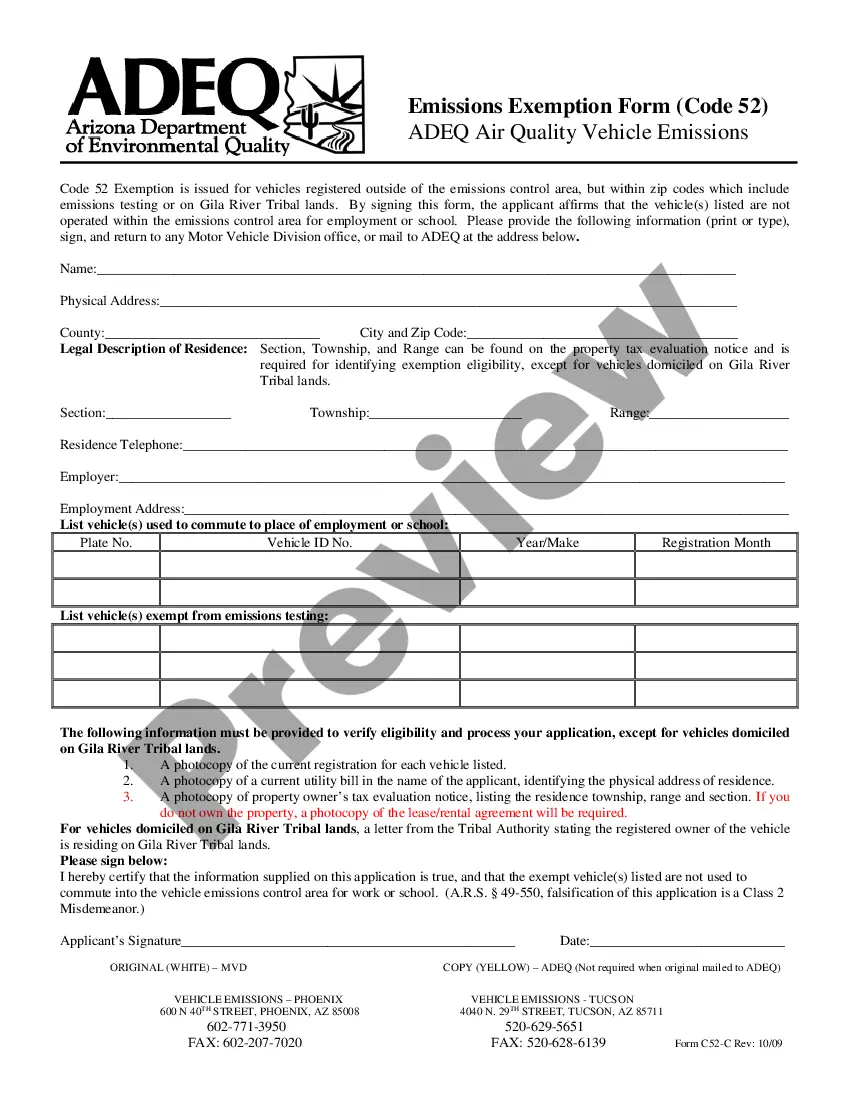

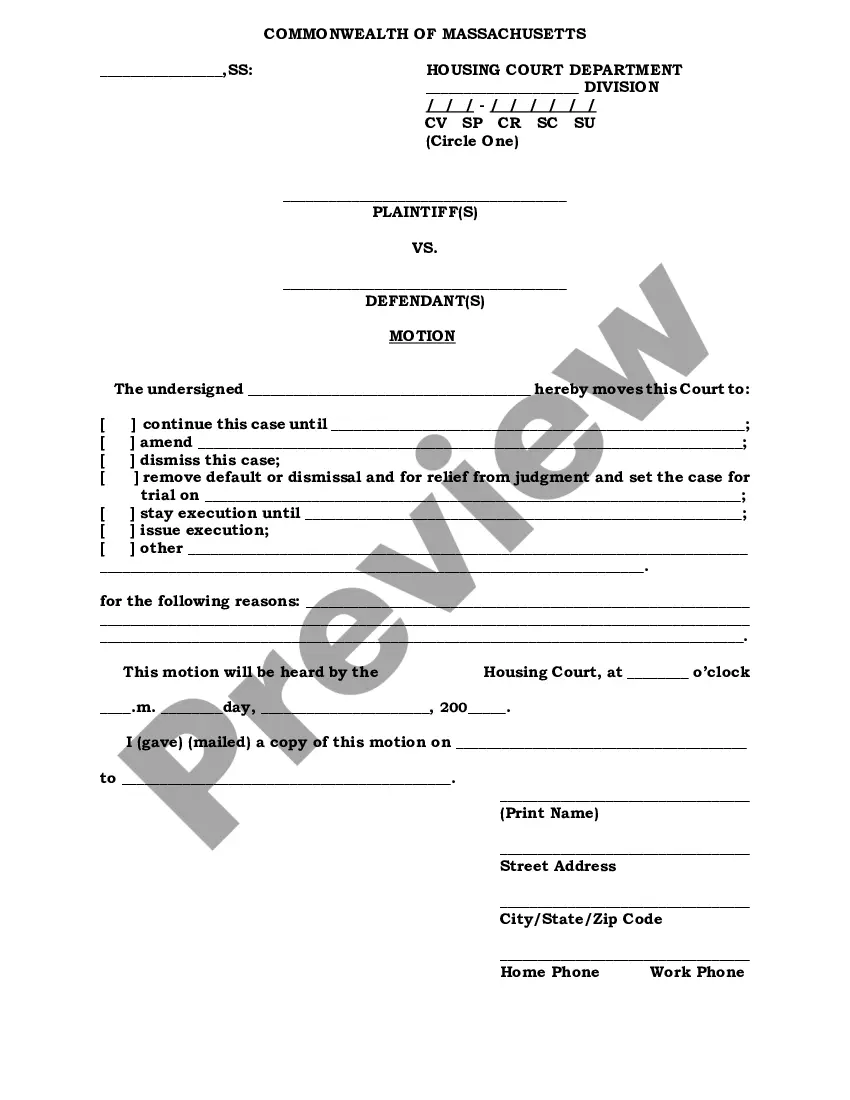

- First, ensure that you have selected the correct form for your city/county.

- You can review the form using the Preview button and read the form description to confirm it is suitable for your needs.

- If the form does not meet your requirements, utilize the Search field to find the proper form.

- Once you are certain that the form is appropriate, click the Acquire now button to obtain the form.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and complete your order using your PayPal account or credit card.

Form popularity

FAQ

Under the law, creditors cannot breach the peace when they repossess a car. So they have no right to use violence or break and enter your property to seize your vehicle. They cannot use or threaten physical force. And they cannot remove your car from your residence without obtaining your permission.

If you've missed a payment on your car loan, don't panic but do act fast. Two or three consecutive missed payments can lead to repossession, which damages your credit score. And some lenders have adopted technology to remotely disable cars after even one missed payment.

A bank can repossess your vehicle when you've stopped making the monthly payments agreed upon in your financing arrangement. Most banks will begin the repossession process after you've stopped making payments for 60-90 days.

What is Repossession? The contractual right of repossession is a process where a creditor can legally take possession of a specific asset or property if a debtor fails to meet their obligations on a contract. This right of repossession exists in many different sorts of agreements and transactions.

Car repossession in North Carolina is permitted as long as it does not breach the peace. There is no right of vehicle redemption after foreclosure and sale of the vehicle. The license plates from the vehicle remain the property of the debtor.

Once your car has been repossessed, your creditor has the right to ask you to pay the late payments plus the cost of repossession. The creditor may also demand that you pay off the balance of the loan in full.

In order to repossess the vehicle an original court order with the stamp of the court needs to be present. If approached by anyone without a court order, it would be best to scrutinize all documentation very closely. Usually a sheriff of the court would have to hand over such a court order.

You can "redeem" the property by offering the creditor the entire unpaid balance on the debt plus expenses reasonably caused by the repossession. You must do this before the creditor has disposed of or sold the property. Usually you cannot redeem just by paying the amount in arrears unless the creditor approves it.