Nevada Installments Fixed Rate Promissory Note Secured by Personal Property

Overview of this form

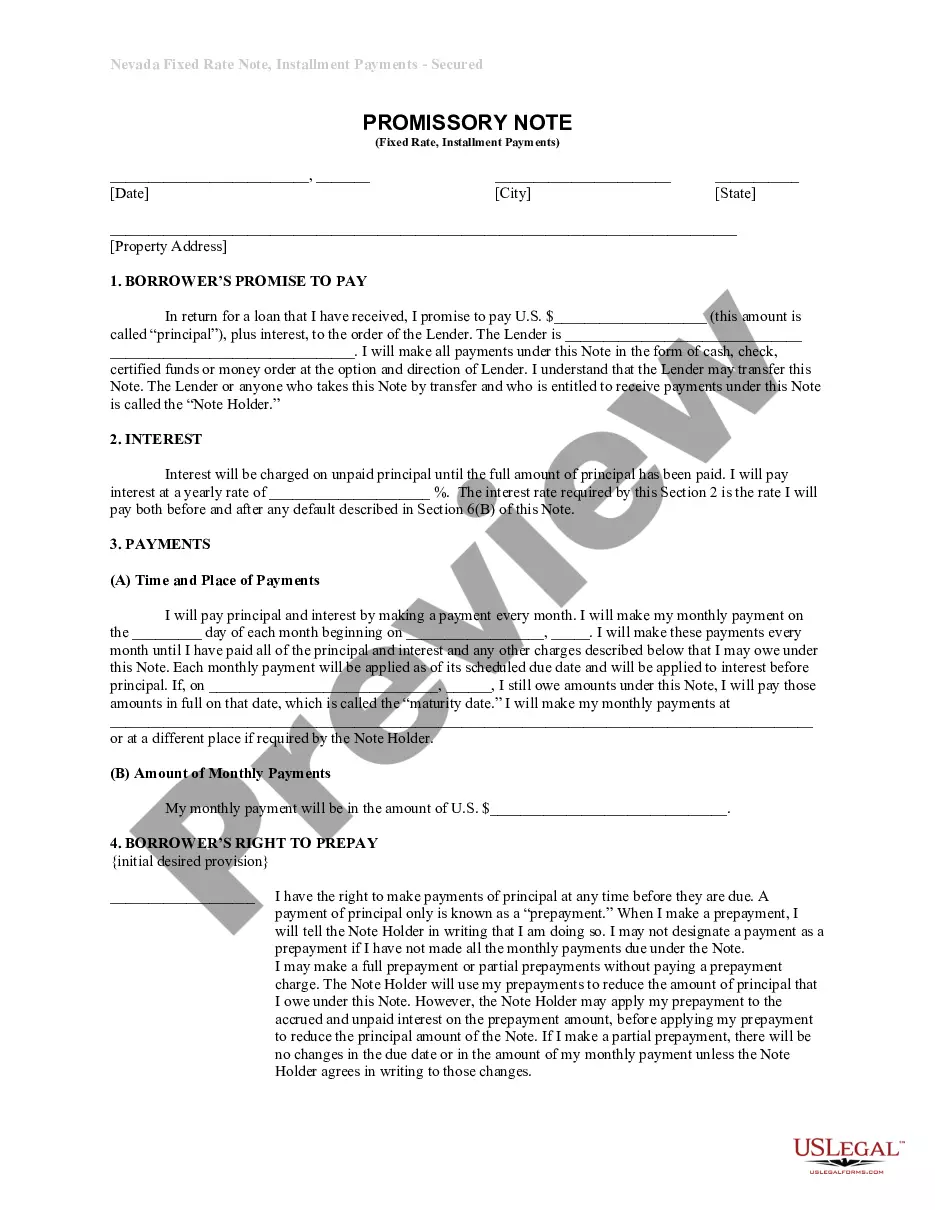

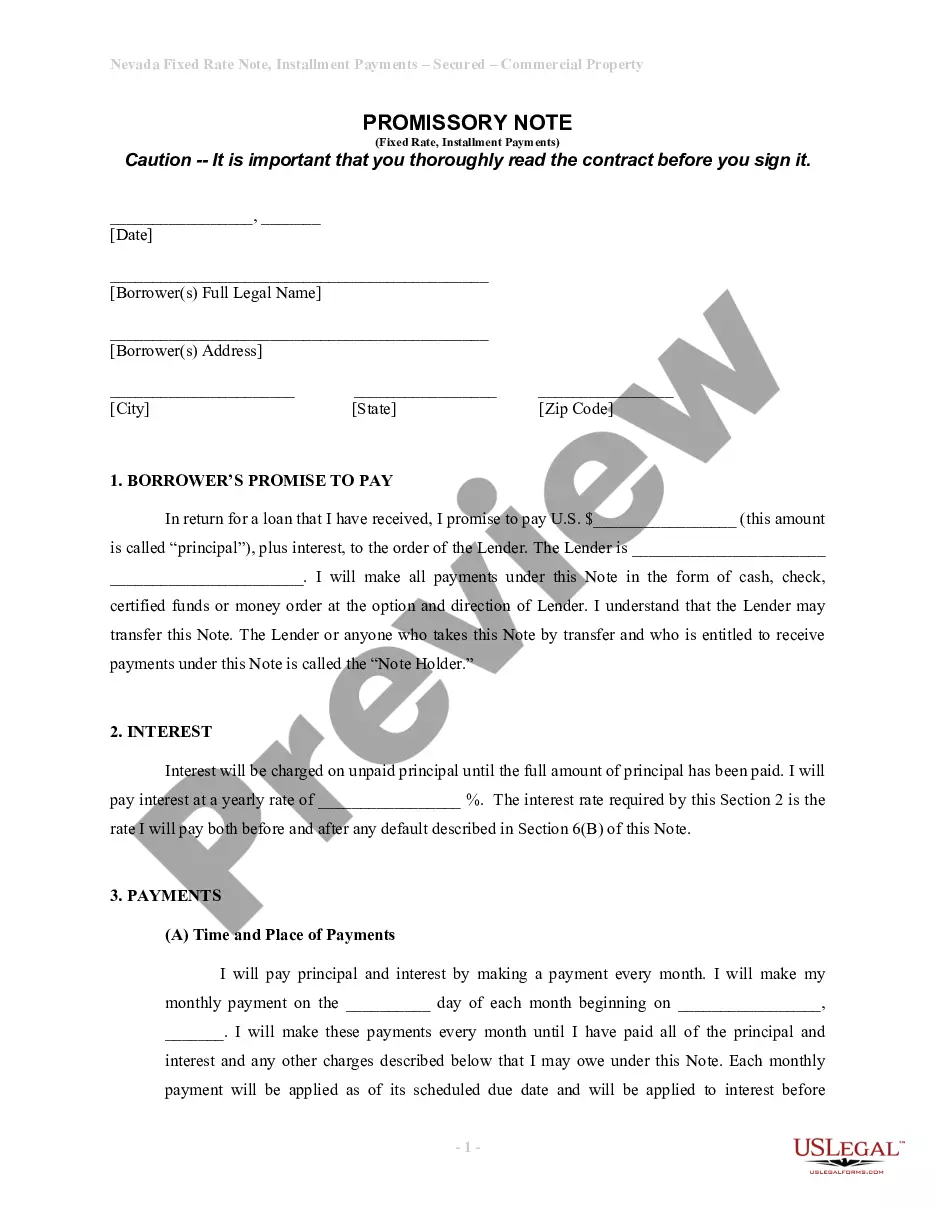

The Nevada Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document outlining a loan agreement where personal property serves as security for the borrowed amount. This form is crucial for detailing the terms of repayment, including the interest rate and payment schedule, ensuring both the borrower and lender are protected in the event of default. Unlike unsecured promissory notes, this document introduces security interests, providing the lender with a claim on specified personal property if obligations are not met.

What’s included in this form

- Borrower's promise to pay specifies the principal amount and interest rate.

- Details on monthly payment amounts and schedule, including the maturity date.

- Provisions regarding prepayment rights, allowing the borrower to pay off the loan early.

- Notice of default, outlining the borrower's obligations if payments fail to meet the due date.

- Security interest clause indicating that personal property secures the loan.

When to use this form

This form is used when borrowing money and providing personal property as collateral. Candidates for use include individuals looking to finance major purchases, such as vehicles or equipment, or those needing a loan but unable to secure traditional financing. It is also suitable for any loan agreements requiring the lender to have a secured interest in the borrowerâs property to mitigate risk.

Intended users of this form

- Individuals or businesses seeking to secure a loan with personal property.

- Lenders who require a formal agreement outlining terms of repayment and collateral.

- Borrowers with limited credit options looking for a secured borrowing alternative.

How to prepare this document

- Identify the parties involved by entering the borrowerâs and lenderâs names and contact information.

- Specify the amount of the loan to be borrowed as the principal.

- Enter the agreed-upon interest rate to be charged on the principal amount.

- Outline the payment schedule, including the monthly payment amount and the maturity date.

- Detail the personal property being used as security for the loan.

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to properly identify the personal property used as collateral.

- Not specifying the correct interest rate and payment terms.

- Overlooking the maturity date, which can lead to payment defaults.

- Neglecting to provide accurate addresses for both parties involved.

Advantages of online completion

- Convenience of completing the form from anywhere at any time.

- Editability, allowing users to customize the document to fit their specific loan terms.

- Access to templates drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Mortgage and security interest are two similar terms, both referring to a collateral created in order to secure a debt by one party to the other.The basic difference is that mortgage is a traditional way of securing obligations under the common law, typically used in property transactions.

Types of Property that can be used as collateral. Speak to them in person. Draft a Demand / Notice Letter. Write and send a Follow Up Letter. Enlisting a Professional Collection Agency. Filing a petition or complaint in court. Selling the Promissory Note. Final Tips.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

A note is a legal document that serves as an IOU from a borrower to a creditor or an investor.Notes can obligate issuers to repay creditors the principal amount of a loan, in addition to any interest payments, at a predetermined date.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.

When you buy a note and mortgage, you're buying the debt that remains to be paid on the note, secured by the asset outlined in the mortgage. You're not buying the property -- you're buying the debt and secured interest in the property. Essentially, a note buyer steps into the shoes of the bank.