Connecticut Self-Employed Awning Services Contract

Description

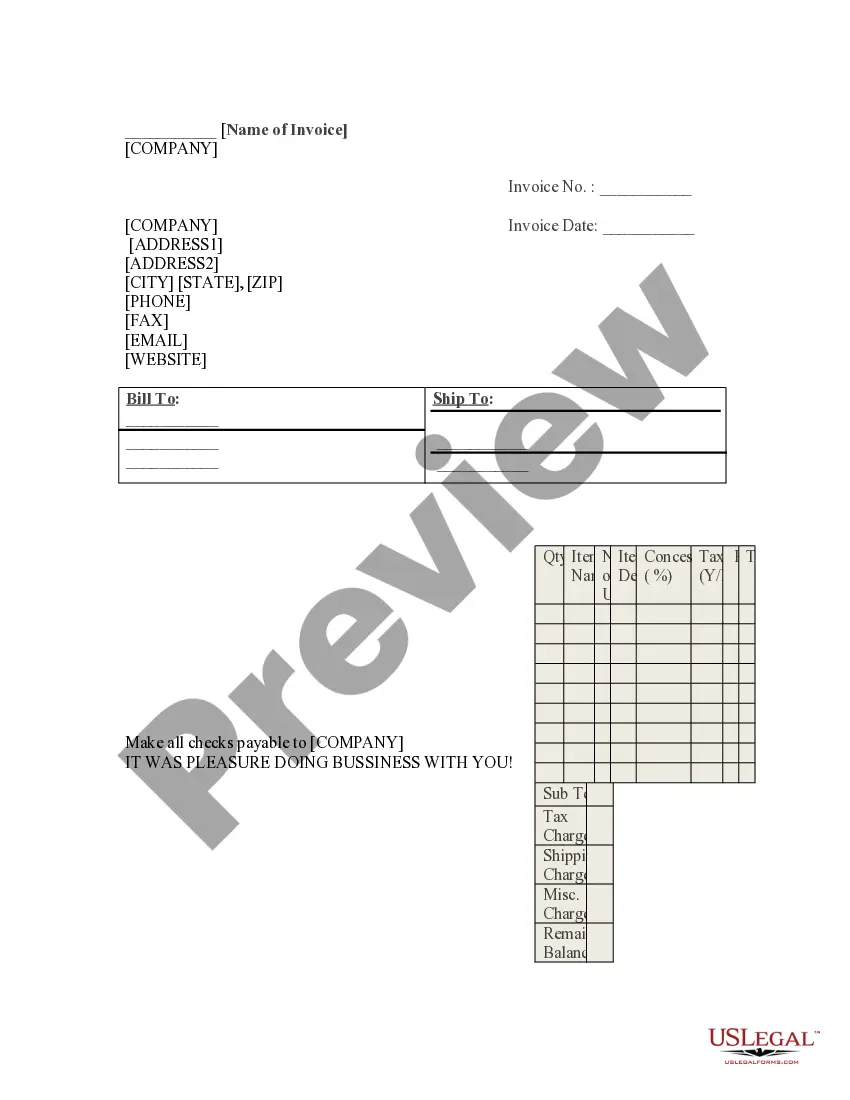

How to fill out Self-Employed Awning Services Contract?

You might spend hours online trying to locate the valid document template that meets the state and federal requirements you desire. US Legal Forms provides thousands of legal forms that are vetted by experts.

You can easily download or print the Connecticut Self-Employed Awning Services Agreement from our platform. If you already have a US Legal Forms account, you can Log In and select the Download option. After that, you can complete, modify, print, or sign the Connecticut Self-Employed Awning Services Agreement.

Each legal document template you purchase is your property indefinitely. To obtain an additional copy of the acquired form, navigate to the My documents section and click the corresponding option. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the county/region of your choice. Review the form description to confirm that you have chosen the appropriate form. If available, utilize the Preview option to browse through the document template as well.

Utilize professional and state-specific templates to address your business or personal needs.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- Once you have found the template you want, click Get now to proceed.

- Select the pricing plan you prefer, enter your credentials, and sign up for an account on US Legal Forms.

- Complete the payment. You can use your credit card or PayPal account to purchase the legal form.

- Choose the format of the document and download it to your device.

- Make changes to your document if necessary. You can complete, modify, and sign and print the Connecticut Self-Employed Awning Services Agreement.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms.

Form popularity

FAQ

Yes, landscaping services are taxable in Connecticut. This includes both the installation of landscaping features and ongoing maintenance services. If you are engaged in providing these services through a Connecticut Self-Employed Awning Services Contract, understanding these tax implications can help you manage your business finances effectively and ensure compliance with state regulations.

Connecticut imposes sales tax on a variety of services, including those related to landscaping, construction, and repair. Specifically, services that enhance or maintain tangible personal property typically fall under taxable categories. If you provide services under a Connecticut Self-Employed Awning Services Contract, you should familiarize yourself with the state's tax regulations to avoid unexpected costs.

In Connecticut, landscaping services are generally subject to sales tax. This includes services related to installing or maintaining landscaping features. However, certain exemptions may apply depending on the nature of the service. If you operate under a Connecticut Self-Employed Awning Services Contract, it's essential to understand your tax obligations to ensure compliance.

To qualify as an independent contractor, you must demonstrate that you operate your business independently. This typically means having control over how and when you work, along with providing your tools and resources. Understanding your qualifications can help when drafting a Connecticut Self-Employed Awning Services Contract to ensure that it reflects your independent status.

Securing government contracts in Connecticut involves several steps. Begin by understanding the bidding process and identifying opportunities that align with your services. Register on government procurement platforms and prepare your proposals carefully. A Connecticut Self-Employed Awning Services Contract can assist in detailing your service offerings and compliance with government requirements.

To become an independent contractor in Connecticut, start by defining your services and target market. Register your business, apply for any necessary licenses, and set up your financial structure. Utilizing a Connecticut Self-Employed Awning Services Contract can provide a solid framework to clarify your service agreements and protect your rights.

In Connecticut, the requirement for a contractor's license depends on the type of work you intend to perform. Some low-risk jobs do not require a license, while others, particularly in construction, do. If you are entering into a Connecticut Self-Employed Awning Services Contract, it is vital to check licensing regulations specific to your services to avoid legal issues.

To become an independent contractor in Connecticut, you need to follow several steps. First, establish your business structure, which may include registering your business name. Next, ensure you obtain the necessary licenses and permits for your services. A Connecticut Self-Employed Awning Services Contract can help outline your responsibilities and protect your interests in this process.

The 4 hour rule in Connecticut refers to the requirement for certain independent contractors to register as employers if they work for more than four hours in a given day. This rule helps distinguish between independent contractors and employees. If you are considering a Connecticut Self-Employed Awning Services Contract, understanding this rule is crucial for compliance and proper classification.

Writing a simple employment contract involves stating the job title, responsibilities, and compensation details. Include the duration of the contract and any conditions for termination. For independent arrangements, the Connecticut Self-Employed Awning Services Contract template from uslegalforms can guide you in crafting a straightforward agreement that meets your needs.