Connecticut Self-Employed Tailor Services Contract

Description

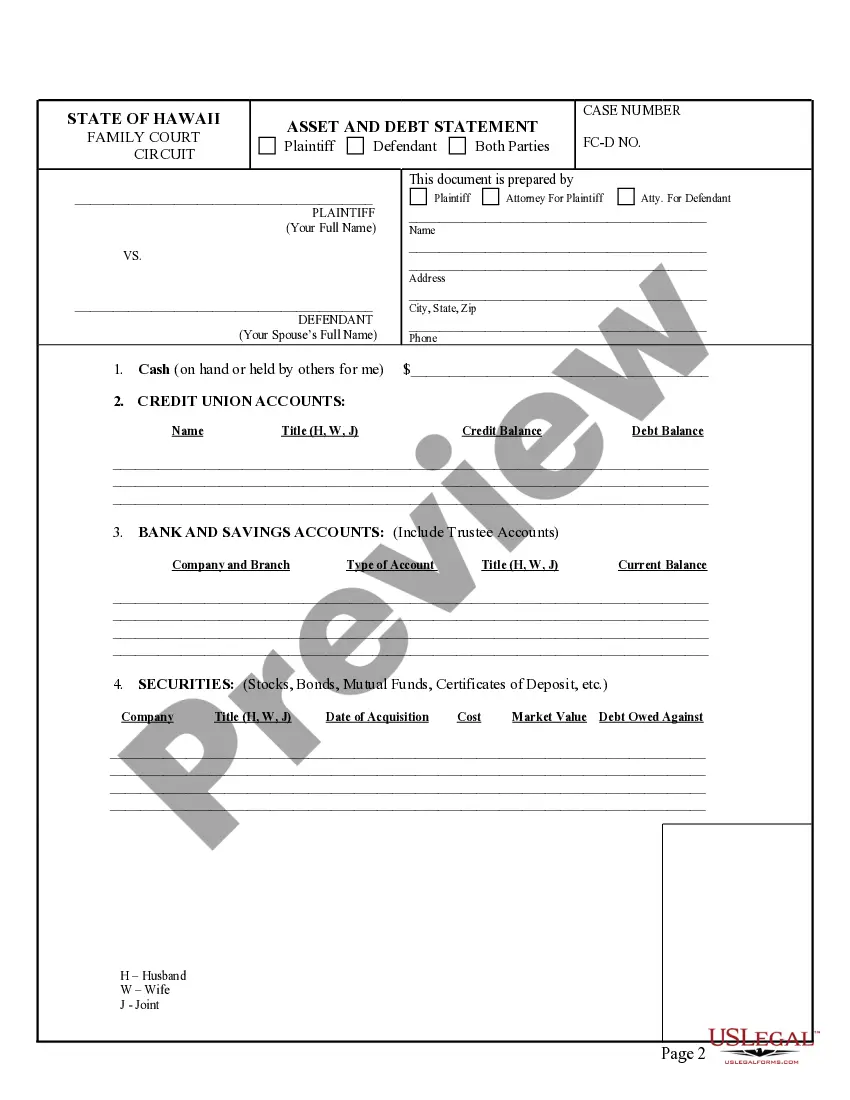

How to fill out Self-Employed Tailor Services Contract?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a wide range of legal document templates that you can download or create. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Connecticut Self-Employed Tailor Services Contract in just minutes.

If you already have a subscription, Log In and download the Connecticut Self-Employed Tailor Services Contract from your US Legal Forms library. The Download option will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are some simple steps to help you get started: Ensure you have selected the correct form for your city/state. Click on the Preview option to review the form’s content. Check the form summary to make sure you have chosen the right form. If the form does not meet your requirements, use the Search box at the top of the screen to find one that does. If you are satisfied with the form, confirm your choice by clicking the Acquire now button. Then, choose the payment plan you prefer and provide your details to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved Connecticut Self-Employed Tailor Services Contract. Each document you add to your account does not have an expiration date and is yours permanently. So, if you want to download or print another copy, just go to the My documents section and click on the form you need.

- Access the Connecticut Self-Employed Tailor Services Contract with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Yes, contract workers are typically classified as self-employed individuals. They offer their services to clients through contracts, like a Connecticut self-employed tailor services contract, rather than being employed by a single employer. This arrangement allows them flexibility in their work and the opportunity to develop diverse client relationships. Understanding this classification can help contract workers navigate their rights and responsibilities.

employed tailor is a skilled professional who operates independently, providing custom tailoring services. In the context of Connecticut selfemployed tailor services, they may create or alter garments to meet specific client needs. This career allows tailors to manage their own business, set their own hours, and build a personal brand. They often rely on contracts to establish clear expectations with clients.

Yes, self-employed individuals, including those offering Connecticut self-employed tailor services, should use a contract. A contract clearly outlines the terms of work, payment, and responsibilities, protecting both the tailor and the client. It helps prevent misunderstandings and provides a reference point for both parties. By using a well-drafted contract, you can ensure a smoother working relationship.

Choosing between forming an LLC or working as an independent contractor depends on your business goals. An LLC provides liability protection and may offer tax advantages, whereas an independent contractor can enjoy more straightforward tax reporting. However, both options can benefit from a Connecticut Self-Employed Tailor Services Contract to ensure clear agreements with clients. Consider consulting a legal expert to determine the best fit for your situation.

To become an independent contractor in Connecticut, you should start by registering your business entity, if necessary. Next, obtain any required licenses or permits specific to tailor services. It’s also crucial to draft a Connecticut Self-Employed Tailor Services Contract to outline your terms with clients clearly. Using platforms like USLegalForms can help you create a legally sound contract tailored to your needs.

You can write your own service agreement by clearly outlining the services, payment terms, and duration of the contract. Make sure to include any specific conditions or obligations for both parties. A Connecticut Self-Employed Tailor Services Contract can help you draft a comprehensive service agreement that meets your needs.

To write a self-employed contract, detail the services you will provide, the compensation, and the timeline for completion. It's also important to clarify the independent nature of the work relationship. Utilizing a Connecticut Self-Employed Tailor Services Contract template can ensure you cover all necessary aspects and protect your interests.

Writing a simple employment contract involves clearly stating the job title, responsibilities, and payment details. Be sure to include the start date and any conditions for termination. A Connecticut Self-Employed Tailor Services Contract can provide a straightforward framework to help you draft a simple yet effective agreement.

To fill out a contract agreement, start by entering the names and addresses of the parties involved. Next, describe the services to be provided and specify the payment terms. Finally, review the contract carefully to ensure that it reflects your intentions before signing. Using a Connecticut Self-Employed Tailor Services Contract can simplify this process.

Yes, you can write your own legally binding contract as long as it includes essential elements like offer, acceptance, and consideration. Make sure to be clear and concise in your language to avoid ambiguity. A Connecticut Self-Employed Tailor Services Contract can serve as a useful template to help you create a sound agreement.