Connecticut Cook Services Contract - Self-Employed

Description

How to fill out Cook Services Contract - Self-Employed?

If you require to sum up, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you need.

A range of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Connecticut Cook Services Contract - Self-Employed in just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and acquire, and print the Connecticut Cook Services Contract - Self-Employed with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Connecticut Cook Services Contract - Self-Employed.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct area/region.

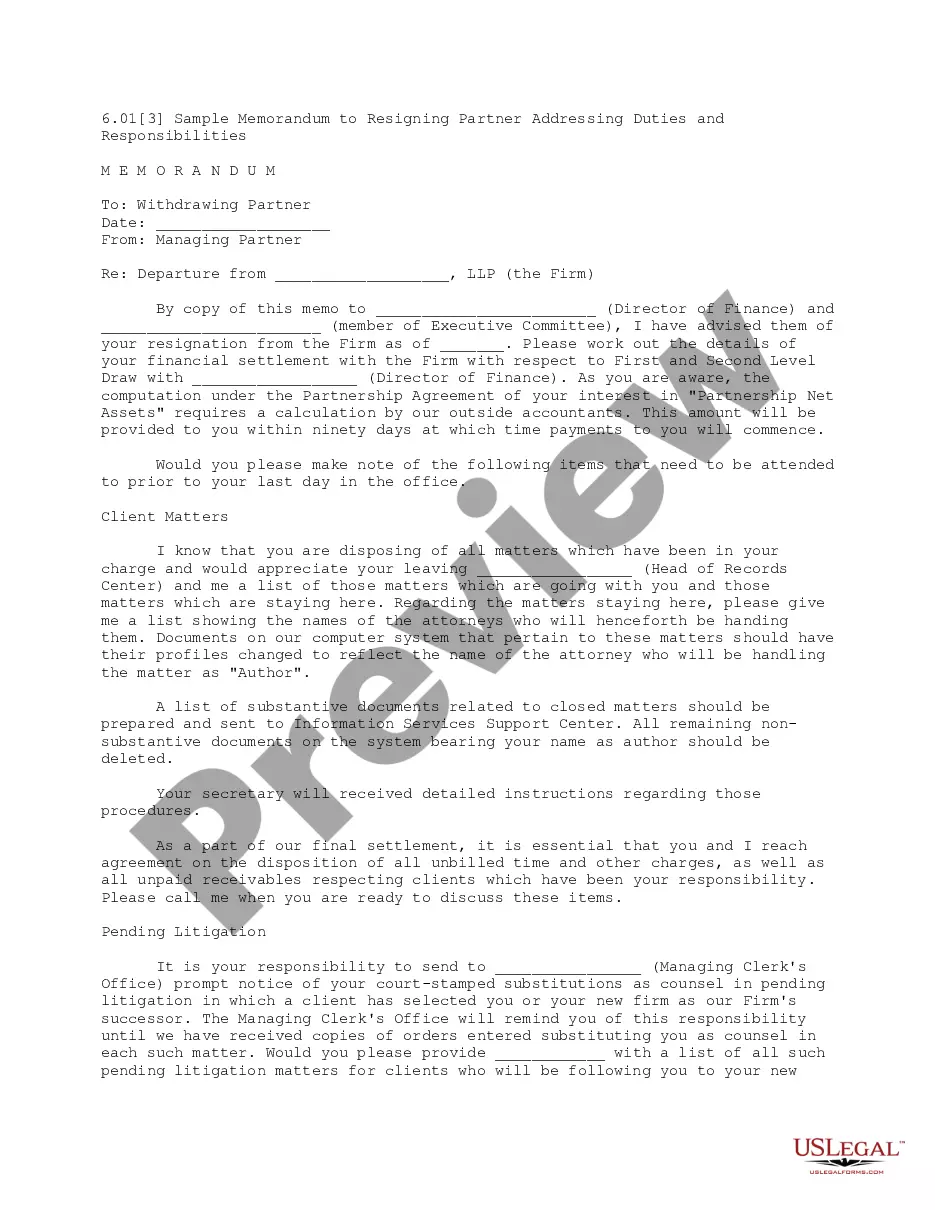

- Step 2. Use the Preview option to review the form’s details. Remember to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have located the form you desire, click the Get now button. Select the pricing plan you prefer and enter your information to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Connecticut Cook Services Contract - Self-Employed.

Form popularity

FAQ

Yes, you can sell food from your home in Connecticut, but there are specific regulations you must follow. You may need to obtain permits and follow local health codes to ensure safety and compliance. A Connecticut Cook Services Contract - Self-Employed can guide you through this process while helping you understand the legal requirements involved. By complying with these regulations, you can successfully operate your home food business.

Yes, having a contract as a self-employed individual is highly recommended. A Connecticut Cook Services Contract - Self-Employed clearly outlines the scope of your services, payment terms, and responsibilities. This clarity protects both you and your clients and helps prevent misunderstandings. Utilizing a well-drafted contract can enhance your professionalism and build trust with your customers.

In Connecticut, the 4 hour rule establishes specific guidelines for food safety in the preparation and serving of food. Under this rule, food prepared at home can be kept at safe temperatures for only up to four hours. If food exceeds this time limit, it must be discarded to prevent health risks. Understanding the 4 hour rule is essential when creating a Connecticut Cook Services Contract - Self-Employed, as it directly affects your food handling practices.

To qualify as an independent contractor, you must meet specific criteria established by the IRS and state regulations. Typically, you should control how and when you deliver your services and handle your business expenses. Additionally, signing a contract like the Connecticut Cook Services Contract - Self-Employed can formalize your status and clarify your working relationship with clients, ensuring compliance with legal standards.

Setting up as a self-employed contractor involves a few straightforward steps. Begin by choosing a business structure that fits your operational needs, such as a sole proprietorship or LLC. Following this, obtain any necessary permits and consider using a comprehensive agreement, like the Connecticut Cook Services Contract - Self-Employed, to establish clear terms with your clients. This will position you for success in your new venture.

To be an independent contractor in Connecticut, start by identifying your skills and the market demand for your services. Next, you should register your business appropriately and secure the required permits or licenses. It is also important to draft a clear Connecticut Cook Services Contract - Self-Employed to set expectations with clients effectively. This contract serves as a framework for your professional engagements, enhancing your reputation.

Absolutely, a self-employed person can and should have a contract when working with clients. A contract defines the scope of work, payment terms, and deadlines, protecting both parties' interests. When using the Connecticut Cook Services Contract - Self-Employed, you can ensure that your agreements are clear and legally binding. This clarity often leads to smoother working relationships and successful project outcomes.

Yes, contract workers are typically classified as self-employed individuals. This classification allows them to operate their own businesses and control their work schedules. However, it is essential to understand the specifics of your contract, including the Connecticut Cook Services Contract - Self-Employed, as it outlines the obligations and expectations of both parties. This can help prevent any misclassification.

To become an independent contractor in Connecticut, first, you need to determine your service area and expertise. Next, ensure that you obtain any necessary licenses specific to your service offering. Additionally, consider setting up a business structure, such as an LLC or sole proprietorship, to manage your finances effectively. Utilizing the Connecticut Cook Services Contract - Self-Employed can help outline your terms and responsibilities with clients.

An independent contractor is someone who provides services under a contract, operating independently from the hiring party. Key characteristics include the ability to control how and when the work is performed. A Connecticut Cook Services Contract - Self-Employed clearly states these conditions, ensuring both parties understand their rights and obligations.