Connecticut Pipeline Service Contract - Self-Employed

Description

How to fill out Pipeline Service Contract - Self-Employed?

Selecting the appropriate legal document template can be quite challenging. Naturally, there are numerous designs available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This platform offers thousands of templates, including the Connecticut Pipeline Service Agreement - Self-Employed, which can be utilized for both business and personal purposes. All documents are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Connecticut Pipeline Service Agreement - Self-Employed. Use your account to browse the legal documents you have previously ordered. Navigate to the My documents section of your account to retrieve another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Connecticut Pipeline Service Agreement - Self-Employed. US Legal Forms is the premier resource for legal templates enabling you to find various document formats. Use this service to download professionally created paperwork that adheres to state standards.

- First, ensure that you have selected the correct form for your locality/state.

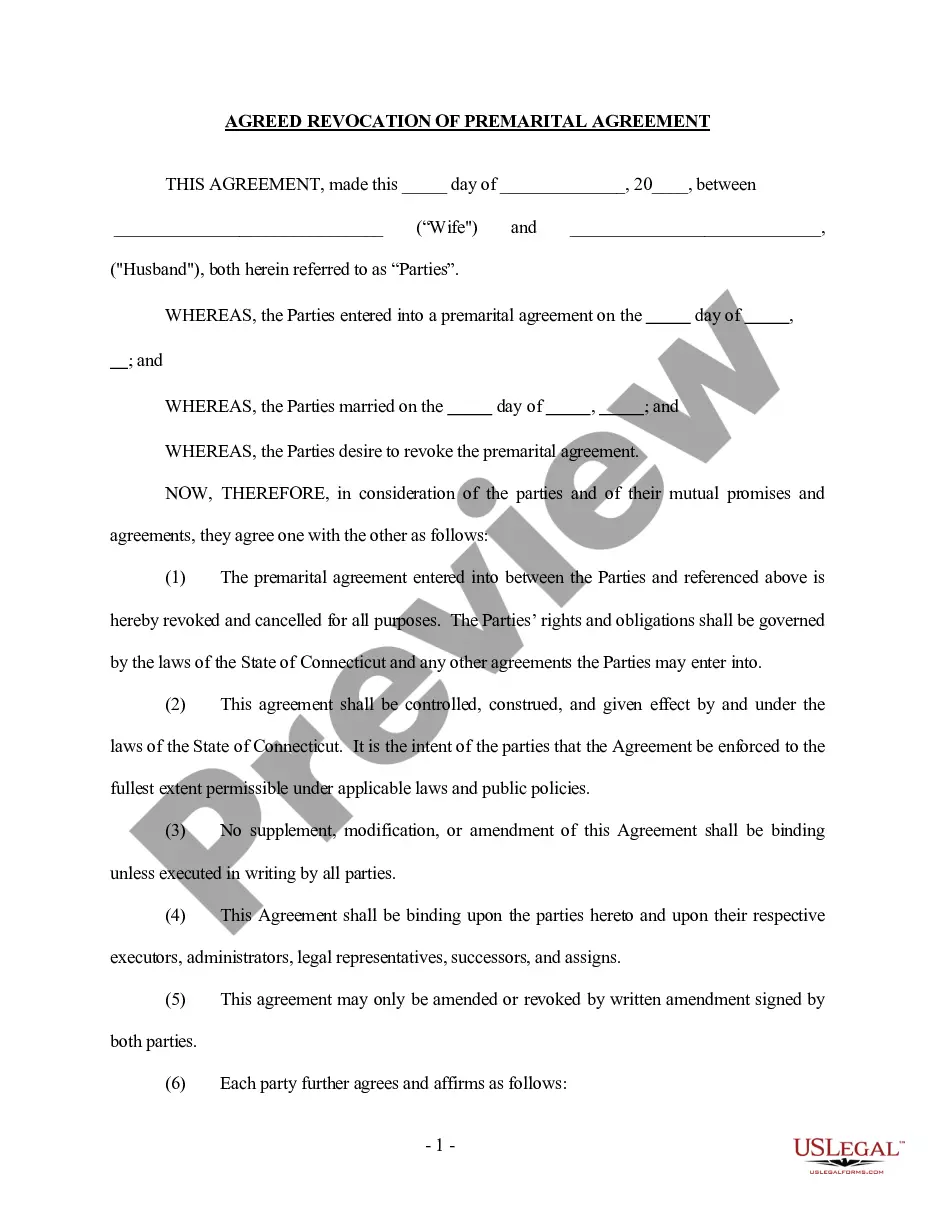

- You can review the document using the Review button and read the document details to confirm it is the right one for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate document.

- Once you are certain that the form is accurate, click the Buy now button to obtain the document.

- Choose the pricing plan you want and provide the required information.

- Create your account and complete the purchase using your PayPal account or a Visa or Mastercard.

Form popularity

FAQ

New rules for self-employed individuals typically involve updated tax policies and benefits eligibility. Changes may also define how self-employed workers report income and manage their business expenses. Staying informed about these rules is important for anyone engaged in a Connecticut Pipeline Service Contract - Self-Employed, ensuring compliance and maximizing benefits.

Yes, you can be self-employed and have a contract. Many self-employed individuals engage clients through contracts that outline specific services. This approach helps establish professionalism, sets expectations, and provides legal protection, particularly in agreements like a Connecticut Pipeline Service Contract - Self-Employed.

Absolutely, a self-employed person can and often does have contracts with clients. These contracts define the scope of work, payment terms, and duration of the engagement, offering clarity and protection for both parties. When navigating a Connecticut Pipeline Service Contract - Self-Employed, having a well-drafted contract can provide security and framework for your work.

The main difference between being contracted and being self-employed lies in the nature of the relationship with the client. A contract worker may be self-employed but operates through a contract for specific projects. On the other hand, a self-employed person may have ongoing relationships with clients and broader responsibilities. Understanding these nuances is vital when considering a Connecticut Pipeline Service Contract - Self-Employed.

In Connecticut, the '4 hour rule' helps clarify whether a worker qualifies as an independent contractor or employee. This rule typically refers to situations where an individual works a minimum period for a client, influencing their classification. Adhering to this rule is essential for those engaging in a Connecticut Pipeline Service Contract - Self-Employed.

The terms self-employed and independent contractor are often used interchangeably, but they can have different connotations. Self-employed refers broadly to anyone running their own business, while independent contractor usually describes someone who provides services to clients under a contract. Understanding these distinctions is crucial when discussing agreements like a Connecticut Pipeline Service Contract - Self-Employed.

Yes, contract workers are generally viewed as self-employed individuals. They operate their own businesses, work independently, and set their own hours. Additionally, while they may work under a contract for a specific project, they are not employees of the company. This distinction is important in the context of a Connecticut Pipeline Service Contract - Self-Employed.

While it is not legally required to have a contract as a self-employed individual, it is highly advisable. A contract protects your rights, outlines project terms, and ensures both parties are aligned on the expectations. For those working with clients or companies, a Connecticut Pipeline Service Contract - Self-Employed can serve as a vital tool for a successful freelance career.

Lacking a contract can lead to significant complications, such as payment disputes or unclear job expectations. In the absence of a formal agreement, you might find it challenging to enforce your rights. To avoid such situations, consider using a Connecticut Pipeline Service Contract - Self-Employed to establish clear terms and protect yourself.

To secure government contracts in Connecticut, you should register with the state’s procurement system and research available opportunities. Networking and building relationships with local agencies can also increase your chances. Utilizing a Connecticut Pipeline Service Contract - Self-Employed can enhance your ability to bid on and fulfill government projects successfully.