Connecticut Death To Do List - Checklist

Description

How to fill out Death To Do List - Checklist?

You may devote several hours on-line looking for the lawful document template that fits the federal and state needs you require. US Legal Forms provides a large number of lawful forms that happen to be analyzed by pros. It is simple to down load or print the Connecticut Death To Do List - Checklist from the assistance.

If you currently have a US Legal Forms bank account, you may log in and click the Obtain option. Following that, you may full, edit, print, or signal the Connecticut Death To Do List - Checklist. Each and every lawful document template you acquire is yours permanently. To get yet another version associated with a purchased form, visit the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website the first time, adhere to the easy guidelines listed below:

- First, be sure that you have selected the best document template for your area/metropolis that you pick. Browse the form information to make sure you have picked the proper form. If readily available, utilize the Preview option to appear with the document template too.

- If you want to discover yet another variation of the form, utilize the Research discipline to find the template that fits your needs and needs.

- Upon having located the template you need, simply click Get now to carry on.

- Select the pricing plan you need, key in your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You can use your charge card or PayPal bank account to cover the lawful form.

- Select the file format of the document and down load it in your system.

- Make alterations in your document if required. You may full, edit and signal and print Connecticut Death To Do List - Checklist.

Obtain and print a large number of document layouts utilizing the US Legal Forms website, which offers the largest selection of lawful forms. Use specialist and status-certain layouts to deal with your company or individual demands.

Form popularity

FAQ

Step by step checklist Step 1 ? Where Do I Start? ... Step 2 ? Registering the Death. ... Step 3 ? Making the Funeral Arrangements. ... Step 4 ? Building a Picture of the Estate. ... Step 5 ? Letting Everyone Know. ... Step 6 ? Working Out if You Need Probate. ... Step 7 ? The Final Step.

Immediate Steps to Take When a Loved One Dies Getting a legal pronouncement of death. ... Arranging for the body to be transported. ... Making arrangements for the care of dependents and pets. Contacting others including: Making final arrangements. ... Getting copies of the death certificate.

The SSA cannot pay benefits for the month of a recipient's death. That means if the person died in July, the check or direct deposit received in August (which is payment for July) must be returned.

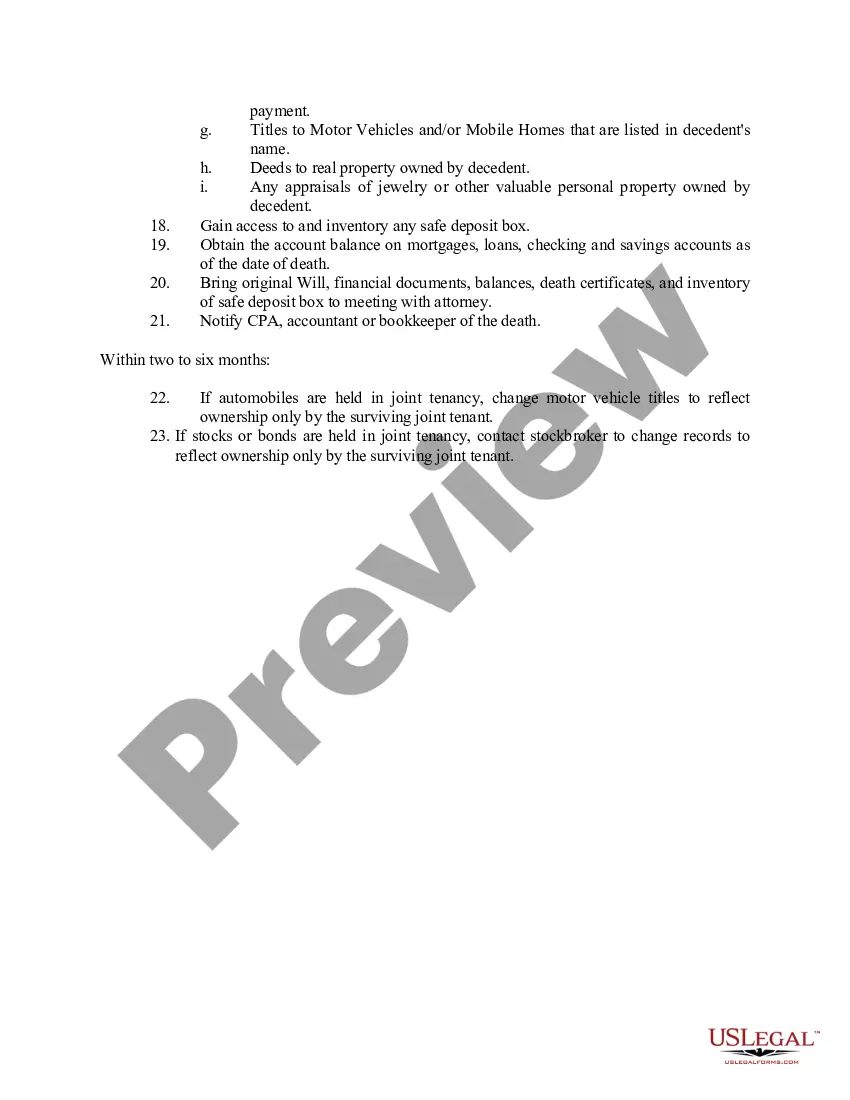

As Connecticut estate planning and probate lawyers, we prepared a handy list of what to do in the first week after someone dies. Handle the care of any dependents and/or pets. ... Monitor the home. ... Notify close family and friends. ... Arrange for funeral and burial or cremation. ... Prepare the funeral service. ... Prepare an obituary.

Spouse, and the children* of both decedent and spouse -Spouse takes first $100,000 plus ½ of the remainder. Children* take the other ½ of the remainder. Spouse, and children* of decedent, one or more of whom is not the child of the spouse ? Spouse takes ½. All the children* share the other ½ equally.

A hospice worker or the funeral director can advise the family on temporary after-death care of the body in the home. The procedure for unexpected deaths at home is different: you should call 911 immediately. Unexpected deaths include the death of a person "too young" or who is not known to have any terminal condition.

Generally, you will need one certified copy of the death certificate for each major asset, such as cars, land, or bank accounts, for which you will need to transfer ownership. You may also need a certified copy for items such as life insurance policies, veterans' survivor benefits, and annuities.

How to Avoid Probate in CT Create a Living Trust. A living trust is one of the most common ways probate can be avoided in Connecticut. ... List Assets Under Joint Ownership. ... Transfer-on-Death Registrations.