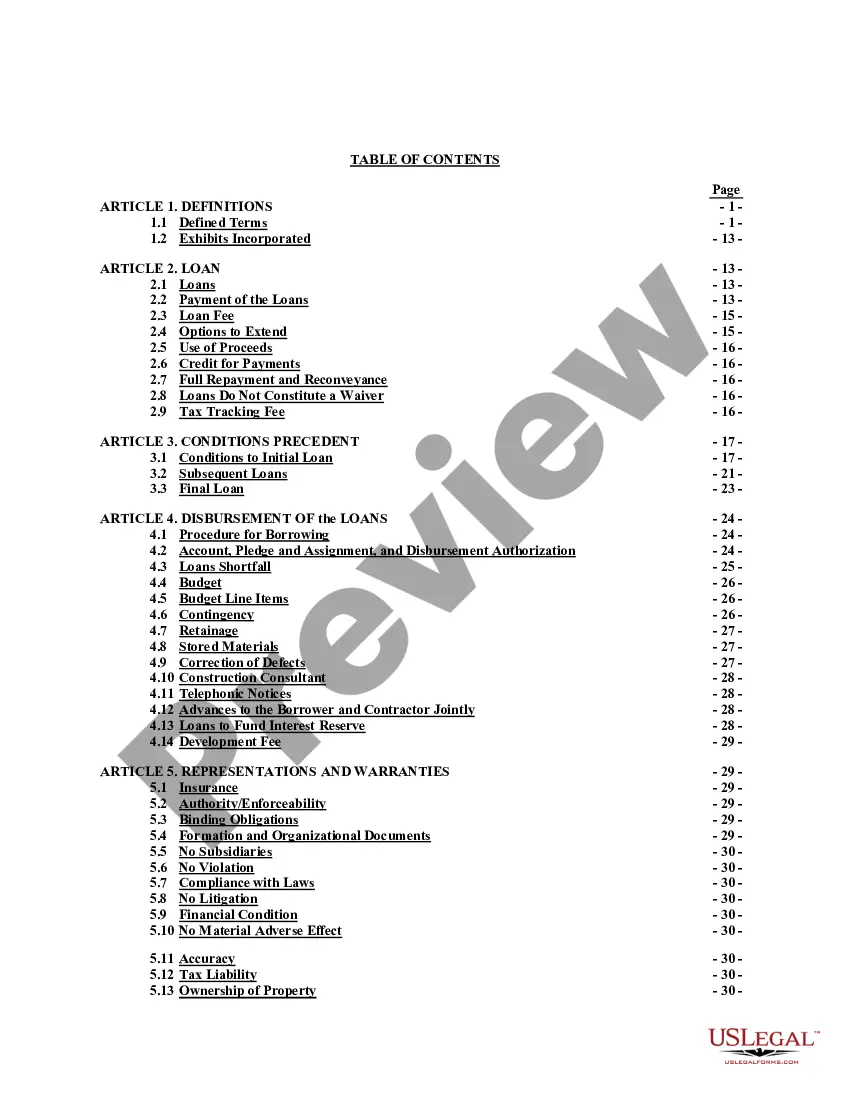

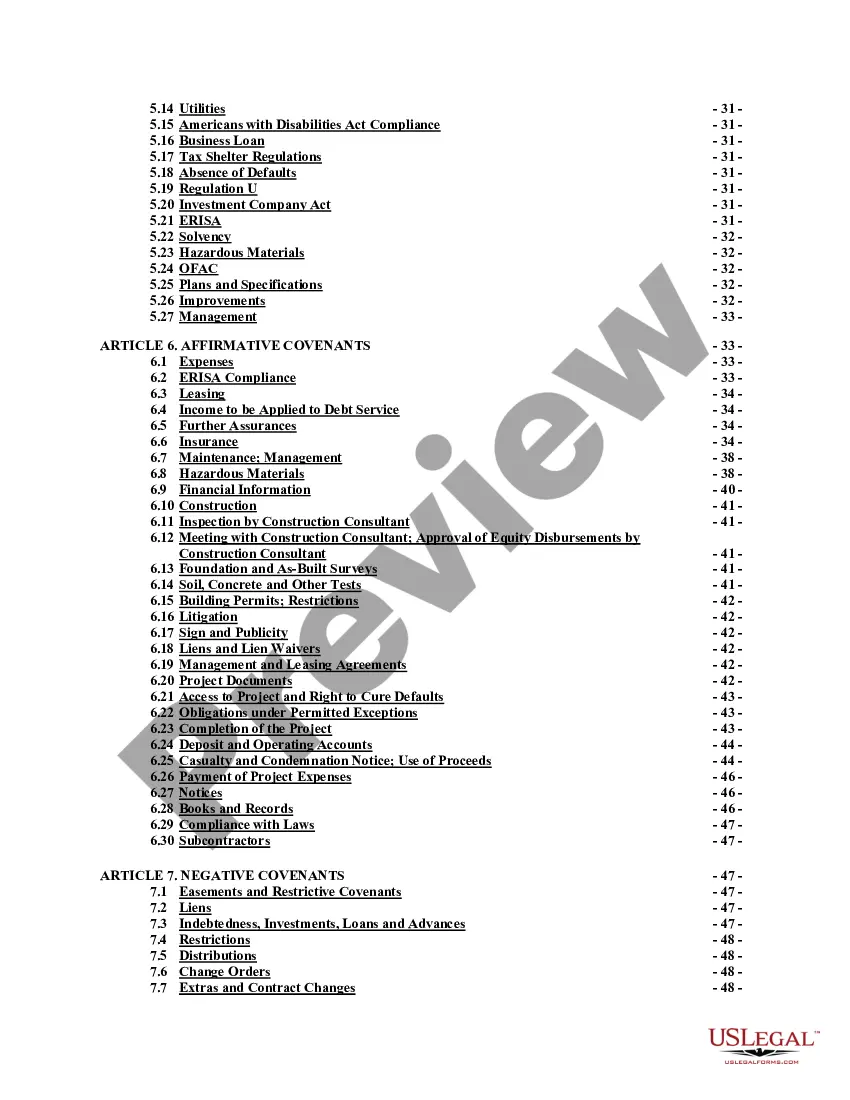

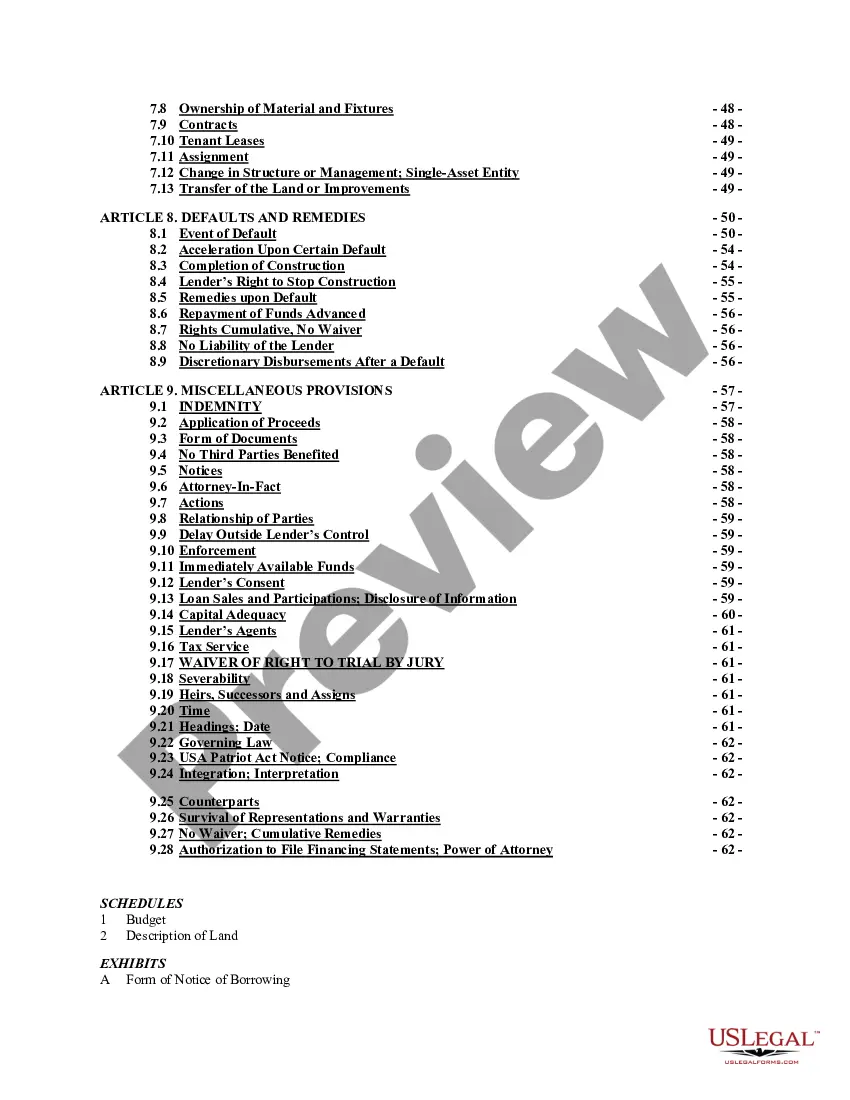

Connecticut Construction Loan Agreement

Description

A Loan Agreement is a document between a borrower and lender that details the loan repayment schedule.

The Loan Agreement protects the lender by enforcing the borrower's pledge to repay the loan; payment via regular payments or lump sums. The borrower may also find the loan contract useful because it records the details of the loan for their records and helps keep track of payments.

Loan agreements generally include information about:

* The location.

* The loan amount.

* Interest and late fees.

* Repayment method.

* Collateral and insurance."

How to fill out Construction Loan Agreement?

US Legal Forms - one of the biggest libraries of authorized types in the USA - delivers a wide array of authorized file themes you are able to obtain or printing. Utilizing the site, you can find thousands of types for company and person purposes, sorted by classes, suggests, or key phrases.You will discover the most recent models of types such as the Connecticut Construction Loan Agreement within minutes.

If you currently have a subscription, log in and obtain Connecticut Construction Loan Agreement through the US Legal Forms local library. The Acquire key will show up on each and every develop you look at. You have access to all earlier delivered electronically types in the My Forms tab of your own bank account.

If you want to use US Legal Forms the first time, listed here are simple instructions to help you get started:

- Be sure you have selected the correct develop for your metropolis/area. Click the Preview key to analyze the form`s information. Read the develop outline to actually have chosen the proper develop.

- In case the develop doesn`t satisfy your requirements, make use of the Search industry towards the top of the display to find the one who does.

- Should you be happy with the form, confirm your decision by simply clicking the Buy now key. Then, pick the prices prepare you want and give your qualifications to sign up for an bank account.

- Method the purchase. Use your charge card or PayPal bank account to perform the purchase.

- Choose the formatting and obtain the form on the system.

- Make alterations. Complete, change and printing and signal the delivered electronically Connecticut Construction Loan Agreement.

Each and every format you included with your money lacks an expiration time and it is yours for a long time. So, if you want to obtain or printing another backup, just visit the My Forms segment and then click in the develop you want.

Obtain access to the Connecticut Construction Loan Agreement with US Legal Forms, the most considerable local library of authorized file themes. Use thousands of specialist and state-specific themes that meet your company or person requirements and requirements.

Form popularity

FAQ

Construction loans have much shorter terms than conventional mortgages. A 30-year loan may be the most common, but homebuyers have the option of selecting shorter terms depending on their bank, such as 20 or 15 years. A construction loan has a term of one year or less. The rates tend to be much higher, too.

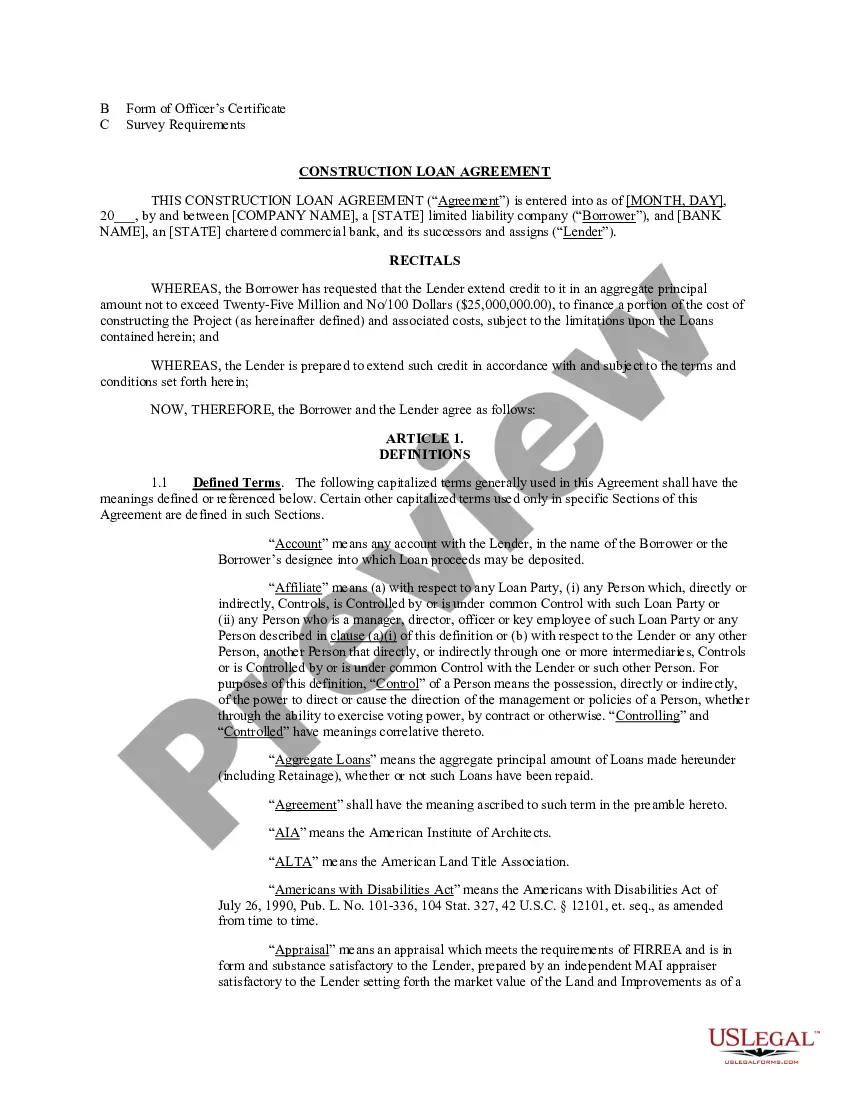

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Cons to doing a construction loan would be that payments on the construction loan begin once funds start being disbursed to the builder. With a traditional mortgage, payments don't begin until settlement. Another con is that the interest rates on construction loans are typically higher than on traditional mortgages.

A building loan agreement is a legal contract between a borrower and a lender that outlines the terms of a mortgage. For example, suppose this agreement requires a borrower to pay interest on the full amount of their loan for its duration instead of just interest on any outstanding balance after each payment is made.

Elements of a construction contract Name of contractor and contact information. ... Name of homeowner and contact information. ... Describe property in legal terms. ... List attachments to the contract. ... The cost. ... Failure of homeowner to obtain financing. ... Description of the work and the completion date. ... Right to stop the project.

A construction loan (also known as a ?self-build loan") is a short-term loan used to finance the building of a home or another real estate project. The builder or home buyer takes out a construction loan to cover the costs of the project before obtaining long-term funding.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

A construction loan agreement is a legally binding contract between the lender and the borrower, detailing the promises and commitments both parties have to uphold through successful project completion.