Connecticut Operating Agreement for the Withdrawal of a Member and Amending the Operating Agreement

Description

How to fill out Operating Agreement For The Withdrawal Of A Member And Amending The Operating Agreement?

US Legal Forms - among the greatest libraries of lawful kinds in the States - gives a variety of lawful document templates you may download or printing. Using the internet site, you may get 1000s of kinds for company and person functions, categorized by classes, states, or search phrases.You will find the newest variations of kinds much like the Connecticut Operating Agreement for the Withdrawal of a Member and Amending the Operating Agreement in seconds.

If you have a registration, log in and download Connecticut Operating Agreement for the Withdrawal of a Member and Amending the Operating Agreement from the US Legal Forms collection. The Download key will appear on each and every kind you perspective. You have access to all in the past saved kinds inside the My Forms tab of your own profile.

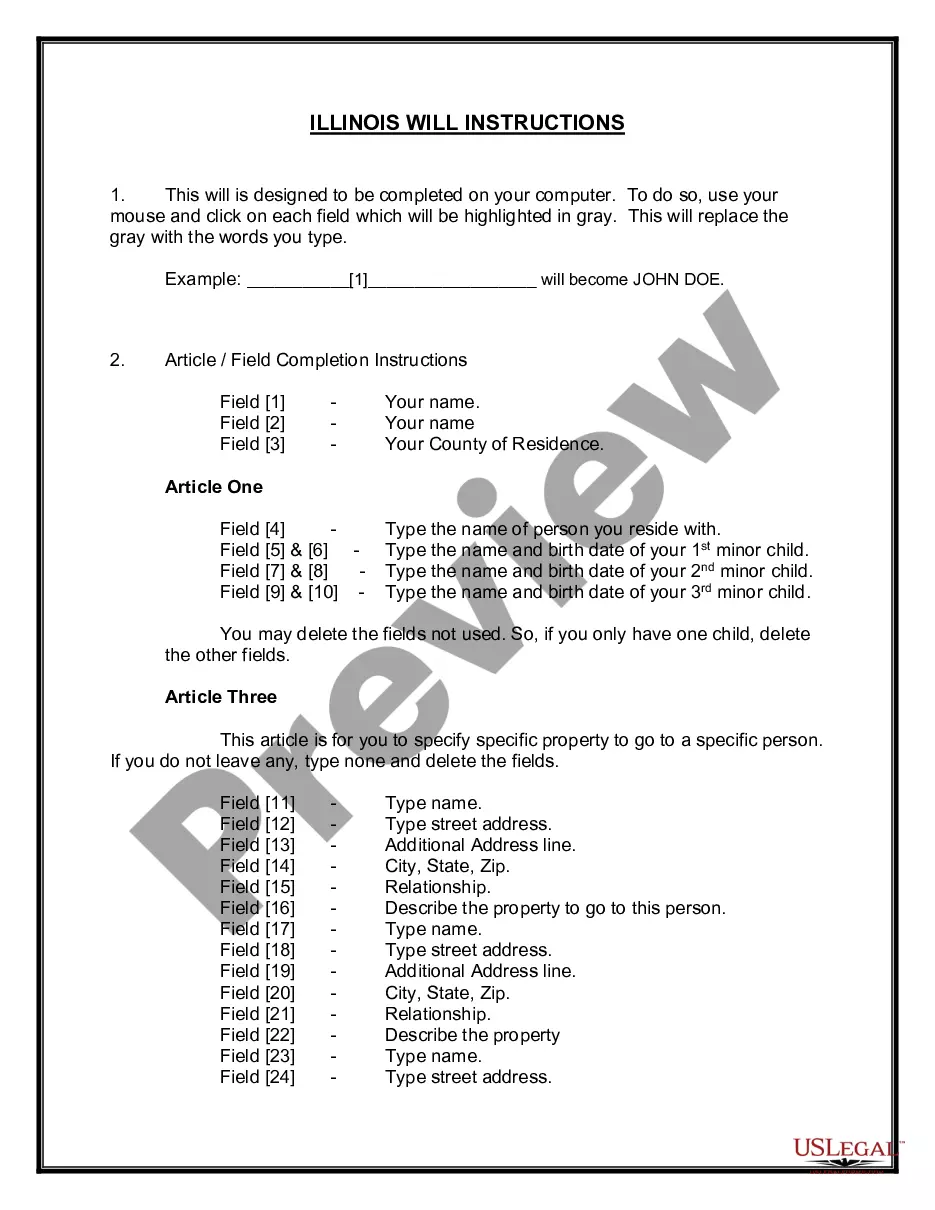

If you want to use US Legal Forms initially, here are simple directions to help you get started out:

- Ensure you have picked out the best kind for your city/region. Select the Review key to check the form`s content. Read the kind explanation to ensure that you have chosen the right kind.

- In the event the kind does not satisfy your needs, take advantage of the Lookup area at the top of the display to find the one which does.

- In case you are pleased with the form, affirm your decision by visiting the Purchase now key. Then, select the prices program you want and offer your accreditations to sign up on an profile.

- Method the deal. Use your credit card or PayPal profile to accomplish the deal.

- Select the formatting and download the form in your device.

- Make alterations. Fill up, revise and printing and signal the saved Connecticut Operating Agreement for the Withdrawal of a Member and Amending the Operating Agreement.

Every single format you added to your bank account does not have an expiry time and is also yours permanently. So, if you wish to download or printing another version, just go to the My Forms segment and click in the kind you will need.

Get access to the Connecticut Operating Agreement for the Withdrawal of a Member and Amending the Operating Agreement with US Legal Forms, the most comprehensive collection of lawful document templates. Use 1000s of specialist and condition-distinct templates that meet your company or person requires and needs.

Form popularity

FAQ

Essentially, you need to clearly discuss changes with other members or managers to get consent. Once that's done, you update the agreement, get it signed and use it for future decisions. The process you choose to follow is up to you, and you can update your Operating Agreement whenever you think it's necessary.

While an LLC and PLLC both provide personal limited liability protection, a PLLC will not protect you from claims of malpractice or wrongdoing. However, a benefit of a PLLC is that the wrongdoing of one individual member does not create liability for other members.

A Connecticut LLC domestication is only possible if the LLC's current state has a legal procedure for changing an LLC's domicile. The other state may call the procedure domestication or conversion, but it must have a law that allows LLCs to officially move to a new state.

Connecticut Law § 34-243d-f describes the powers and limitations of an operating agreement, but doesn't require LLCs to adopt one. However, your operating agreement may be your most important internal document.

By default, Connecticut LLCs are taxed as pass-through entities. LLCs don't pay federal taxes directly?instead, an LLC's income passes through the business to LLC members.

It is possible to have multiple classes of equity in an LLC. In a real estate LLC, for example, you may have an actively managing member and other passive participants.

One type of legal entity that professionals consider is a professional limited liability company (PLLC). A PLLC is a business structure made for licensed professionals in specialized industries such as the medical or legal fields.

Connecticut does not allow professionals, such as accountants, attorneys and physicians, to form a professional limited liability companies (PLLCs).. After forming a limited liability company (LLC) , you must undertake certain steps on an ongoing basis to keep your business in compliance.