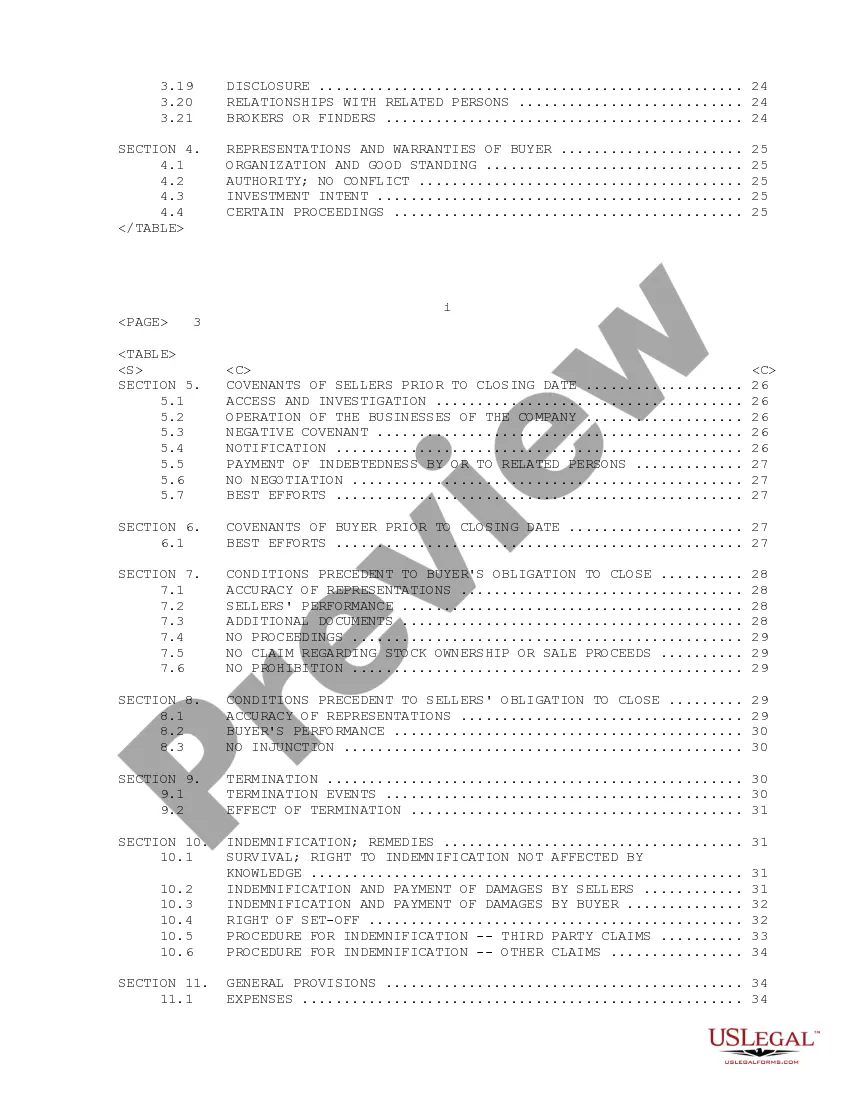

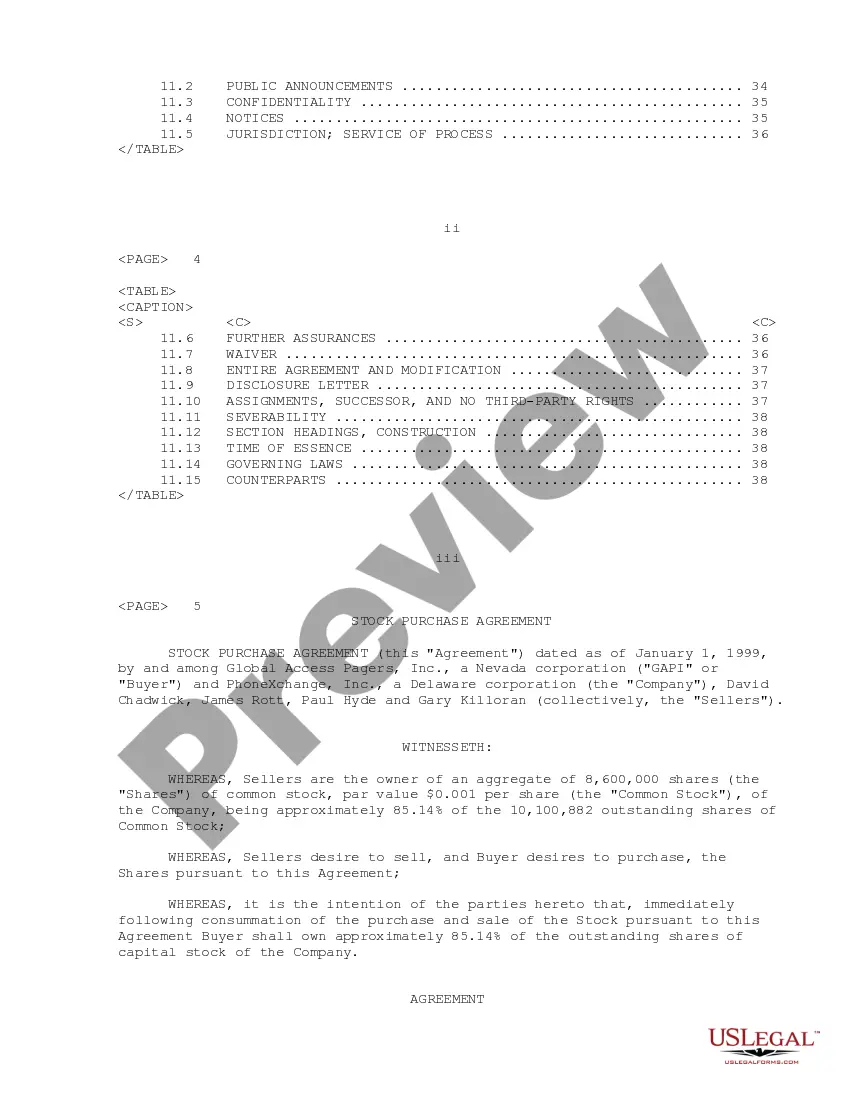

Connecticut Sample Stock Purchase Agreement between Integrated Communication Networks, Inc. and PhoneXchange, Inc.

Description

How to fill out Sample Stock Purchase Agreement Between Integrated Communication Networks, Inc. And PhoneXchange, Inc.?

Have you been within a situation where you require files for sometimes organization or personal functions almost every day? There are plenty of lawful file templates available online, but locating versions you can depend on is not simple. US Legal Forms gives 1000s of type templates, much like the Connecticut Sample Stock Purchase Agreement between Integrated Communication Networks, Inc. and PhoneXchange, Inc., which are written to meet state and federal needs.

Should you be already acquainted with US Legal Forms internet site and possess an account, basically log in. After that, it is possible to obtain the Connecticut Sample Stock Purchase Agreement between Integrated Communication Networks, Inc. and PhoneXchange, Inc. format.

Should you not come with an bank account and need to begin using US Legal Forms, adopt these measures:

- Get the type you want and make sure it is to the right area/area.

- Utilize the Preview option to check the shape.

- Browse the outline to actually have selected the proper type.

- In the event the type is not what you`re seeking, utilize the Research area to obtain the type that meets your requirements and needs.

- Whenever you get the right type, click on Purchase now.

- Select the pricing program you want, submit the necessary info to produce your money, and purchase the order using your PayPal or Visa or Mastercard.

- Pick a hassle-free document structure and obtain your duplicate.

Find all the file templates you might have bought in the My Forms food selection. You may get a further duplicate of Connecticut Sample Stock Purchase Agreement between Integrated Communication Networks, Inc. and PhoneXchange, Inc. at any time, if necessary. Just select the necessary type to obtain or print out the file format.

Use US Legal Forms, by far the most considerable collection of lawful varieties, to save time as well as prevent errors. The assistance gives expertly produced lawful file templates that you can use for an array of functions. Produce an account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

This might include provisions for price and payment, conditions precedent to sale, completion arrangements, warranties, restraints and miscellaneous provisions (such as indemnity clauses, tax provisions or confidentiality agreements).

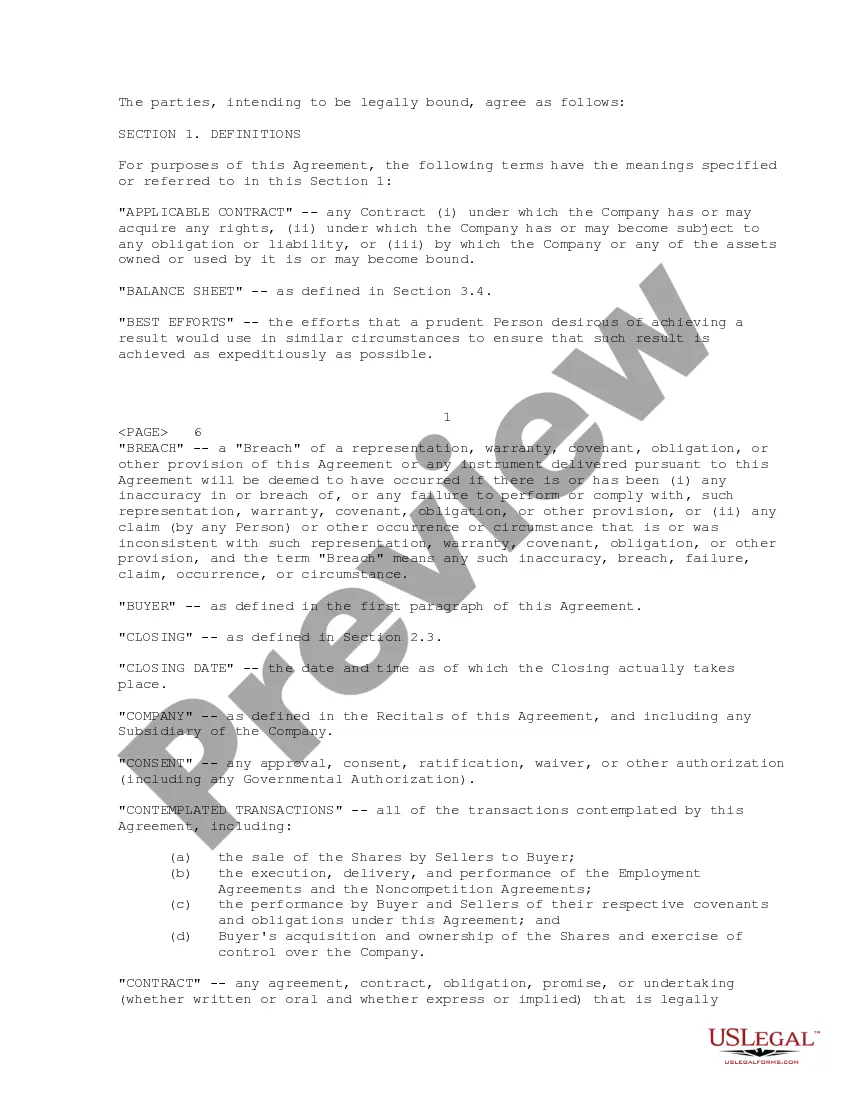

A stock purchase agreement is a contract signed by two parties when they buy or sell stock in a corporation in the US. Small firms that sell stock frequently use these agreements. Stock can be sold to buyers by either the corporation or its shareholders.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

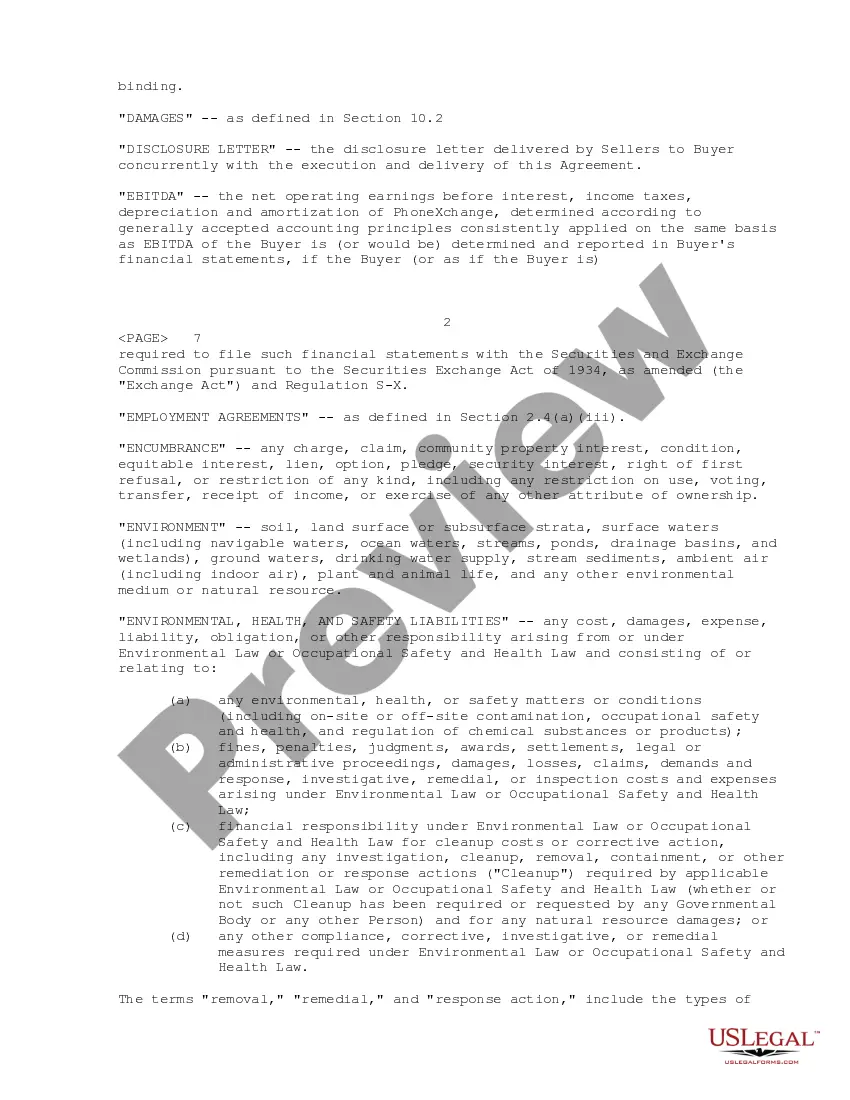

Common due diligence issues unique to stock purchases include the seller's title to the target company's stock, terms of key contracts, identifying the target company's liabilities, and the nature and condition of the target company's assets.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).