Connecticut Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund

Description

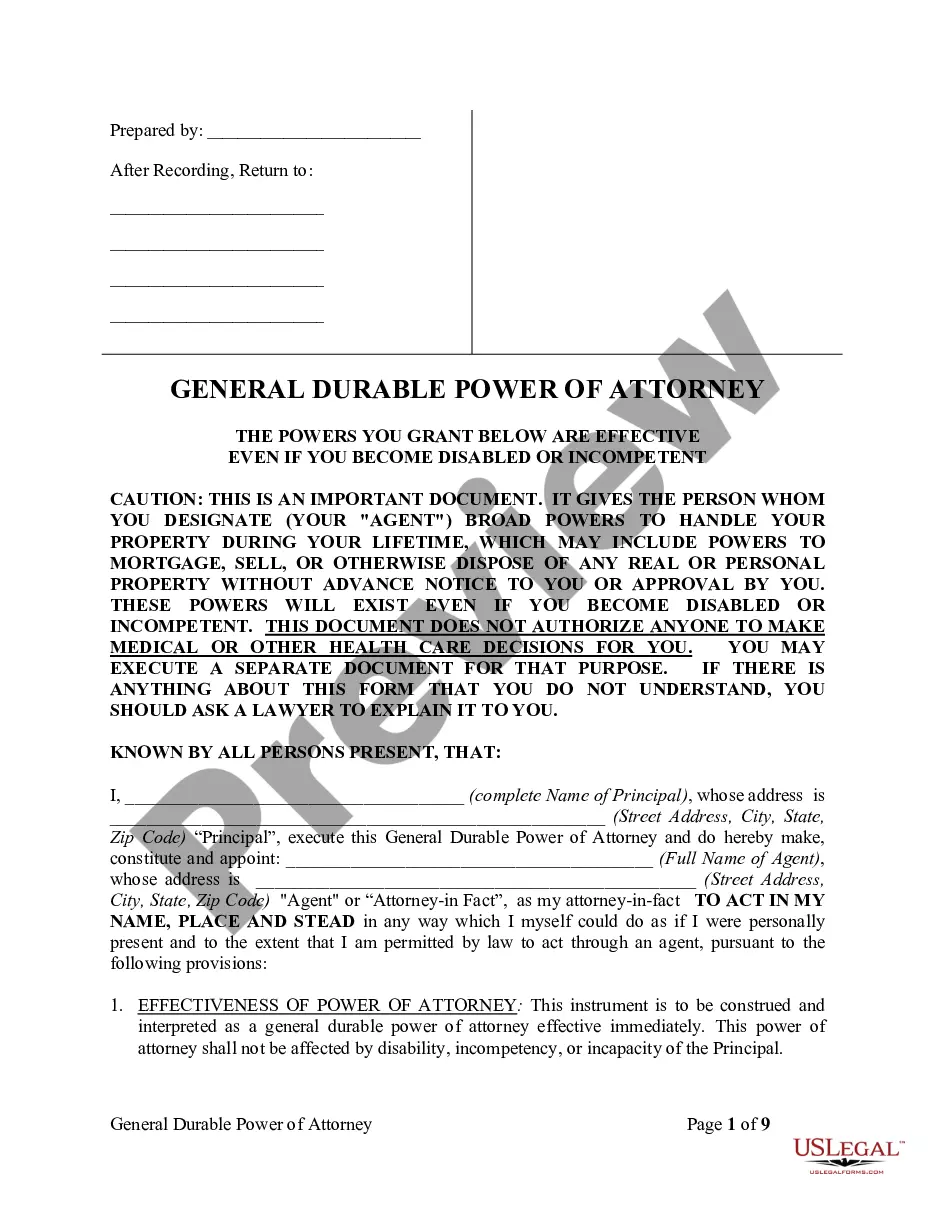

How to fill out Plan Of Reorganization Between Franklin Gold Fund And Franklin Gold And Precious Metals Fund?

It is possible to commit hrs online looking for the authorized papers format that meets the federal and state needs you require. US Legal Forms provides 1000s of authorized kinds which can be reviewed by experts. It is simple to acquire or printing the Connecticut Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund from your service.

If you already possess a US Legal Forms account, you can log in and click the Acquire option. Next, you can full, edit, printing, or sign the Connecticut Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund. Each and every authorized papers format you acquire is your own property eternally. To obtain one more backup for any purchased type, visit the My Forms tab and click the related option.

If you are using the US Legal Forms web site the very first time, follow the easy directions beneath:

- Initial, ensure that you have chosen the proper papers format for your county/metropolis of your choosing. Look at the type outline to make sure you have selected the right type. If readily available, use the Preview option to appear from the papers format at the same time.

- In order to find one more model of your type, use the Look for industry to discover the format that meets your needs and needs.

- When you have found the format you want, just click Acquire now to continue.

- Choose the costs prepare you want, enter your qualifications, and register for a free account on US Legal Forms.

- Full the financial transaction. You can utilize your charge card or PayPal account to pay for the authorized type.

- Choose the formatting of your papers and acquire it in your product.

- Make modifications in your papers if required. It is possible to full, edit and sign and printing Connecticut Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund.

Acquire and printing 1000s of papers templates using the US Legal Forms Internet site, that provides the largest selection of authorized kinds. Use specialist and express-specific templates to handle your organization or individual requirements.

Form popularity

FAQ

Traditional financial advice is that gold should comprise 5-10 percent of assets, or 10-20 percent if you're not including home equity.

Alternative assets can include precious metals, real estate and even private equity. So, how much should you consider allocating toward gold? Updated research published in Proactive advisor magazine identified the optimal gold allocation amount at 20% of one's portfolio.

Gold has an established history as a reliable store of value and as a hedge against inflation. Financial advisors and market analysts commonly recommend an allocation of gold between 5 and 10 percent of one's total investment capital as part of a well-diversified investment portfolio.

Abrdn Standard Physical Precious Metals Basket Shares ETF As of late 2021, the fund's net assets were approximately 57% gold, 26% silver, 12% palladium, and 4% platinum. The ETF provides broad exposure to a basket of precious metals for a reasonable cost, given its 0.6% expense ratio.

Many precious metals market analysts and financial advisors recommend allocating somewhere between 5-10% of your investment portfolio to gold. Speak to your financial advisor to find an allocation that works best for your financial situation.

Most experts recommend limiting your gold investment to 10% or less of your overall portfolio. The range between 1% and 10%, however, will often vary based on your age and overall investor profile.