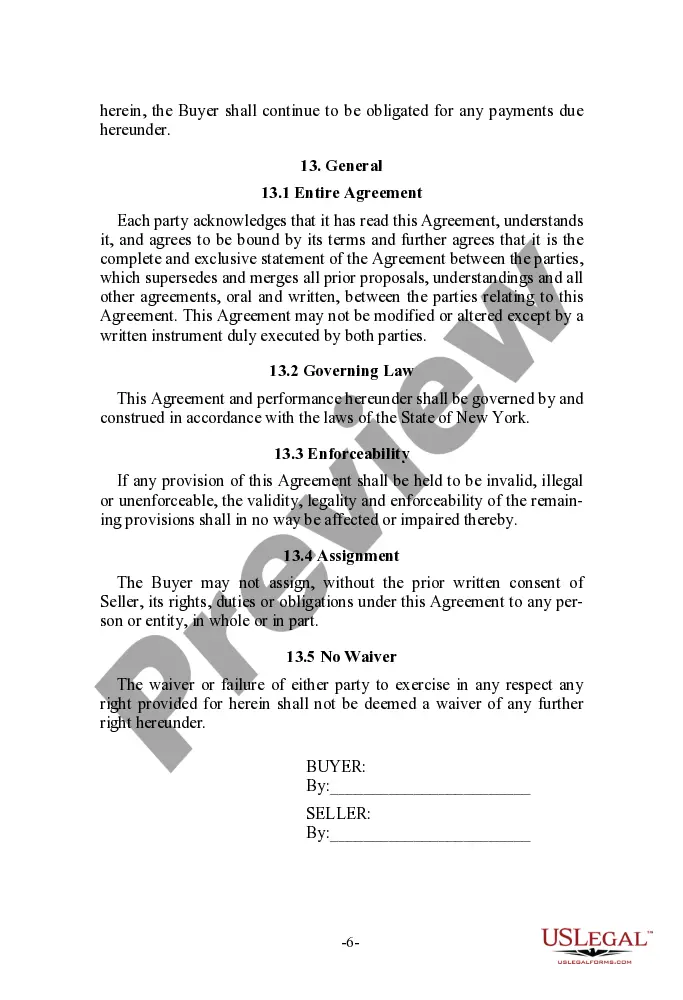

Connecticut Hardware Purchase Agreement with an Independent Sales Organization

Description

How to fill out Hardware Purchase Agreement With An Independent Sales Organization?

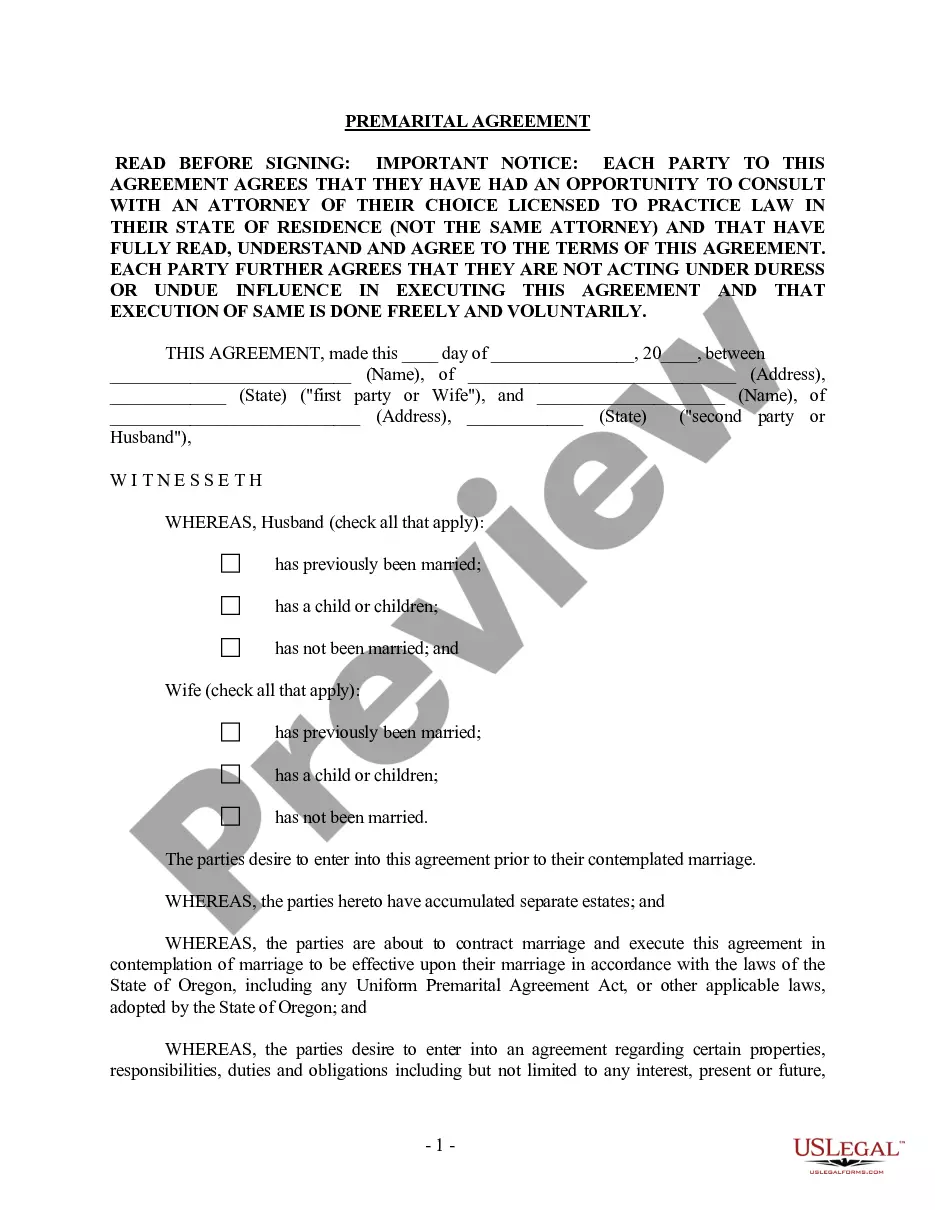

US Legal Forms - among the biggest libraries of authorized forms in America - delivers a wide array of authorized file layouts you may download or print out. Using the internet site, you may get 1000s of forms for organization and specific purposes, categorized by classes, says, or keywords.You will find the newest variations of forms much like the Connecticut Hardware Purchase Agreement with an Independent Sales Organization within minutes.

If you have a membership, log in and download Connecticut Hardware Purchase Agreement with an Independent Sales Organization from the US Legal Forms local library. The Acquire key can look on each and every kind you look at. You get access to all in the past downloaded forms within the My Forms tab of the account.

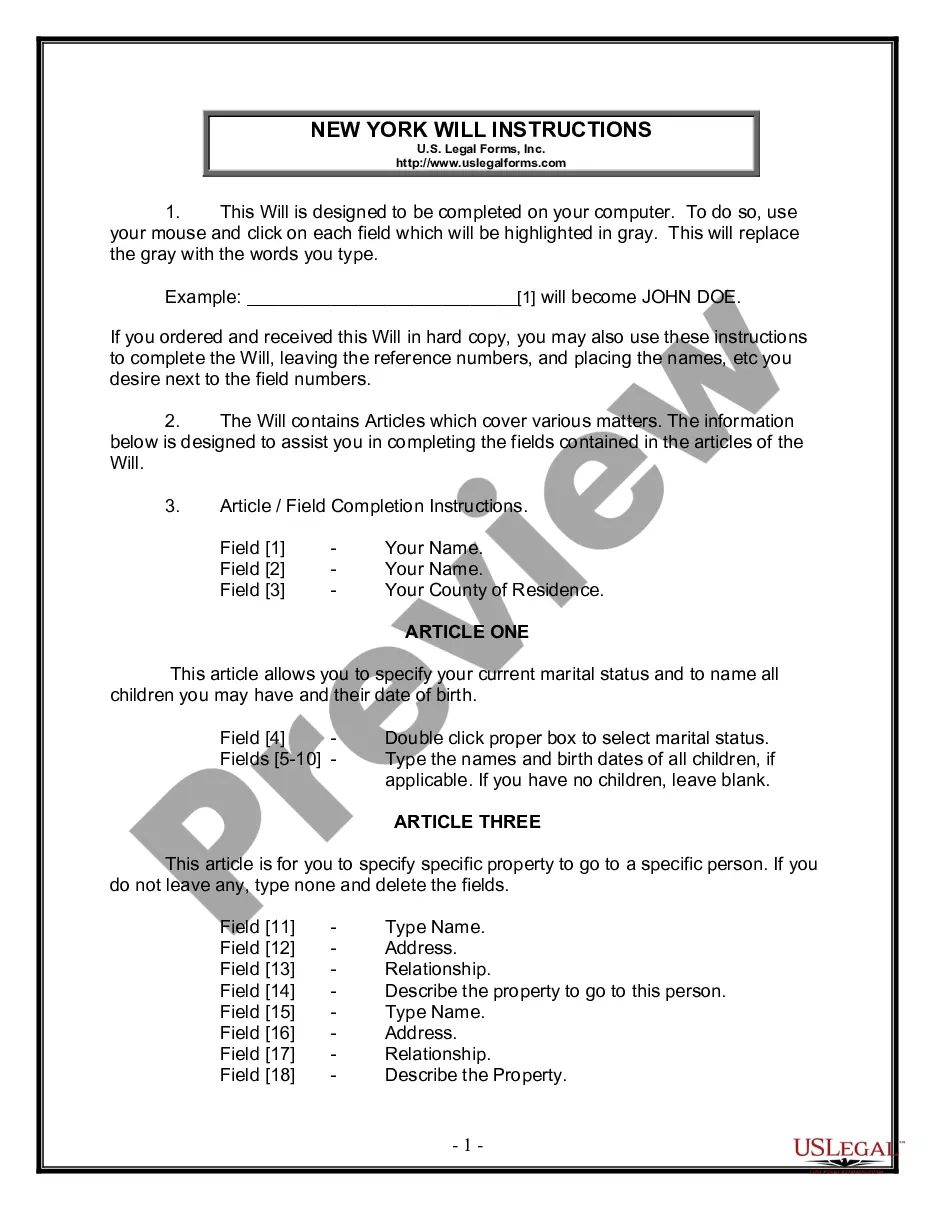

If you want to use US Legal Forms for the first time, listed here are straightforward guidelines to obtain started off:

- Ensure you have picked out the correct kind to your area/state. Select the Review key to check the form`s content. Browse the kind explanation to ensure that you have chosen the correct kind.

- In the event the kind doesn`t suit your demands, use the Lookup industry at the top of the display screen to find the the one that does.

- If you are satisfied with the shape, affirm your choice by visiting the Purchase now key. Then, choose the pricing strategy you prefer and give your references to register to have an account.

- Method the purchase. Make use of your credit card or PayPal account to perform the purchase.

- Select the file format and download the shape on your device.

- Make adjustments. Fill out, change and print out and sign the downloaded Connecticut Hardware Purchase Agreement with an Independent Sales Organization.

Each design you included in your money does not have an expiration day which is your own property eternally. So, if you wish to download or print out an additional backup, just proceed to the My Forms portion and then click around the kind you will need.

Obtain access to the Connecticut Hardware Purchase Agreement with an Independent Sales Organization with US Legal Forms, one of the most extensive local library of authorized file layouts. Use 1000s of specialist and condition-distinct layouts that fulfill your small business or specific requires and demands.

Form popularity

FAQ

The planting of trees, shrubs and sod are considered to be landscaping services. Landscaping services rendered to new construction, residential real estate, and industrial, commercial or income-producing property are subject to sales and use tax.

Form OS?114, Connecticut Sales and Use Tax Return, must be filed and paid electronically using myconneCT. DRS myconneCT allows taxpayers to electronically file, pay, and manage state tax responsibilities. Click here to File, Pay, or Register Now on myconneCT!

Connecticut building contractors and out-of-state contractors performing services in Connecticut are generally required to collect sales tax on their sales. Moreover, such contractors are required to pay sales or use tax on their purchases.

Tax-exempt goods Some goods are exempt from sales tax under Connecticut law. Examples include bicycle helmets, most non-prepared food items, medicines, and some medical devices and supplies.

Connecticut building contractors and out-of-state contractors performing services in Connecticut are generally required to collect sales tax on their sales. Moreover, such contractors are required to pay sales or use tax on their purchases.

Acts 3, §103 (June Spec. Sess.) treating as sales subject to the sales and use taxes the following renovation and repair services provided to renovation and repair services provided to residential real property: paving, painting or staining, wallpapering, roofing, siding and exterior sheet metal work.

Services in Connecticut are generally not taxable. However, iif the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Connecticut, with a few exceptions.

Reminder: As of July 1, 2001, paving, painting, staining, wallpapering, roofing, siding and exterior sheet metal services are no longer subject to sales tax when rendered to owner-occupied residential real property.