Connecticut Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act

Description

How to fill out Sections 302A.471 And 302A.473 Of Minnesota Business Corporation Act?

Are you within a place that you need to have papers for possibly organization or person uses nearly every day time? There are a lot of lawful record web templates accessible on the Internet, but discovering types you can rely on is not straightforward. US Legal Forms gives a huge number of type web templates, like the Connecticut Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act, that are created in order to meet federal and state needs.

If you are previously acquainted with US Legal Forms internet site and possess a merchant account, basically log in. Next, you may down load the Connecticut Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act template.

If you do not offer an bank account and would like to begin using US Legal Forms, abide by these steps:

- Find the type you will need and ensure it is for the appropriate metropolis/county.

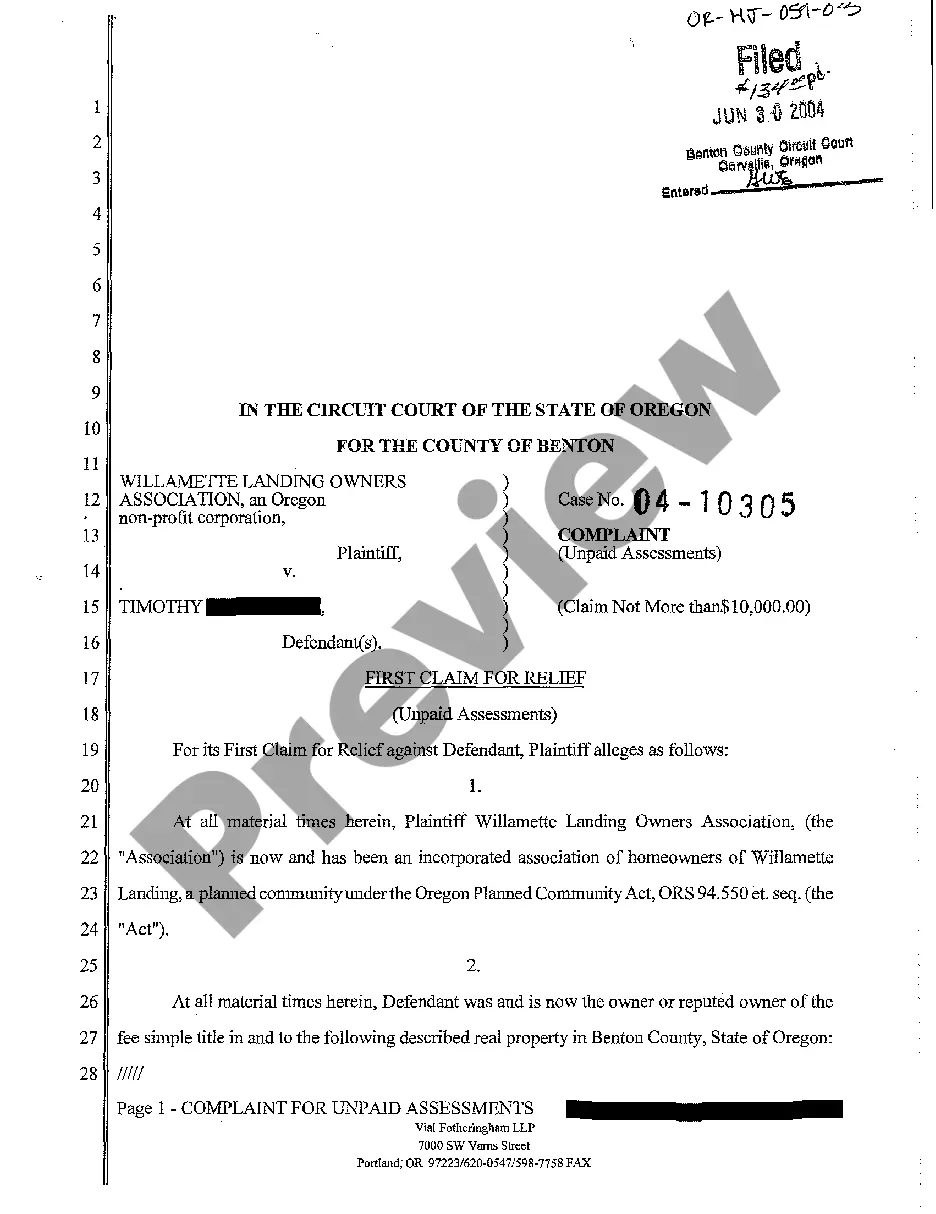

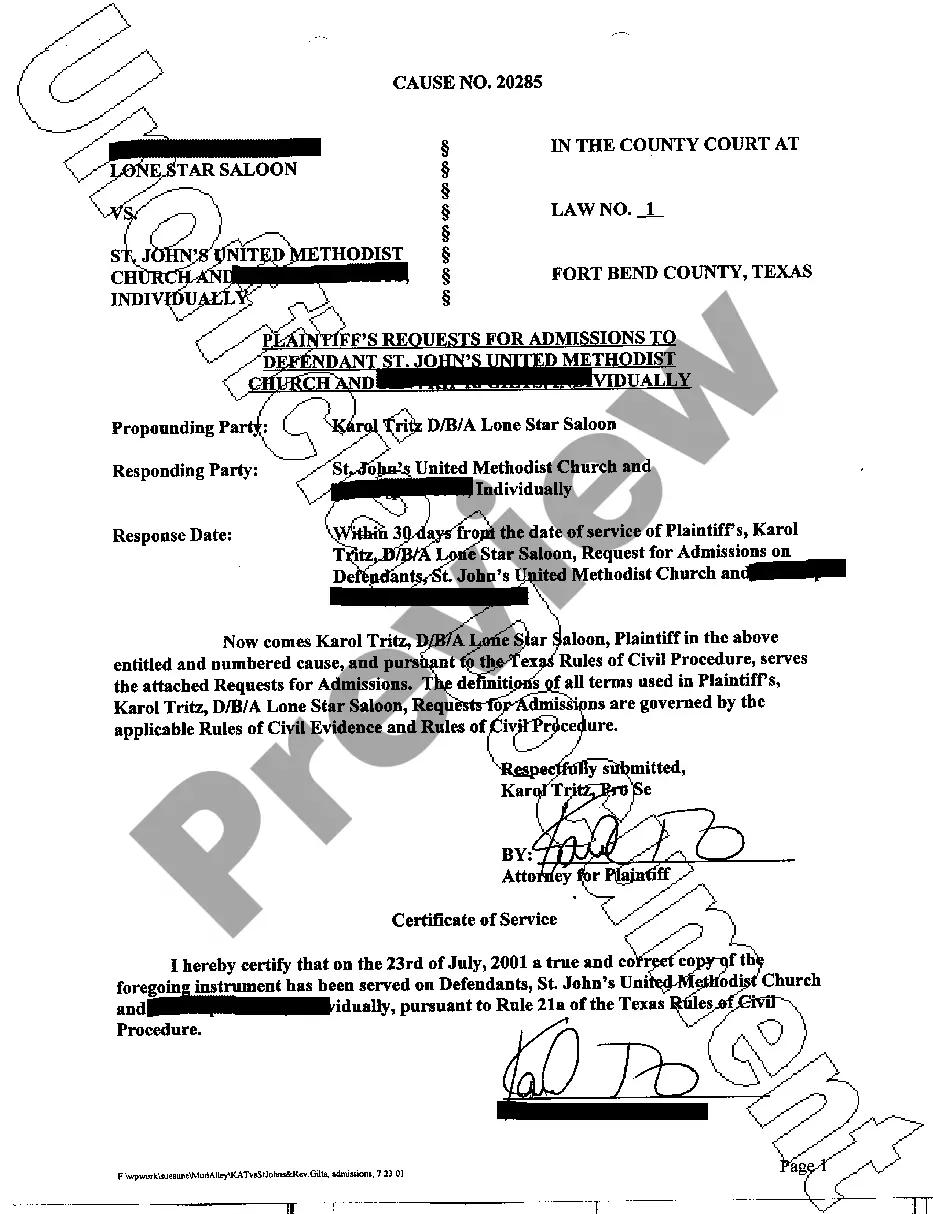

- Use the Review button to review the form.

- Browse the outline to actually have chosen the proper type.

- In the event the type is not what you are trying to find, take advantage of the Look for area to obtain the type that meets your needs and needs.

- When you discover the appropriate type, just click Acquire now.

- Opt for the rates program you desire, fill in the required details to make your money, and buy the transaction utilizing your PayPal or credit card.

- Decide on a hassle-free file formatting and down load your copy.

Discover every one of the record web templates you have bought in the My Forms food selection. You can get a extra copy of Connecticut Sections 302A.471 and 302A.473 of Minnesota Business Corporation Act whenever, if possible. Just go through the necessary type to down load or produce the record template.

Use US Legal Forms, probably the most extensive variety of lawful kinds, to save lots of time as well as stay away from mistakes. The service gives skillfully created lawful record web templates which you can use for a range of uses. Create a merchant account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

(a) A shareholder shall not assert dissenters' rights as to less than all of the shares registered in the name of the shareholder, unless the shareholder dissents with respect to all the shares that are beneficially owned by another person but registered in the name of the shareholder and discloses the name and address ...

CHAPTER 461. REGULATING SALES OF TOBACCO; TOBACCO-RELATED AND ELECTRONIC DELIVERY DEVICES; AND NICOTINE AND LOBELIA PRODUCTS. MUNICIPAL LICENSE OF TOBACCO, TOBACCO-RELATED DEVICES, AND SIMILAR PRODUCTS. CIGARETTE LICENSE FEES, APPORTIONMENT.

An action required or permitted to be taken at a meeting of the shareholders may be taken without a meeting by written action signed, or consented to by authenticated electronic communication, by all of the shareholders entitled to vote on that action.

In discharging the duties of the position of director, a director may, in considering the best interests of the corporation, consider the interests of the corporation's employees, customers, suppliers, and creditors, the economy of the state and nation, community and societal considerations, and the long-term as well ...

(a) A shareholder shall not assert dissenters' rights as to less than all of the shares registered in the name of the shareholder, unless the shareholder dissents with respect to all the shares that are beneficially owned by another person but registered in the name of the shareholder and discloses the name and address ...

When written action is permitted to be taken by less than all directors, all directors shall be notified immediately of its text and effective date. Failure to provide the notice does not invalidate the written action.

A shareholder, beneficial owner, or holder of a voting trust certificate who has gained access under this section to any corporate record including the share register may not use or furnish to another for use the corporate record or a portion of the contents for any purpose other than a proper purpose.

An action required or permitted to be taken at a board meeting may be taken by written action signed, or consented to by authenticated electronic communication, by all of the directors.