Connecticut Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc.

Description

How to fill out Agreement And Plan Of Merger By Filtertek, Inc., Filtertek De Puerto Rico, And Filtertek USA, Inc.?

Choosing the right legitimate file template can be a have difficulties. Obviously, there are a variety of themes accessible on the Internet, but how will you discover the legitimate form you will need? Use the US Legal Forms site. The support offers a large number of themes, for example the Connecticut Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc., which you can use for business and private requires. Each of the types are examined by pros and satisfy federal and state demands.

When you are previously signed up, log in to the profile and then click the Download switch to get the Connecticut Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc.. Make use of your profile to appear from the legitimate types you may have ordered formerly. Go to the My Forms tab of your profile and obtain one more copy of the file you will need.

When you are a brand new user of US Legal Forms, here are simple instructions so that you can adhere to:

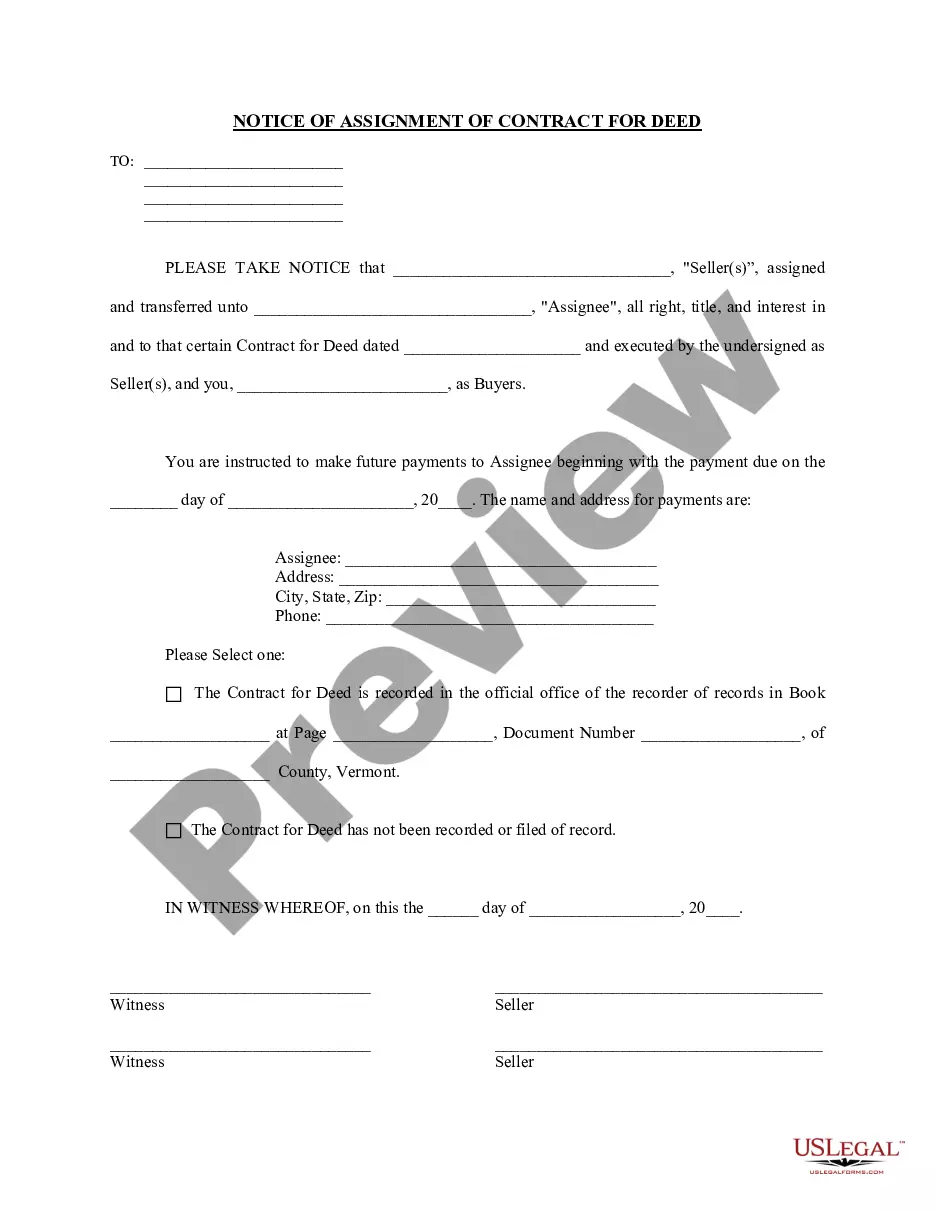

- First, ensure you have selected the right form for the area/region. You can look over the form utilizing the Review switch and read the form information to make sure this is basically the best for you.

- In the event the form fails to satisfy your needs, make use of the Seach discipline to discover the appropriate form.

- When you are sure that the form is suitable, select the Buy now switch to get the form.

- Select the rates strategy you need and type in the necessary information and facts. Make your profile and pay money for the order making use of your PayPal profile or credit card.

- Choose the data file format and acquire the legitimate file template to the system.

- Full, revise and produce and indication the attained Connecticut Agreement and Plan of Merger by Filtertek, Inc., Filtertek de Puerto Rico, and Filtertek USA, Inc..

US Legal Forms is definitely the biggest local library of legitimate types for which you can find different file themes. Use the service to acquire appropriately-produced files that adhere to state demands.