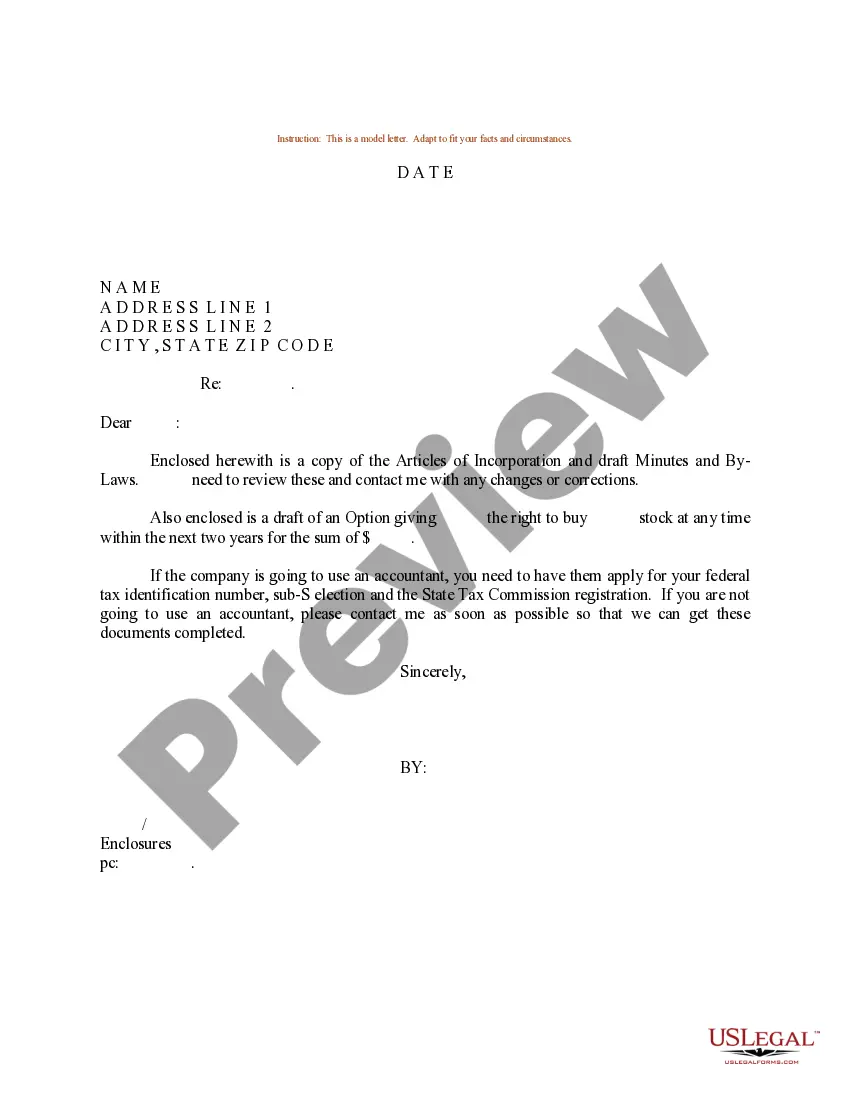

Connecticut Management Stock Purchase Plan

Description

How to fill out Management Stock Purchase Plan?

You are able to invest hrs on the Internet attempting to find the legal papers web template that fits the state and federal demands you will need. US Legal Forms provides a large number of legal types that happen to be examined by professionals. It is simple to down load or print out the Connecticut Management Stock Purchase Plan from the assistance.

If you already possess a US Legal Forms profile, you are able to log in and then click the Download switch. Afterward, you are able to full, revise, print out, or indicator the Connecticut Management Stock Purchase Plan. Each and every legal papers web template you acquire is your own permanently. To have one more version associated with a purchased type, proceed to the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms internet site the first time, stick to the simple recommendations listed below:

- Very first, make sure that you have chosen the correct papers web template for the county/city of your liking. Browse the type information to ensure you have picked the correct type. If offered, take advantage of the Review switch to appear throughout the papers web template also.

- If you want to locate one more edition of the type, take advantage of the Lookup area to get the web template that meets your requirements and demands.

- When you have found the web template you would like, click on Buy now to carry on.

- Choose the prices program you would like, type your references, and register for a free account on US Legal Forms.

- Total the financial transaction. You can use your credit card or PayPal profile to purchase the legal type.

- Choose the format of the papers and down load it to the gadget.

- Make alterations to the papers if possible. You are able to full, revise and indicator and print out Connecticut Management Stock Purchase Plan.

Download and print out a large number of papers layouts making use of the US Legal Forms website, which offers the biggest collection of legal types. Use skilled and status-particular layouts to take on your organization or person requirements.

Form popularity

FAQ

Disadvantages of Employee Stock Purchase Plans Ensuring the ESPP follows security and tax law guidelines can be challenging. A large amount of HR functions goes into administering the stock purchase plan. There are legal, tax, and administrative issues that go into setting up the plan.

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution.

You will continue to own stock purchased for you during your employment, but your eligibility for participation in the plan ends. Any funds withheld from your salary but not used to purchase shares before the end of your employment will be returned to you, normally without interest, within a reasonable period.

The Bottom Line. Employee stock options can be a valuable part of your compensation package, especially if you work for a company whose stock has been soaring of late. In order to take full advantage, make sure you exercise your rights before they expire.

How is the $25,000 limit calculated? The basic rule is that each employee cannot purchase more than $25,000 per year, valued using the fair market value on the date he/she enrolled in the current offering.

Cons of Participating in an ESPP: Single Stock Risk: Investing in a single company's stock can be risky, especially if the company is experiencing financial difficulties or its stock price is experiencing significant fluctuations.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

Employees who elect to participate in a qualified ESPP are typically able to take advantage of some tax benefits, as the discount is not recognized as taxable income until the stock is sold. When you sell the stock, the discount you received when you bought it may be taxable as income.