Connecticut Nonqualified and Incentive Stock Option Plan of Intercargo Corp.

Description

How to fill out Nonqualified And Incentive Stock Option Plan Of Intercargo Corp.?

US Legal Forms - one of several largest libraries of authorized kinds in America - delivers a wide range of authorized papers web templates you may download or print. Using the site, you will get a large number of kinds for business and specific reasons, sorted by groups, states, or key phrases.You will find the newest models of kinds like the Connecticut Nonqualified and Incentive Stock Option Plan of Intercargo Corp. in seconds.

If you have a registration, log in and download Connecticut Nonqualified and Incentive Stock Option Plan of Intercargo Corp. through the US Legal Forms collection. The Acquire button will appear on each and every type you see. You gain access to all in the past delivered electronically kinds inside the My Forms tab of your own accounts.

In order to use US Legal Forms for the first time, listed below are basic recommendations to help you get started off:

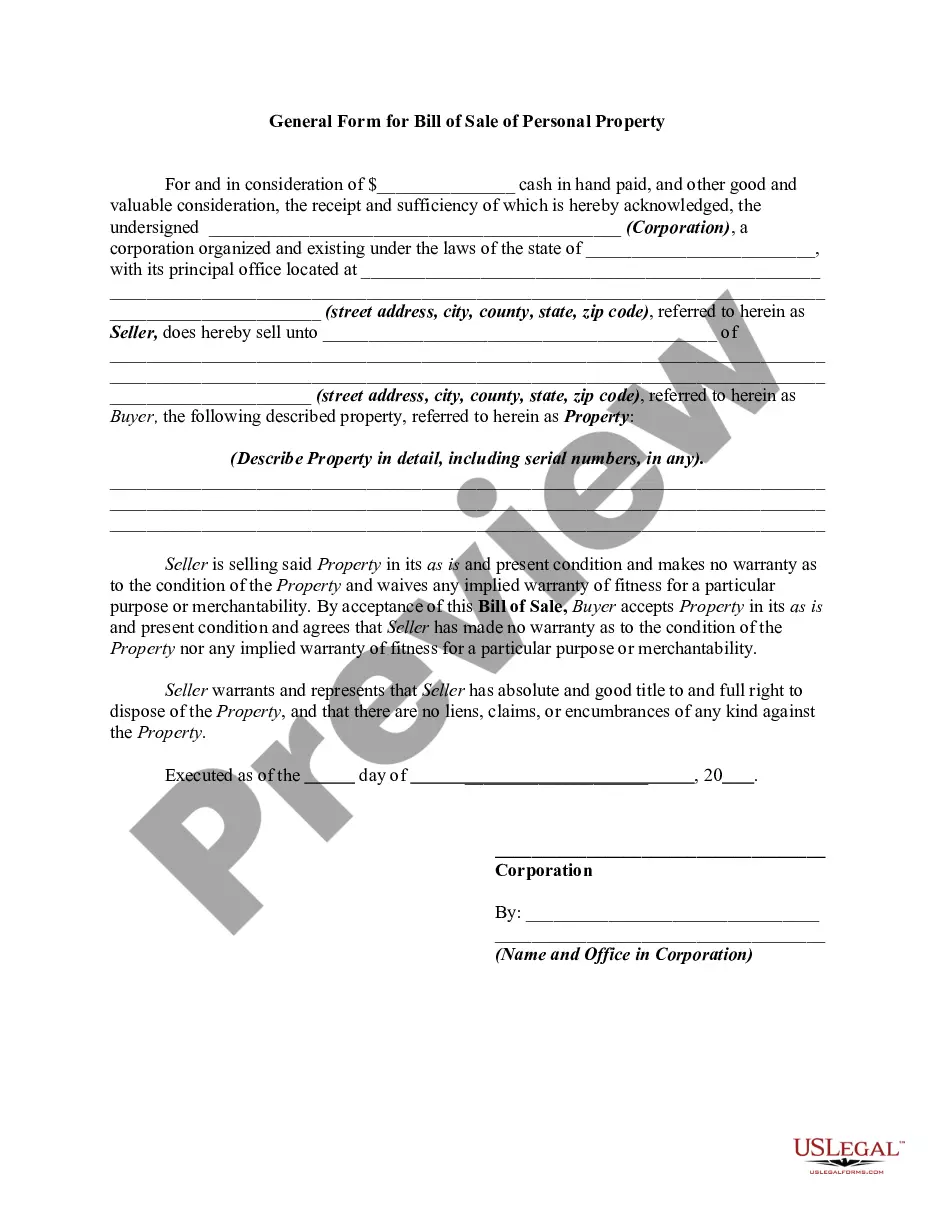

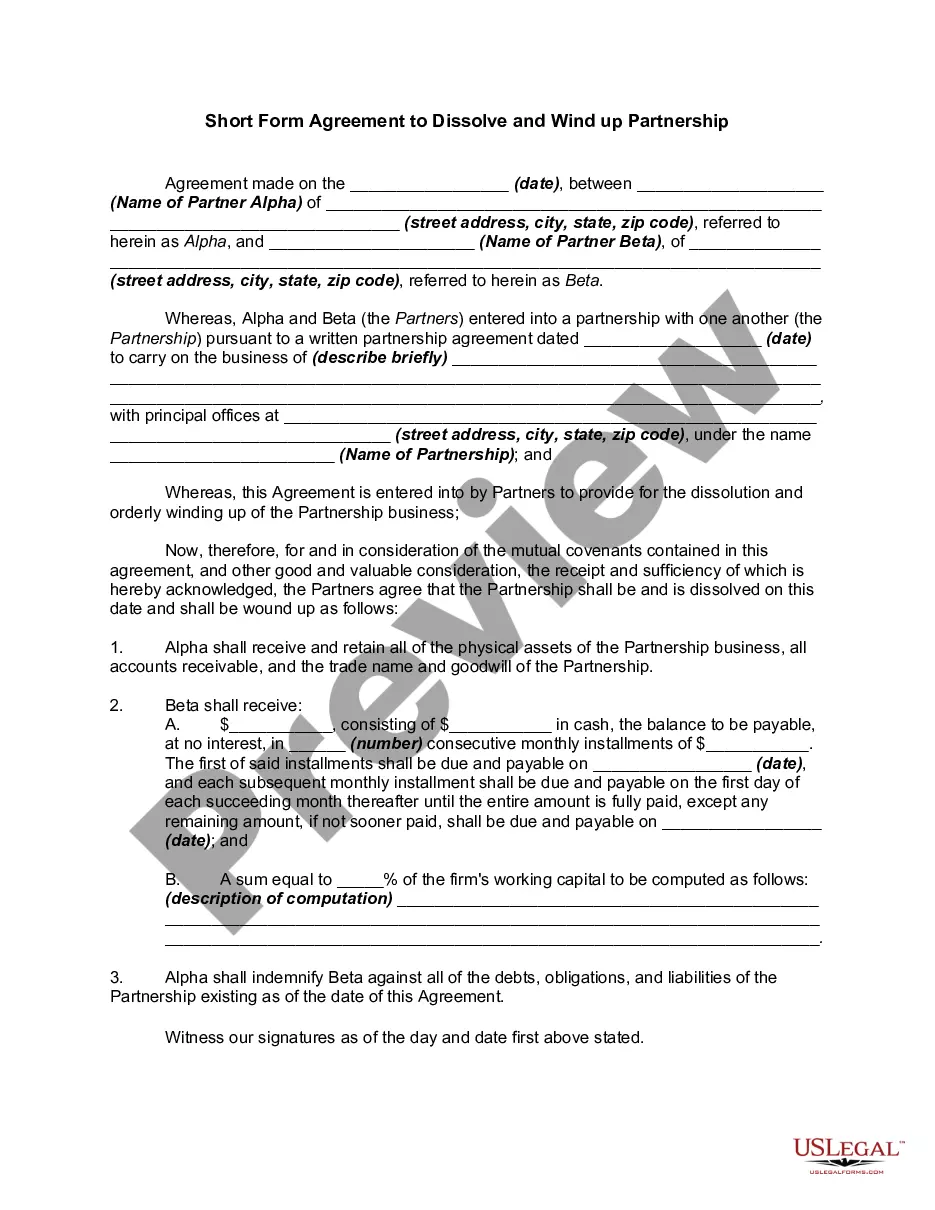

- Make sure you have selected the right type to your metropolis/state. Go through the Review button to check the form`s articles. Browse the type description to ensure that you have selected the proper type.

- If the type does not fit your needs, make use of the Search discipline near the top of the display screen to get the one which does.

- In case you are content with the form, affirm your choice by clicking the Get now button. Then, choose the prices strategy you want and provide your accreditations to sign up on an accounts.

- Method the financial transaction. Make use of your credit card or PayPal accounts to perform the financial transaction.

- Pick the file format and download the form on your device.

- Make adjustments. Load, revise and print and indicator the delivered electronically Connecticut Nonqualified and Incentive Stock Option Plan of Intercargo Corp..

Each and every web template you put into your account lacks an expiry particular date which is yours forever. So, if you wish to download or print an additional copy, just go to the My Forms section and click about the type you will need.

Get access to the Connecticut Nonqualified and Incentive Stock Option Plan of Intercargo Corp. with US Legal Forms, the most extensive collection of authorized papers web templates. Use a large number of skilled and condition-distinct web templates that meet your business or specific requirements and needs.

Form popularity

FAQ

At their core, Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NQSOs) are similar. With some exceptions, both are options to purchase a company's stock at a predetermined exercise price after a certain period of time or after the achievement of milestones.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

Companies can choose between two types of stock option plans?incentive stock options (ISOs) and nonqualified stock options (NSOs). Both types grant a holder the right to purchase stock over a future period at a given price and make the holder a legal corporate owner (shareholder) upon exercise.

Taxation. The main difference between ISOs and NQOs is the way that they are taxed. NSOs are generally taxed as a part of regular compensation under the ordinary federal income tax rate. Qualifying dispositions of ISOs are taxed as capital gains at a generally lower rate.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.

ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.