Connecticut Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

Choosing the right legitimate file design can be a battle. Naturally, there are plenty of layouts accessible on the Internet, but how can you get the legitimate kind you need? Utilize the US Legal Forms internet site. The support gives 1000s of layouts, for example the Connecticut Proposal to approve material terms of stock appreciation right plan, that you can use for company and private requires. All of the types are examined by pros and meet up with federal and state demands.

Should you be presently authorized, log in to the profile and click the Acquire switch to obtain the Connecticut Proposal to approve material terms of stock appreciation right plan. Use your profile to check from the legitimate types you may have ordered earlier. Check out the My Forms tab of your own profile and obtain one more duplicate of the file you need.

Should you be a whole new customer of US Legal Forms, listed below are straightforward instructions that you can stick to:

- Initially, make sure you have chosen the right kind to your town/area. You may examine the shape utilizing the Preview switch and look at the shape outline to guarantee this is the right one for you.

- In the event the kind is not going to meet up with your expectations, take advantage of the Seach area to get the proper kind.

- When you are positive that the shape is acceptable, click the Acquire now switch to obtain the kind.

- Opt for the costs strategy you would like and type in the required information. Create your profile and pay money for the transaction with your PayPal profile or charge card.

- Pick the document format and obtain the legitimate file design to the system.

- Complete, edit and print out and sign the received Connecticut Proposal to approve material terms of stock appreciation right plan.

US Legal Forms is the biggest local library of legitimate types for which you can discover a variety of file layouts. Utilize the company to obtain skillfully-made paperwork that stick to condition demands.

Form popularity

FAQ

Employee stock ownership plans (ESOPs), which can be stock bonus plans or stock bonus/money purchase plans, are qualified defined contribution plans under IRC section 401(a). Similar to stock options, stock appreciation rights are given at a predetermined price and often have a vesting period and expiration date.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

Stock appreciation rights are similar to stock options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a stock appreciation right vests, an employee can exercise it at any time prior to its expiration.

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

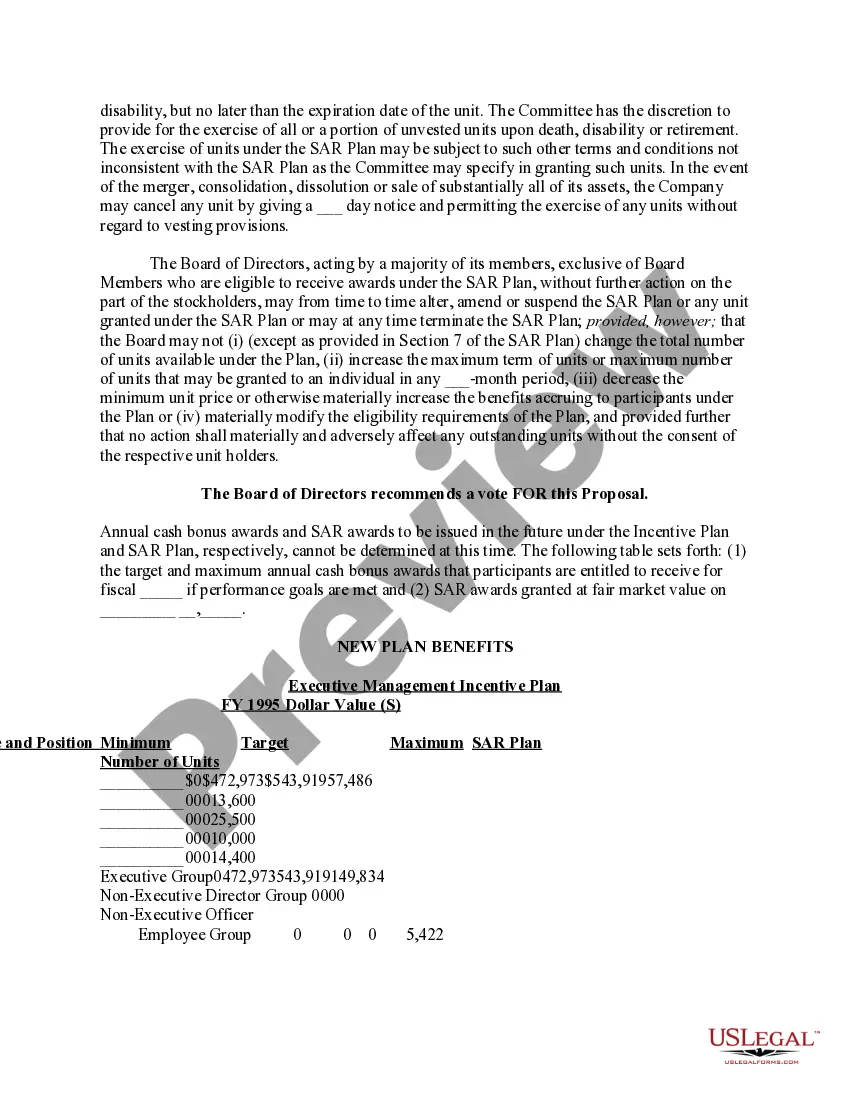

?Stock Appreciation Right? or ?SAR? means a hypothetical or ?phantom? unit of ownership in the Corporation, as awarded to a Participant under Section 5 of this Plan, having a total value equivalent to one share of Common Stock.