Connecticut Nonqualified Stock Option Plan of the Banker's Note, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of The Banker's Note, Inc.?

US Legal Forms - among the greatest libraries of legal kinds in the USA - delivers a wide range of legal papers layouts you can download or print. Making use of the site, you can find a huge number of kinds for company and person purposes, sorted by groups, states, or keywords.You can find the most recent variations of kinds such as the Connecticut Nonqualified Stock Option Plan of the Banker's Note, Inc. in seconds.

If you already possess a subscription, log in and download Connecticut Nonqualified Stock Option Plan of the Banker's Note, Inc. from the US Legal Forms collection. The Down load button can look on each and every kind you view. You get access to all in the past delivered electronically kinds from the My Forms tab of your own account.

In order to use US Legal Forms for the first time, listed below are straightforward directions to help you started out:

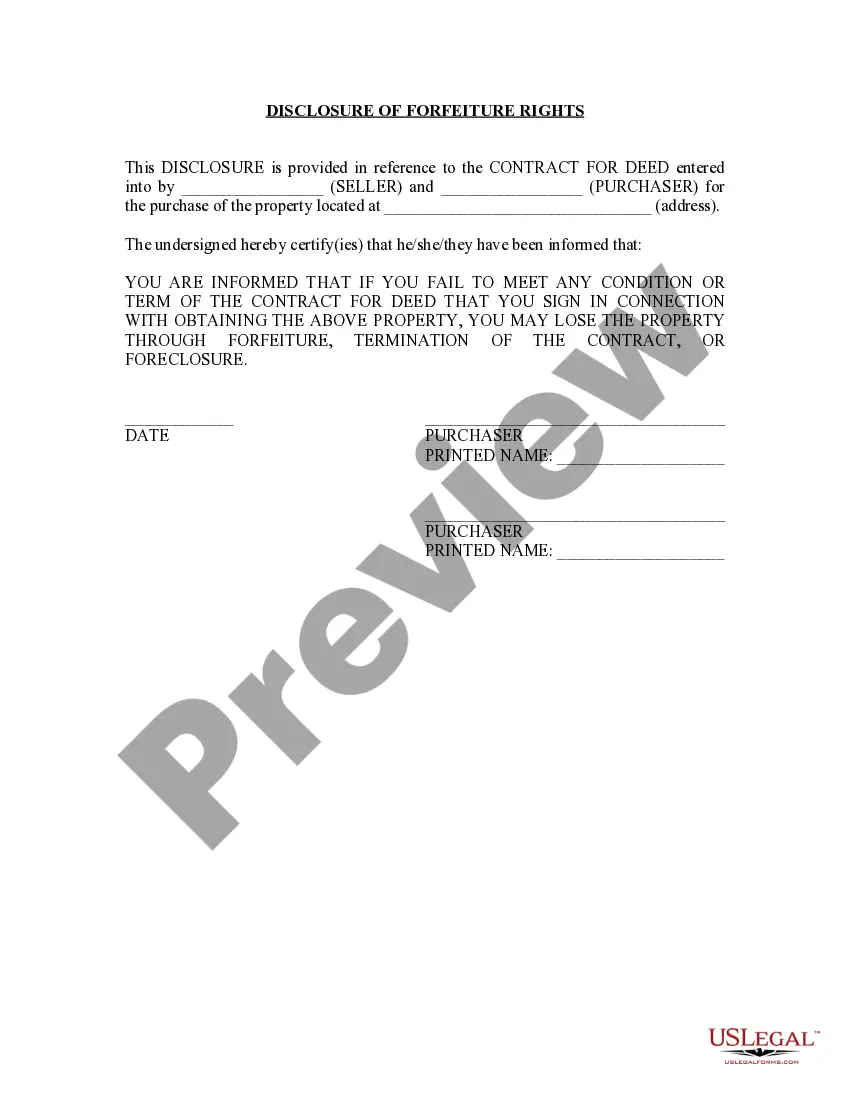

- Make sure you have chosen the correct kind for your personal area/state. Click on the Review button to analyze the form`s information. Read the kind outline to actually have selected the appropriate kind.

- In case the kind does not suit your requirements, utilize the Research industry on top of the monitor to find the one which does.

- Should you be satisfied with the form, confirm your option by visiting the Get now button. Then, opt for the rates strategy you want and provide your qualifications to register on an account.

- Process the deal. Make use of your credit card or PayPal account to perform the deal.

- Pick the file format and download the form in your device.

- Make changes. Fill out, modify and print and signal the delivered electronically Connecticut Nonqualified Stock Option Plan of the Banker's Note, Inc..

Every web template you added to your bank account lacks an expiration date and is also yours for a long time. So, if you want to download or print an additional copy, just visit the My Forms area and click on about the kind you require.

Obtain access to the Connecticut Nonqualified Stock Option Plan of the Banker's Note, Inc. with US Legal Forms, one of the most substantial collection of legal papers layouts. Use a huge number of skilled and condition-distinct layouts that fulfill your company or person demands and requirements.

Form popularity

FAQ

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company. These shares are purchased by employees at price below market price, or in other words, a discounted price.

Theoretically, ISOs receive favorable tax treatment and additional restrictions to offset their benefit, while NQSOs receive double taxation. Anyone ? including employees, advisors, or other service providers ? may receive NQSOs. NQSOs may vest over time or immediately, and may contain certain restrictions.