Connecticut Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed

Description

How to fill out Amended Stock Exchange Agreement By SJW Corp, Roscoe Moss Co, And RMC Shareholders - Detailed?

Are you within a placement in which you need to have files for either organization or specific purposes almost every working day? There are tons of legitimate papers templates available online, but discovering kinds you can rely isn`t effortless. US Legal Forms delivers thousands of type templates, just like the Connecticut Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed, which can be composed to fulfill federal and state needs.

Should you be previously acquainted with US Legal Forms internet site and possess your account, just log in. Following that, you are able to down load the Connecticut Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed web template.

If you do not offer an accounts and wish to start using US Legal Forms, abide by these steps:

- Get the type you need and ensure it is for that appropriate city/state.

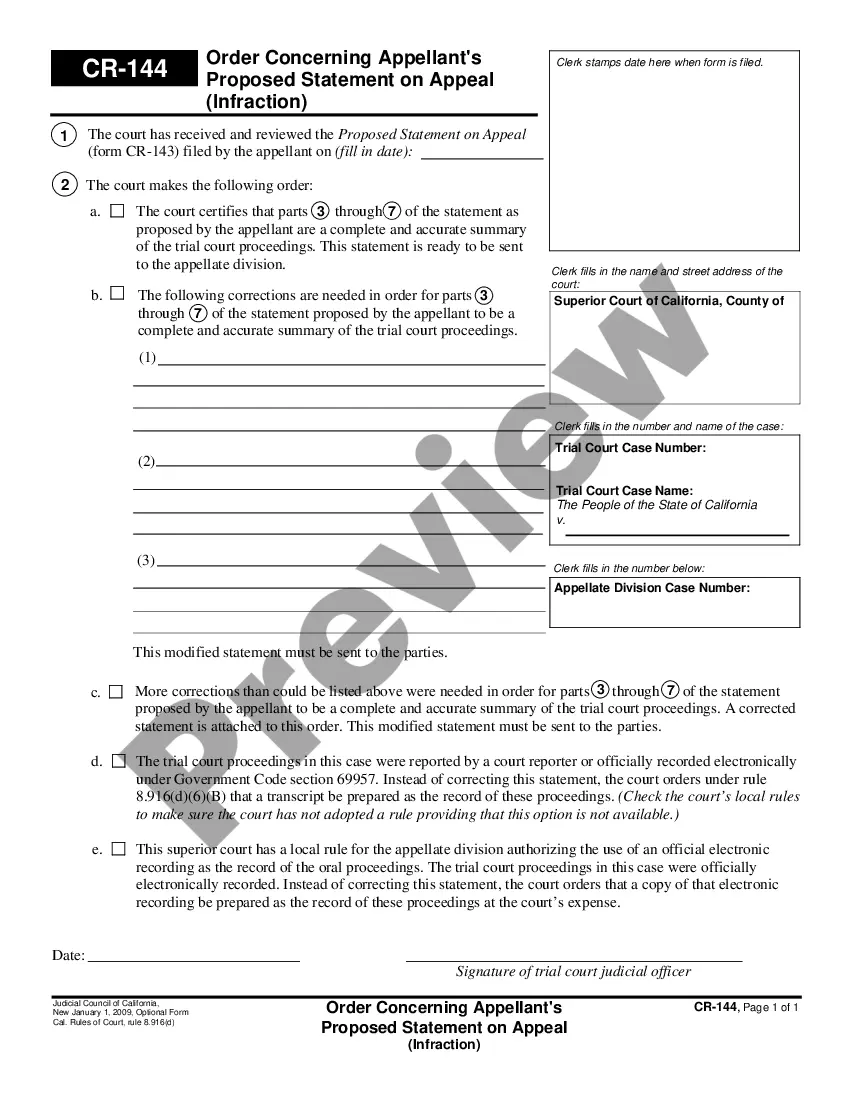

- Utilize the Preview switch to examine the form.

- Read the explanation to actually have selected the correct type.

- If the type isn`t what you are trying to find, utilize the Research industry to discover the type that fits your needs and needs.

- Once you obtain the appropriate type, just click Purchase now.

- Select the rates program you desire, fill in the specified details to produce your bank account, and purchase the transaction making use of your PayPal or credit card.

- Pick a hassle-free file format and down load your backup.

Discover every one of the papers templates you possess bought in the My Forms menus. You can get a extra backup of Connecticut Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed anytime, if needed. Just click the essential type to down load or produce the papers web template.

Use US Legal Forms, probably the most considerable selection of legitimate varieties, to save lots of time as well as steer clear of mistakes. The services delivers professionally manufactured legitimate papers templates which you can use for a variety of purposes. Create your account on US Legal Forms and start generating your lifestyle easier.