Connecticut Check Requisition Worksheet

Description

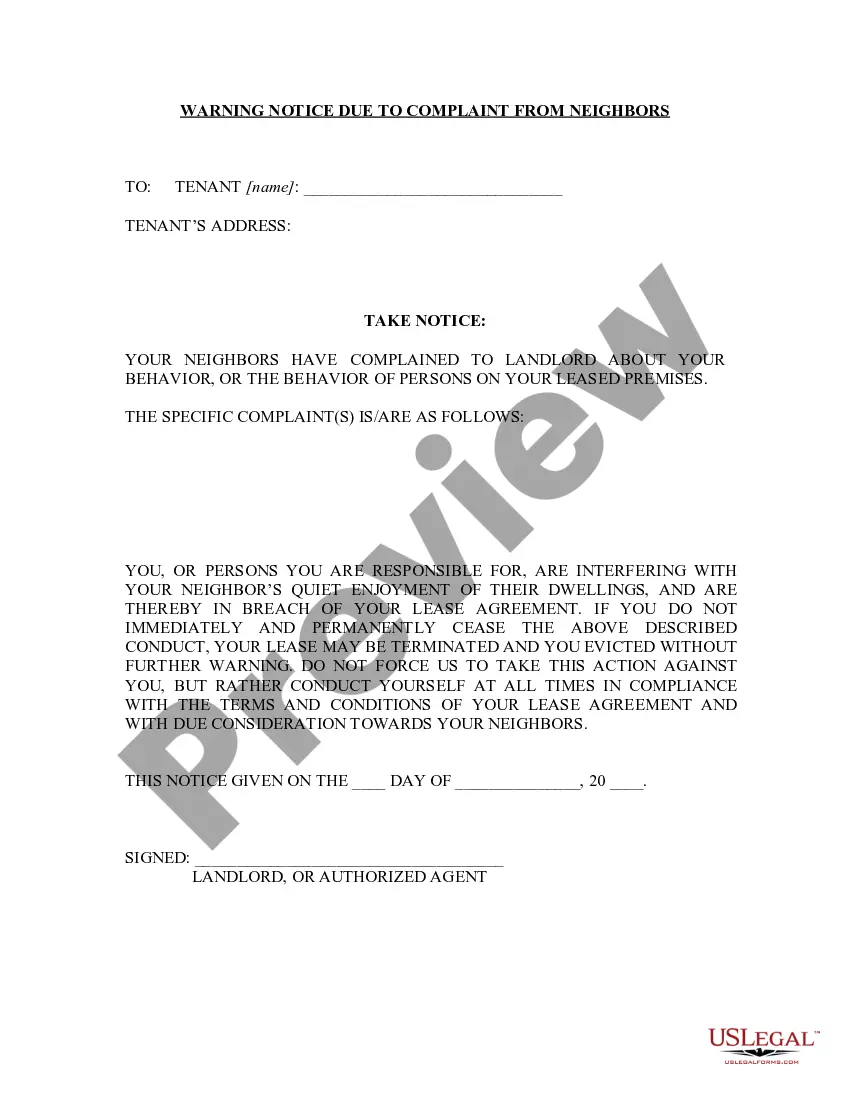

How to fill out Check Requisition Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Connecticut Check Requisition Worksheet in seconds.

If you already hold a subscription, Log In to download the Connecticut Check Requisition Worksheet from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents tab of your account.

If you are satisfied with the form, confirm your selection by clicking the Download now button. Then, choose the payment plan you prefer and provide your credentials to register for an account.

Complete the transaction. Use your credit card or PayPal account to finish the payment. Select the format and download the form to your device. Edit. Fill out, modify, and print or sign the downloaded Connecticut Check Requisition Worksheet.

Every template you add to your account has no expiration date and is yours permanently. So, if you want to download or print another copy, simply navigate to the My documents section and click on the form you desire.

Access the Connecticut Check Requisition Worksheet with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates to meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, below are simple steps to get you started.

- Ensure you have selected the correct form for your city/county.

- Click on the Preview option to review the content of the form.

- Check the form details to ensure you have selected the right form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find the appropriate one.

Form popularity

FAQ

C Married, filing jointly, and spouse is not employed; this the default when the federal marital status is M. D Married, filing jointly, both work, and combined income. is more than $100,500; or there is significant non-wage income; this code also applies to nonresident employees.

How much will it cost to renew my vehicle registration? The renewal fee for a passenger registration is $80 for two years plus $10 for the Clean Air Act fee. An individual 65 years old or older can request a one-year renewal for $45. For fees other than passenger registrations, please see Registration Fees.

Purpose: Complete Form CT20111040V if you filed your Connecticut income tax return electronically and elect to make payment by check. You must pay the total amount of tax due on or before April 15, 2021. Any unpaid balance will be subject to penalty and interest.

How to Renew OnlineA Personal Identification Number (PIN), or.First and Last Names as it appears on your license or ID card.CT Driver's License or Non-Driver ID Number.Date of Birth.If you're an organization, you will need your Secretary of State number.

Please make all checks payable to DMV. Acceptable forms of payment are: cash, money orders, personal checks and bank checks. American Express, Mastercard, Visa, Discover and most debit cards with Mastercard/Visa logo. Please make all checks payable to DMV.

Credit card payment for DMV services. We accept most major credit cards. DMV kiosks do not accept cash.

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

Your W-4 tells your employer how much federal income tax to withhold from your wages every pay period. Using the information you provided when filling out the form, your employer will determine how much tax to withhold from your paycheck.

If a vehicle is over 20 model years old, a Connecticut title will not be required to sell a vehicle. If title is not available, a Supplemental Assignment of Ownership form (Form Q-1) can be completed in full to indicate the buyer and the seller.

Expired Vehicle RegistrationMake an appointment at a DMV office.Provide license plate number or registration document of expired vehicle.Present your Connecticut Driver's License.Complete Application for Registration and Certificate of Title (form H-13B).Provide current Connecticut Insurance Identification Card.More items...