Connecticut FLSA Exempt / Nonexempt Compliance Form

Description

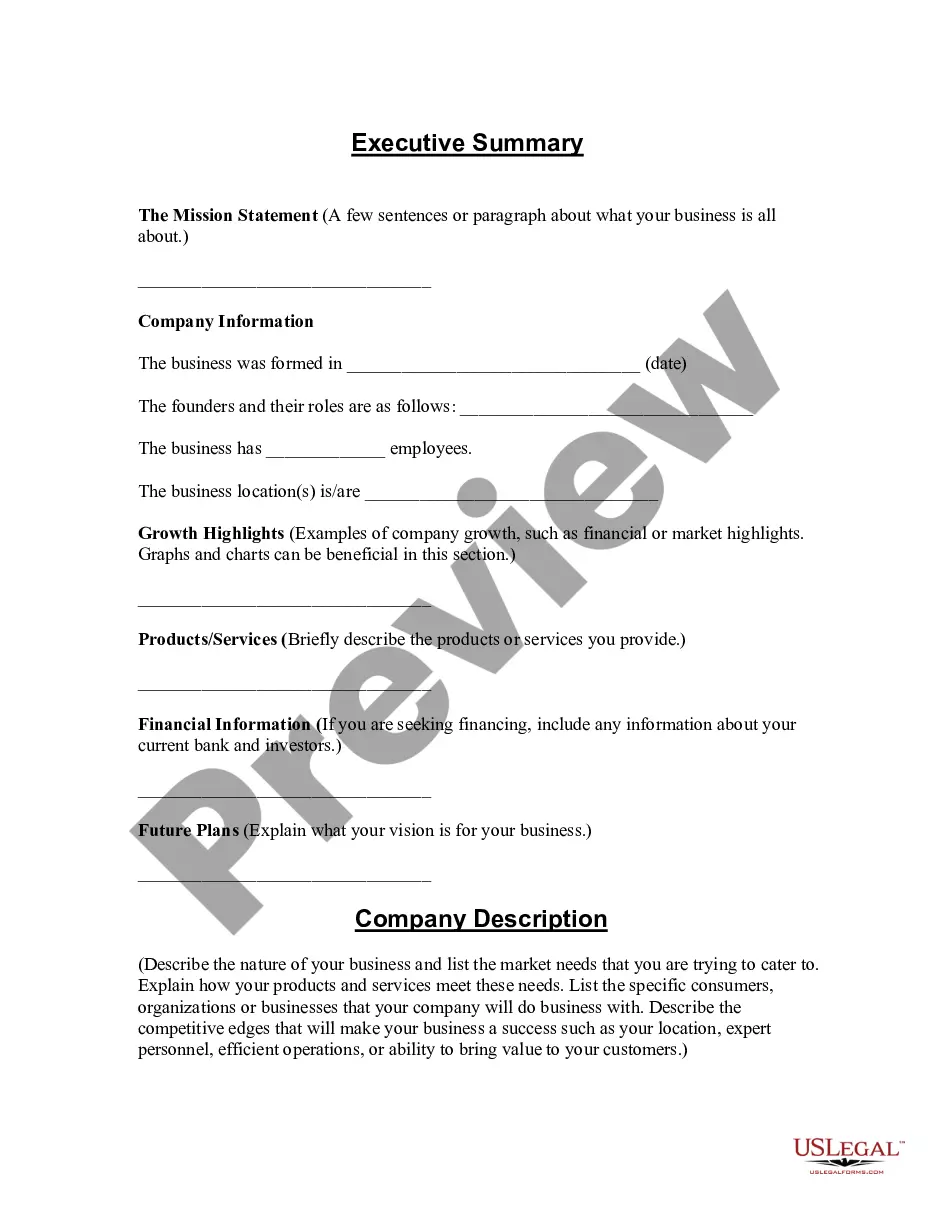

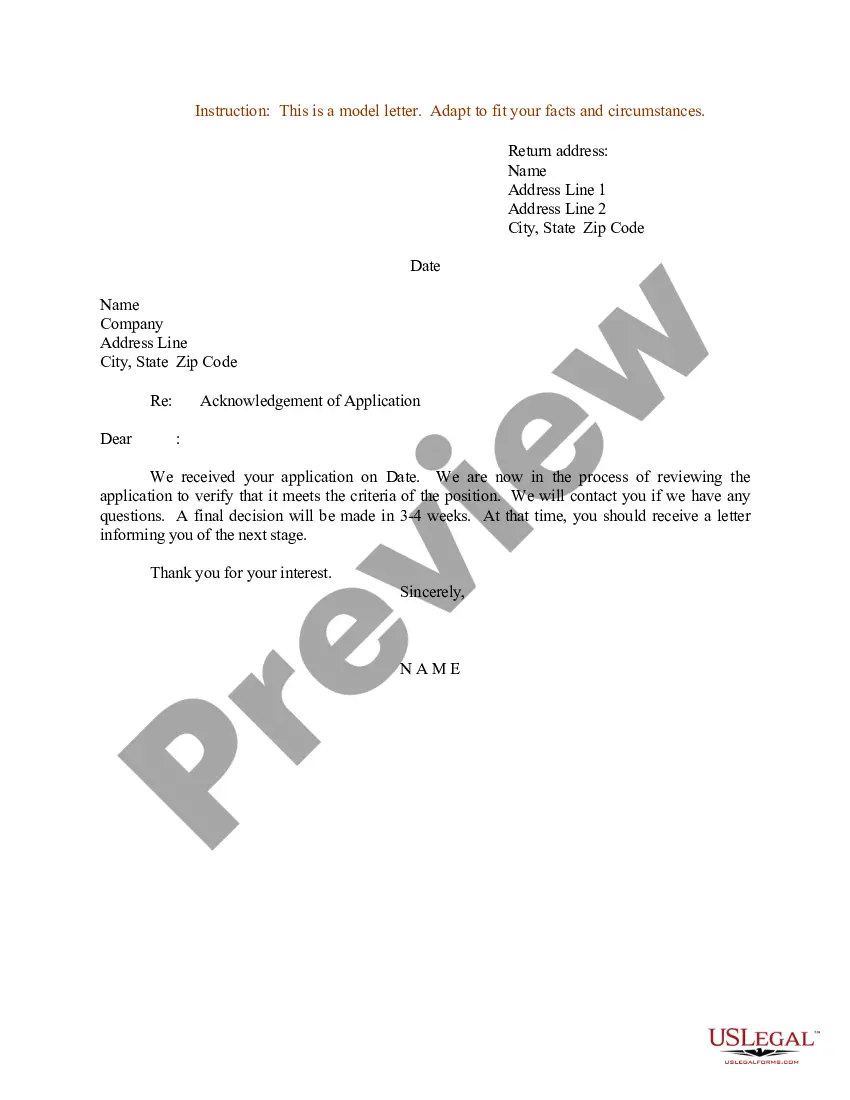

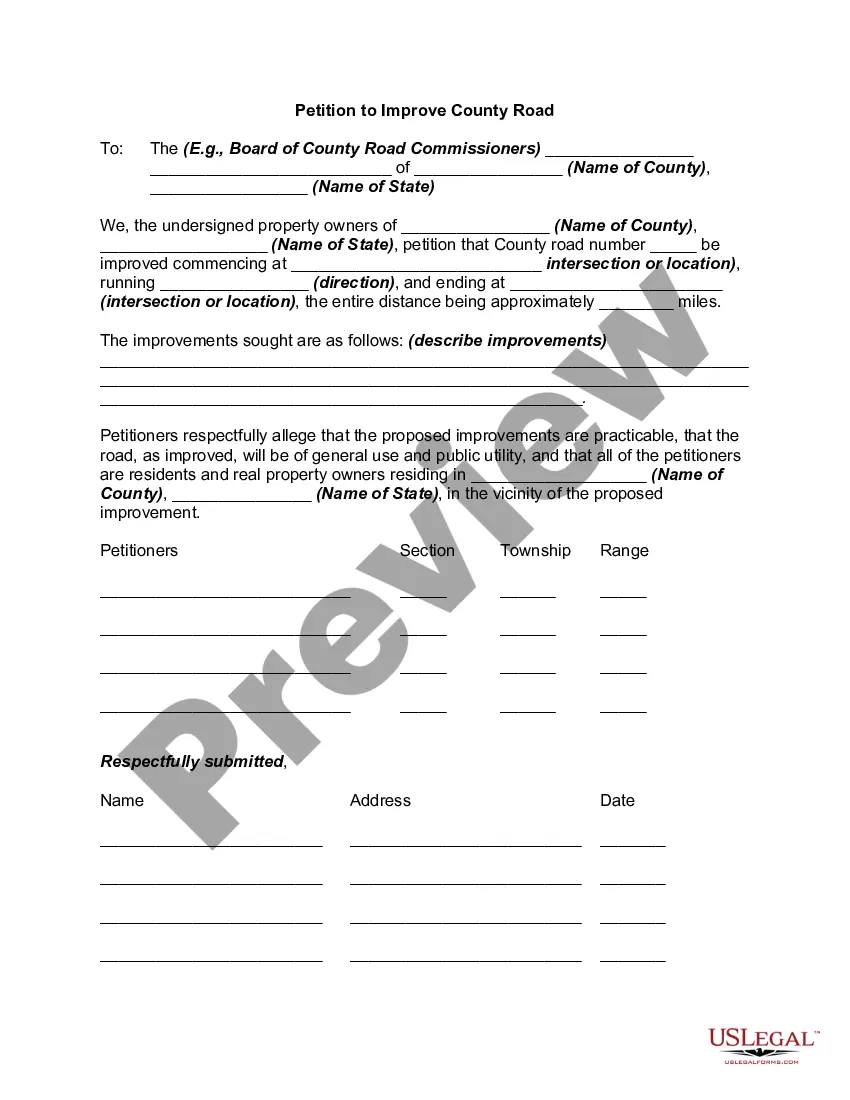

How to fill out FLSA Exempt / Nonexempt Compliance Form?

If you need to complete, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search feature to find the documents you require. Various templates for business and personal purposes are categorized by types and categories, or keywords.

Use US Legal Forms to obtain the Connecticut FLSA Exempt / Nonexempt Compliance Form with just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download and print the Connecticut FLSA Exempt / Nonexempt Compliance Form using US Legal Forms. There are millions of professional and state-specific forms that you can utilize for your business or personal needs.

- If you are a current US Legal Forms user, Log Into your account and click on the Obtain button to locate the Connecticut FLSA Exempt / Nonexempt Compliance Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Connecticut FLSA Exempt / Nonexempt Compliance Form.

Form popularity

FAQ

An exempt employee is not entitled to overtime pay according to the Fair Labor Standards Act (FLSA). To be exempt, you must earn a minimum of $684 per week in the form of a salary. Non-exempt employees must be paid overtime and are protected by FLSA regulations.

Non-Exempt Employees in ConnecticutEmployees that do not meet the requirements to classify as exempt are classified as non-exempt. This means that they are subject to overtime requirements under state and federal law.

How to Communicate a Change in FLSA Exemption Status to EmployeesStep 1: Explain Why the Change Is Occurring.Step 2: Discuss the Meaning of a Change in Status.Step 3: Apprise the Employee of Changes in Compensation.Step 4: Inform the Employee of Changes in Position.More items...

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments.

If you are a non-exempt employee, your employer must pay you at least the federal minimum wage (currently $7.25 per hour in Texas and under federal law) and must pay you overtime pay at a rate of at least one and a half times your hourly pay rate for all hours worked over 40 in each workweek.

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting employees in the private sector and in Federal, State, and local governments.

While the specific criteria for duties vary somewhat depending on whether exempt status is claimed as an Executive, Administrative, and/or Professional employee, examples of exempt duties include hiring and firing employees, scheduling employees, determining credit policies, formulating personnel policies, assessing

How to Make Sure You Stay Compliant with FLSA RequirementsAudit Jobs to Understand which are Exempt and Non-Exempt.Check the Minimum Wage Requirement in Your State.Pay for All Time Worked Even if it Is Unauthorized Overtime.Keep Detailed Documentation of All Non-Exempt Employees.

An employee's FLSA status is whether that employee is classified as exempt or nonexempt according to the Fair Labor Standards Act (FLSA). An employee who is nonexempt is entitled to receive overtime pay after they work a certain number of hours, while exempt employees are not eligible for overtime.

CT State Statute 31-58 - exempt employees not covered by minimum wage or record keeping laws. CT State Statute 31-76i - exempt employees not covered for the purpose of overtime payment.