Connecticut Nonexempt Employee Time Report

Description

How to fill out Nonexempt Employee Time Report?

Are you in a situation where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust is not simple.

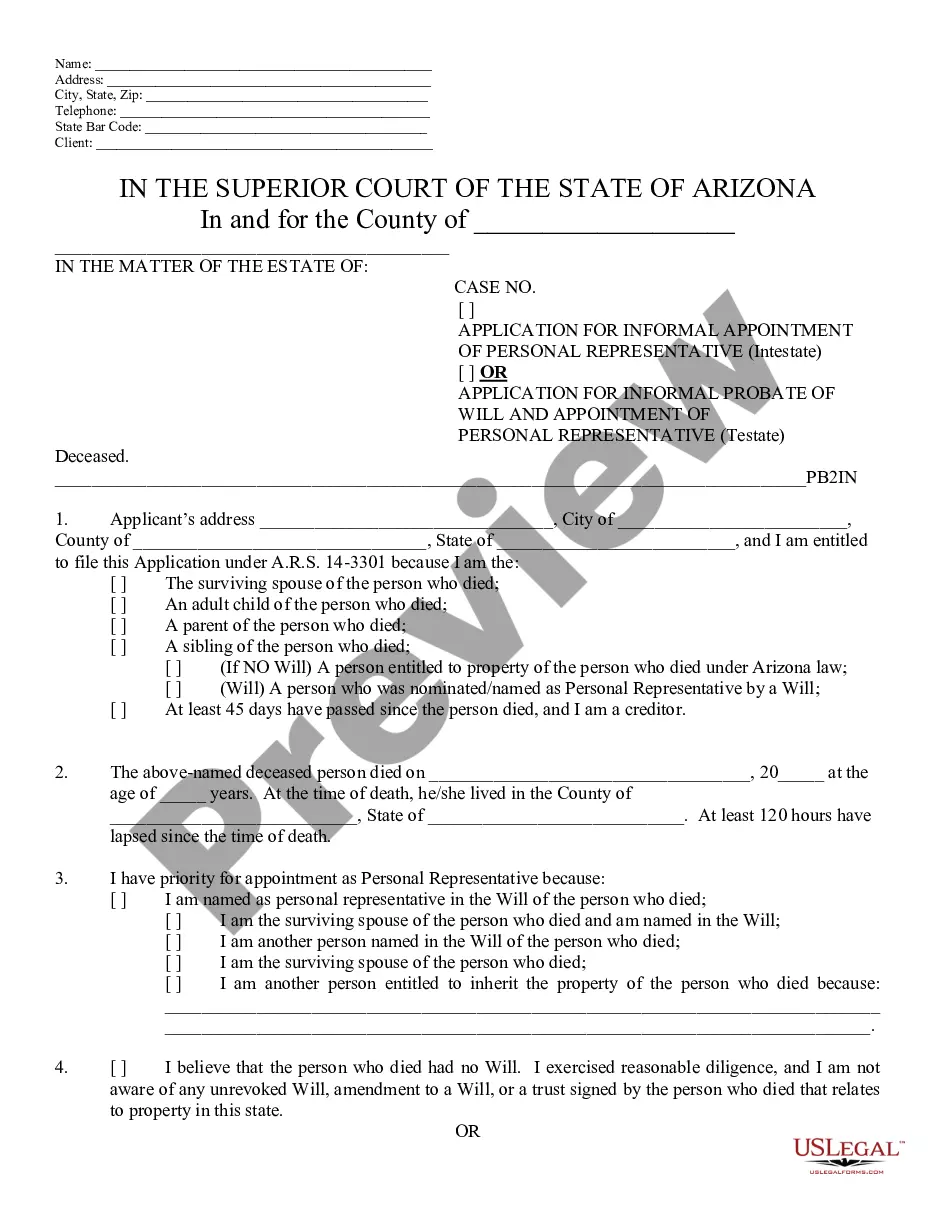

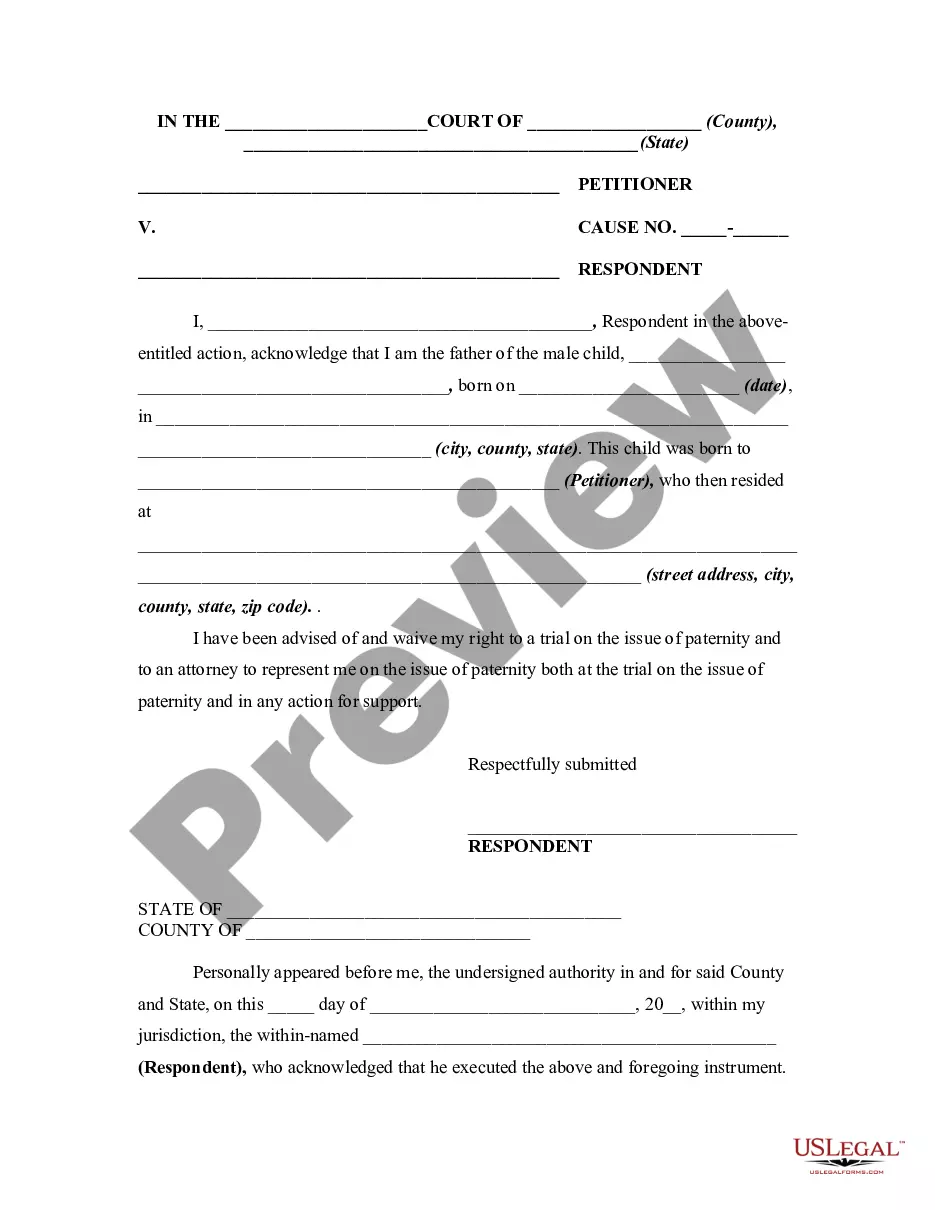

US Legal Forms offers a vast array of form templates, including the Connecticut Nonexempt Employee Time Report, which can be downloaded to meet state and federal regulations.

Once you find the correct form, click Get now.

Choose a payment plan you prefer, enter the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can access the Connecticut Nonexempt Employee Time Report template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

- Utilize the Preview feature to review the form.

- Check the description to make sure you have chosen the right form.

- If the form is not what you are looking for, use the Research section to find a form that suits your needs and specifications.

Form popularity

FAQ

Connecticut's proposal, SB 668, requires employers to post a weekly schedule no less than 14 days in advance of the first day of the scheduled week. If any changes are made, employers must pay affected workers half of any lost wages due to cancelled or reduced shifts.

As hospitality shifts towards employee-centric labor modules, more and more restaurants are finding their business subject to Fair Workweek predictive scheduling laws. Connecticut is next on the list of states attempting to increase scheduling stability for hourly employees working in restaurants, hotels, and retail.

What can I do if my employer doesn't pay me my reporting time pay? A. You can either file a wage claim with the Division of Labor Standards Enforcement (the Labor Commissioner's Office), or you can file a lawsuit in court against your employer to recover the reporting time pay.

Connecticut Callback/Report-In Pay: What you need to know Other than mercantile, beauty shop, laundry, and restaurant exceptions, there is no requirement in law that employees be guaranteed a minimum number of hours work when called back.

Mercantile trade employers, which includes retail establishments, must pay employees for a minimum of four (4) hours at their regular rate regardless of the number of hours actually worked if the employees are required by or received permission from the employer to show up or report to work.

Under Connecticut law, employers must give a 30-minute meal break to employees who work at least seven and a half consecutive hours. An employer does not have to pay for this time; in other words, meal breaks are unpaid.

In most cases, yes. Federal employment lawsmost notably the Fair Labor Standards Act (FLSA)allow for a number of employer changes, including changing the employee's schedule.

Non-Exempt Employees in ConnecticutEmployees that do not meet the requirements to classify as exempt are classified as non-exempt. This means that they are subject to overtime requirements under state and federal law.

The bill defined part-time employment to mean regularly scheduled work of up to 32 hours per week or less than 64 hours over two weeks.

Connecticut's proposal, SB 668, requires employers to post a weekly schedule no less than 14 days in advance of the first day of the scheduled week. If any changes are made, employers must pay affected workers half of any lost wages due to cancelled or reduced shifts.