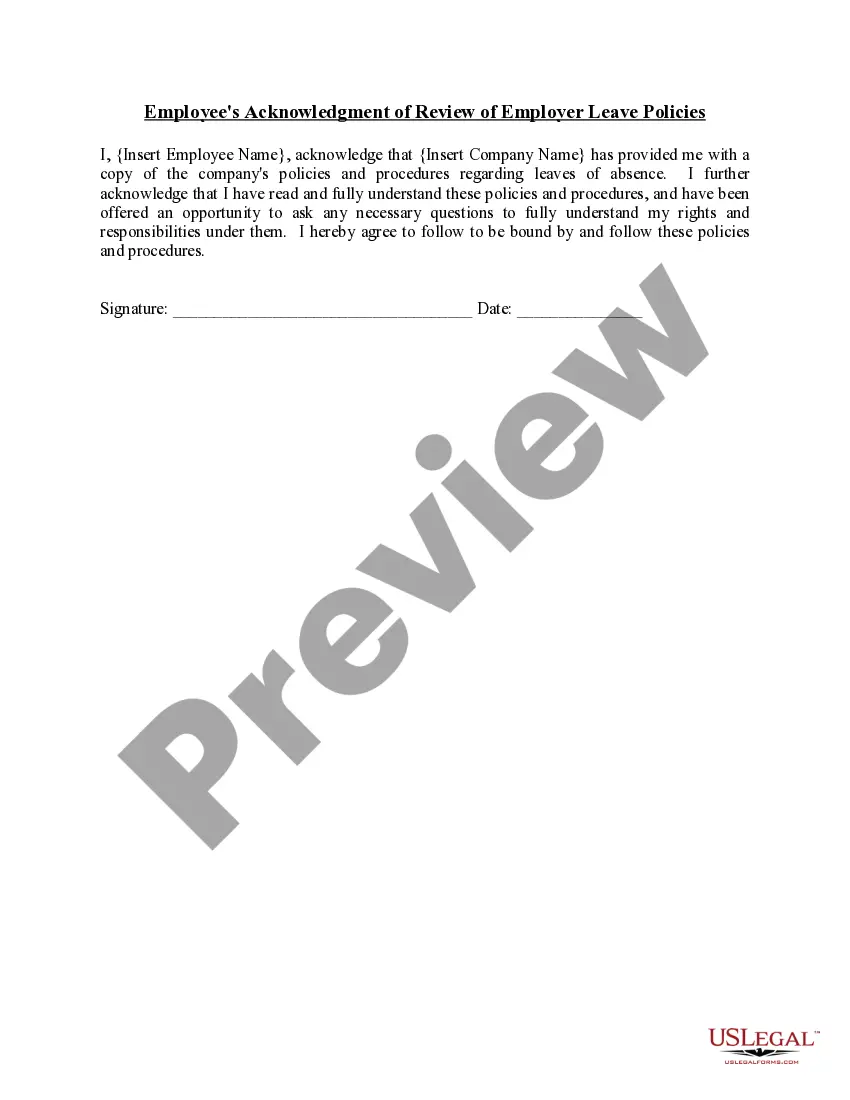

Connecticut Employee's Acknowledgment of Review of Employer Leave Policies

Description

How to fill out Employee's Acknowledgment Of Review Of Employer Leave Policies?

It is feasible to devote hours on the web seeking the legal document format that fulfills the state and federal requirements you need.

US Legal Forms offers numerous legal templates that are reviewed by professionals.

It is easy to access or print the Connecticut Employee's Acknowledgment of Review of Employer Leave Policies from your services.

If available, utilize the Review button to look through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Connecticut Employee's Acknowledgment of Review of Employer Leave Policies.

- Every legal document format you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct document format for the county/city of your choice.

- Review the form information to verify that you have chosen the right type.

Form popularity

FAQ

How to Approve or Deny FMLA LeaveStep 1: Provide Education and Notices.Step 2: Respond to a Request for FMLA Leave.Step 3: Determine Certification Needs.Step 4: Determine Clarification and Authentication Needs, if Any.Step 5: Obtain Second and Third Opinions, if Needed.Step 6: Approve or Deny the Leave.More items...

Does the CT Paid Leave contribution (0.5%) apply to STD/LTD benefit payments? Yes, to the extent that STD and LTD benefits are considered by the IRS to be taxable wages subject to FICA.

The Connecticut Paid Leave (CTPL) program covers all employers with one or more employees and is accessible to all employees who have met certain earned-wage thresholds. Those who are self-employed or are sole proprietors are eligible to opt-in to the program.

This mandatory employee-funded benefit, as well as changes to the existing Connecticut Family Medical Leave Act (CT FMLA), passed in 2019, have several implications for Connecticut businesses including employment size of businesses that must participate, the definition of a family member one is eligible to leave to

2022Knowledge As such, the contributions are deductible on federal income tax returns as state income taxes for those taxpayers that elect to itemize their deductions (subject to the $10,000 SALT deduction cap).

Administered through the CT Paid Leave Authority, the Paid Family and Medical Leave Act (PFMLA) offers Connecticut workers the opportunity to take time to attend to personal and family health needs without worrying about lost income.

Prior to the enactment of the PFMLA, Connecticut state law required employers with 75 or more employees to provide 16 weeks of family and medical leave, and the leave could be unpaid. Under the Federal FMLA, employers with 50 or more employees must provide 12 weeks of leave, paid or unpaid.

The CT Paid Leave Authority provides Connecticut's workforce access to paid family and medical leave benefits by offering helpful tools and resources to help administer this new program. Employee payroll deductions begin on January 1, 2021 and Paid Leave benefits become available starting January 1, 2022.

Covered employees in Connecticut are eligible for benefits under the PFMLA if they have earned wages of at least $2,325 in the highest quarter of the first four of the five most recently completed quarters and are currently employed, or have been employed within the last 12 weeks, or are self-employed, a sole

2022Knowledge Can an employee opt-out of payroll deductions? Employees are not allowed to opt out of mandatory contributions, though the Connecticut Paid Family and Medical Leave Act (PFMLA) does list some categories of employees who are exempt from the program.