Connecticut Agreement between Co-lessees as to Payment of Rent and Taxes

Description

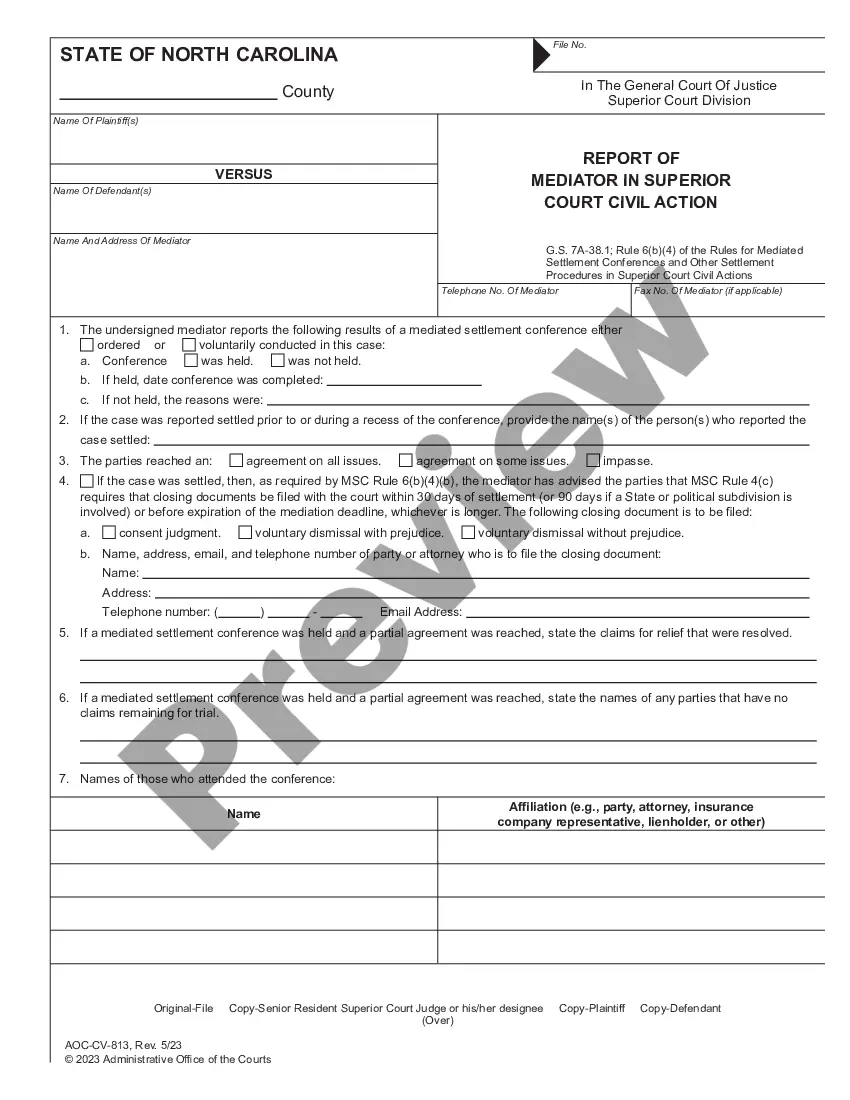

How to fill out Agreement Between Co-lessees As To Payment Of Rent And Taxes?

It is possible to devote hrs on the web trying to find the lawful file design that fits the state and federal demands you need. US Legal Forms offers 1000s of lawful types that are evaluated by professionals. You can actually down load or produce the Connecticut Agreement between Co-lessees as to Payment of Rent and Taxes from your service.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Download switch. Following that, it is possible to total, revise, produce, or indicator the Connecticut Agreement between Co-lessees as to Payment of Rent and Taxes. Every single lawful file design you acquire is the one you have forever. To obtain yet another version for any purchased kind, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site for the first time, adhere to the straightforward guidelines beneath:

- First, ensure that you have chosen the proper file design for your area/area of your choice. Browse the kind information to make sure you have chosen the appropriate kind. If offered, use the Preview switch to appear with the file design at the same time.

- In order to get yet another version from the kind, use the Look for industry to get the design that meets your requirements and demands.

- Once you have identified the design you desire, simply click Acquire now to carry on.

- Find the prices plan you desire, type your qualifications, and register for an account on US Legal Forms.

- Comprehensive the transaction. You should use your credit card or PayPal accounts to pay for the lawful kind.

- Find the formatting from the file and down load it to the system.

- Make modifications to the file if required. It is possible to total, revise and indicator and produce Connecticut Agreement between Co-lessees as to Payment of Rent and Taxes.

Download and produce 1000s of file layouts utilizing the US Legal Forms Internet site, that offers the biggest variety of lawful types. Use skilled and condition-specific layouts to handle your business or personal needs.

Form popularity

FAQ

Rental income is taxed very similarly to regular income, and tax rates will vary based on the specific property.

The trade vehicle value is subtracted from the taxable value in Connecticut. For example, if the selling vehicle costs $30000 and the trade value is $10000 then the tax owed would be 6.35% of $20000, which equals $1270 tax.

Leased and privately owned cars are subject to property taxes in Connecticut; excise taxes in Maine, Massachusetts, and Rhode Island; and motor vehicle registration fees in New Hampshire. They are not subject to local taxes in New Jersey, New York, and Vermont.

Generally, a landlord can terminate a lease without reason at the expiration of the lease term. That means your landlord is under no obligation to renew your lease or allow you to stay on the property for additional time unless you are able to invoke an anti-retaliation law.

Hear this out loud PauseThe sales tax is a levy imposed on the sale, rental or lease of most goods and certain services at a rate of 6%. The tax is collected by the retailer and remitted directly to the state. There is also a 12% room occupancy tax on the rental of rooms in hotels, motels or lodging houses.

Hear this out loud PauseAll rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income.

Hear this out loud PauseYou're responsible for filing a return if your 2022 gross income exceeded the following amounts: Married filing separately: $12,000. Single: $15,000. Head of household: $19,000.

Decrease the sales tax from 6.35% to 5.99% from February 15 through the end of calendar year 2022. Reduction would only apply to the sales tax that is at the 6.35% rate (e.g., no reduction to the 7.75% "luxury" rate for motor vehicles over $50,000 or jewelry over $5,000).

Motor vehicles are subject to a local property tax under Connecticut state law, whether registered or not. Motor vehicles are assessed ing to State statutes at 70% of the Clean Retail value through the use of the NADA Guides and other resources. The uniform assessment date is October 1st in Connecticut.

While there is no statute in Connecticut that specifically addresses this type of termination, it's generally accepted for a monthly lease to be terminated by a 30 day notice.