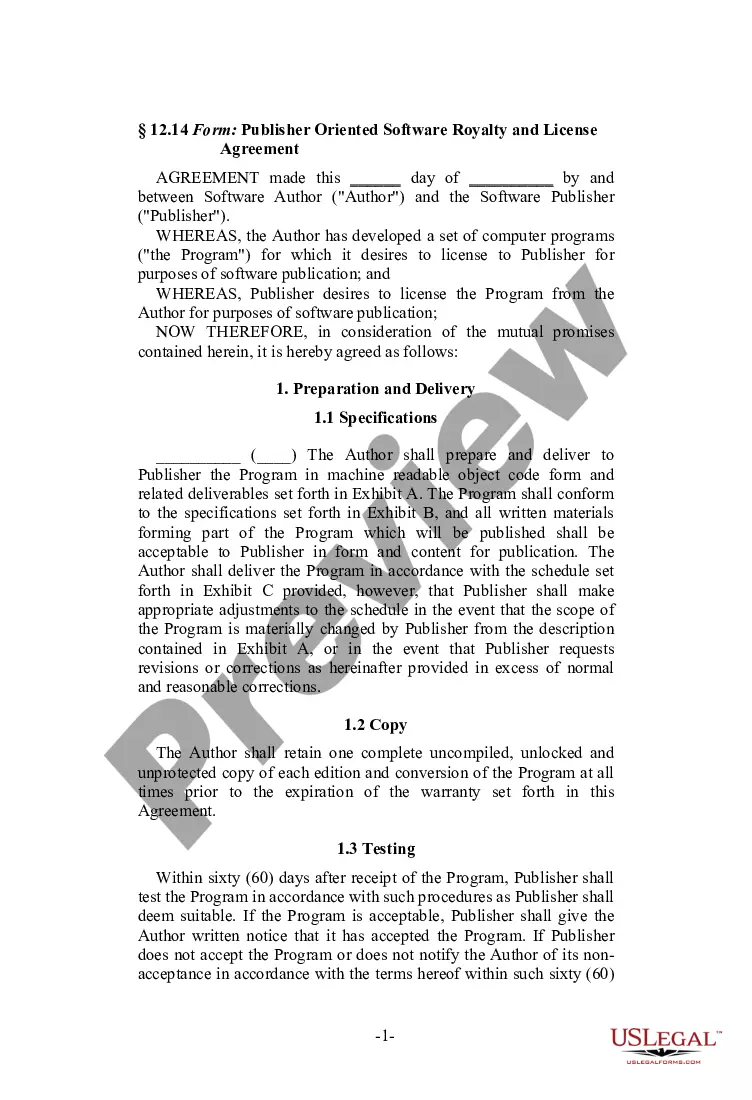

Connecticut Publisher Oriented Software Royalty and License Agreement

Description

How to fill out Publisher Oriented Software Royalty And License Agreement?

You might invest countless hours online trying to locate the authentic document template that complies with the state and federal requirements you require.

US Legal Forms offers a vast array of lawful forms that can be reviewed by professionals.

You can easily download or print the Connecticut Publisher Oriented Software Royalty and License Agreement from the service.

First, make sure you have selected the correct document template for the state or city of your choice. Review the form details to ensure you have chosen the appropriate form.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Connecticut Publisher Oriented Software Royalty and License Agreement.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

A license is an agreement between two parties for using someone's property without paying any money for it, whereas royalty is paying an agreed fee each time he/she use the owners asset.

The 25% rule also refers to a technique for determining royalties, which stipulates that a party selling a product or service based on another party's intellectual property must pay that party a royalty of 25% of the gross profit made from the sale, before taxes.

Elements of a standard licensing agreementName of Parties It includes the name and the place of residence of the parties. In case of a company, it also includes the act under which the company is registered. Tenure It specifies the term for which the license is granted by the licensor to the licensee.

Practitioners and licensing executives often refer to three basic types of voluntary licenses: non-exclusive, sole, and exclusive. A non-exclusive licence allows the licensor to retain the right to use the licensed property and the right to grant additional licenses to third parties.

Royalty rates vary per industry, but a good rule of thumb is between 2-3% on the low end, and 7-10% on the high end. I have licensed consumer products for as low as 3% and as high as 7%, with 5% being the most common and a generally fair number.

In an industry where the average operating profit is about 18.5% (such as the medical products industry), the average royalty rate is about 4.5%. Finally, where the average operating profit in a certain industry is about 26% (such as the pharmaceutical industry), the average royalty rate is about 6.5%.

Royalty. Royalties are usage-based payments for using an asset or property. It's generally a percentage of gross revenue or net profit. Meanwhile, a licensing fee is money paid by someone using someone's property, but this fee is generally a fixed amount.

In most cases, licensors prefer a royalty rate that falls within 25% to 75% range of the sublicensing income. Their stake usually amounts to more than half of all profits. In rare cases, the licensee can negotiate a rate split and apply their own royalty obligation to the sale of sub-licensed products.

Royalty rates. Royalty payments are computed by multiplying the royalty rate against net sales. For example, a royalty rate of 5% multiplied by net sales of $1,000 equals a net sales royalty of $50. Royalty rates for licensing vary depending on the artwork involved.

The commission is paid in relation to the performance of an employee (for example, a successful business deal or their sales performance). Royalties, on the other hand, are payments made to owners of intellectual property in exchange for usage or licensing rights of that property over a specified period of time.