Connecticut Employment of Executive with Stock Options and Rights in Discoveries

Description

How to fill out Employment Of Executive With Stock Options And Rights In Discoveries?

Have you ever been in a situation where you require paperwork for both business or specific needs nearly every day.

There are numerous legitimate document templates available online, but finding forms you can rely on is not easy.

US Legal Forms offers thousands of form templates, such as the Connecticut Employment of Executive with Stock Options and Rights in Discoveries, which are crafted to comply with federal and state regulations.

If you find the correct form, click Get now.

Select the pricing plan you desire, complete the necessary information to create your account, and pay for your order using PayPal or credit card. Choose a convenient format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Connecticut Employment of Executive with Stock Options and Rights in Discoveries anytime if needed. Just click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and avoid mistakes. This service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are currently familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Connecticut Employment of Executive with Stock Options and Rights in Discoveries template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct town/region.

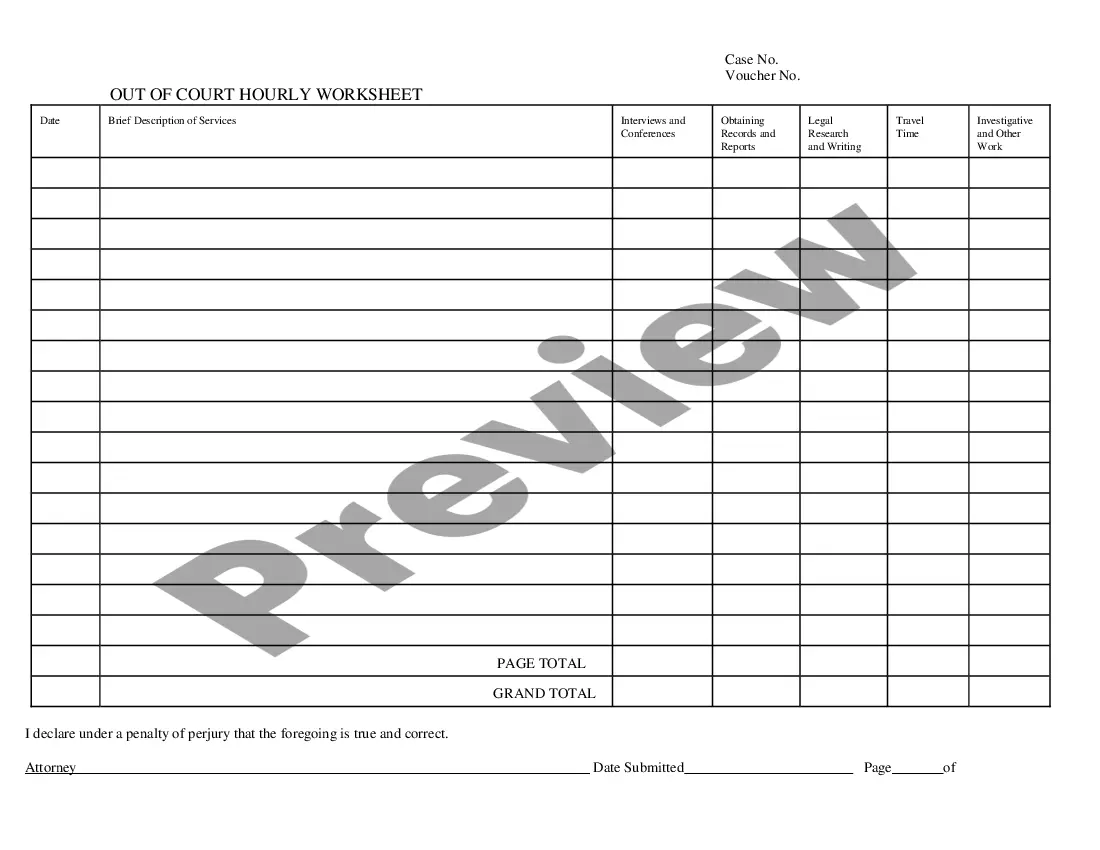

- Use the Preview button to review the form.

- Read the description to confirm that you have chosen the right form.

- If the form isn’t what you're searching for, use the Search section to find the form that meets your needs.

Form popularity

FAQ

Unit Appreciation Rights: When a partnership or LLC grants unit appreciation rights, it awards the recipient a right to receive a cash payment equal to the appreciation of a specified number of units of the LLC or partnership subject to specified vesting conditions.

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

Typically, ESOs are issued by the company and cannot be sold, unlike standard listed or exchange-traded options. When a stock's price rises above the call option exercise price, call options are exercised and the holder obtains the company's stock at a discount.

The three major common law exceptions are public policy, implied contract, and implied covenant of good faith.

Exempt Employees in Connecticut For an employee to be classified as an exempt employee they must pass both the duties and the salary tests, under both Connecticut and Federal law. Duties Test - Under the Duties Test, the employee's primary duty must require that they act with discretion and independent judgment.

PURPOSE OF THE PLAN. The purposes of the Reliant Pharmaceuticals, LLC Unit Appreciation Rights Plan are to attract and retain the best available personnel and to provide Employees, Managers and Consultants of Reliant with an incentive to promote the long-term performance of Reliant.

Maintain a 'Register of Employee Stock Options' in Form No. SH-6 and enter the particulars of the ESOP granted to the employees, directors or officers of the company. If a private company wants to issue ESOP, then it should ensure that the Articles of Association (AoA) authorises for issuance of shares through ESOP.

Exercising a stock option means purchasing the issuer's common stock at the price set by the option (grant price), regardless of the stock's price at the time you exercise the option.

Five Considerations For Managing Your Employee Stock OptionsKnow what you have. Consider what kind of instrument you have.Plan for taxes. The good news is that employee stock options receive tax benefits under current Federal law.Beware of the risks of ownership.Harvest your gains.Plan for Re-investment.