Connecticut Balance Sheet Deposits

Description

How to fill out Balance Sheet Deposits?

If you require to complete, acquire, or print legitimate document formats, utilize US Legal Forms, the most extensive collection of legal templates, accessible online.

Employ the website's user-friendly and efficient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal document and download it to your device.

- Use US Legal Forms to obtain the Connecticut Balance Sheet Deposits in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Connecticut Balance Sheet Deposits.

- You can also access forms you have previously purchased from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form appropriate for your city/state.

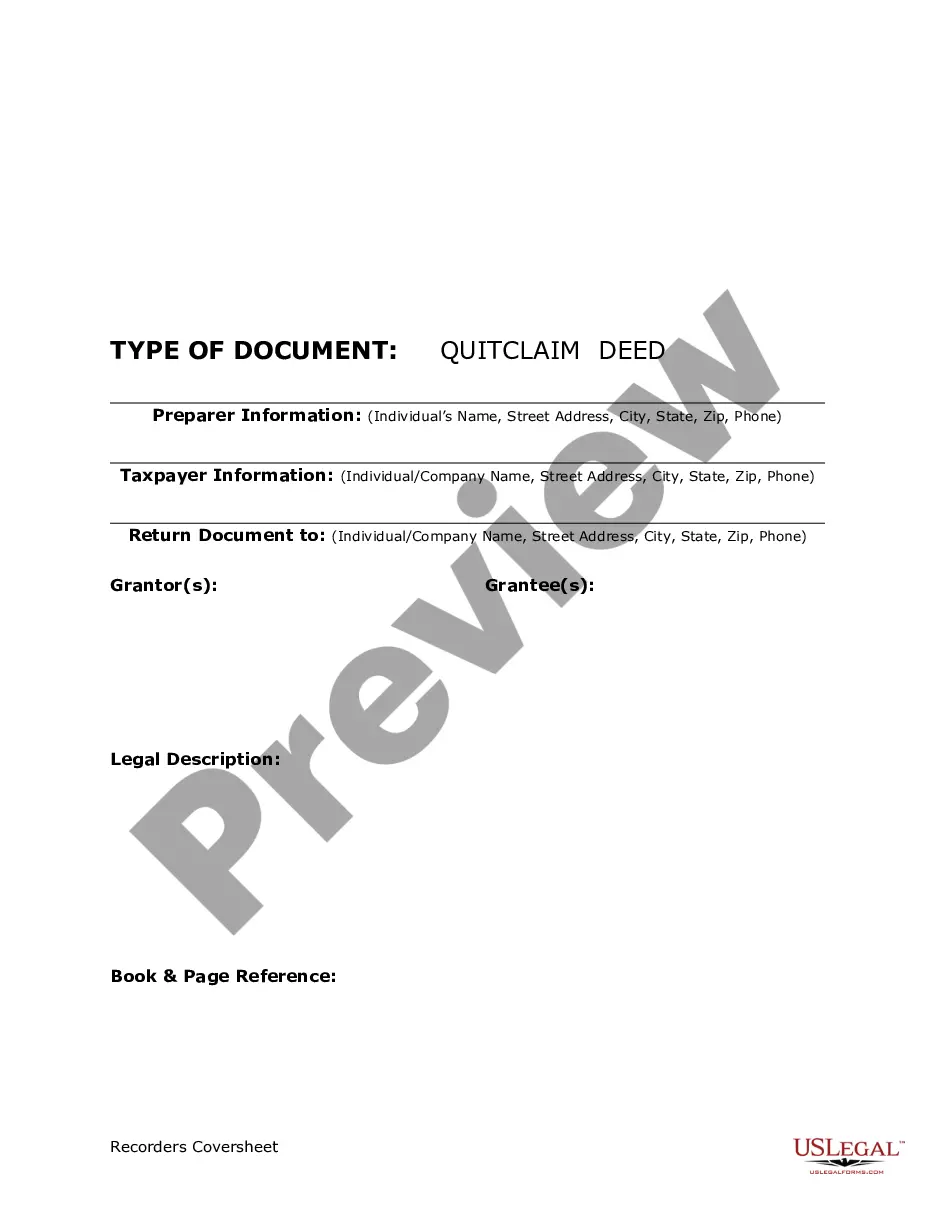

- Step 2. Use the Preview option to review the contents of the form. Be sure to check the details.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative templates in the legal form format.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

Deposits in transit are deposits that were made after the bank statement was issued, but have been recorded on the books. Outstanding checks are checks that have been written and recorded on the books, but have not yet been cashed or have not cleared the bank.

The person paying the security deposit would credit the asset account Cash and would debit the asset account Security Deposits. The person receiving the security deposit would debit the asset account Cash and would credit the liability account Security Deposits Returnable. Let's use an example.

A company's deposit in transit is the currency and customers' checks that have been received and are rightfully reported as cash on the date received, and the amount will not appear on the company's bank statement until a later date. A deposit in transit is also known as an outstanding deposit.

What are the common reasons for deposit deductionsUnpaid rent at the end of the tenancy.Unpaid bills at the end of the tenancy.Stolen or missing belongings that are property of the landlord.Direct damage to the property and it's contents (owned by the landlord)Indirect damage due to negligence and lack of maintenance.More items...

This question is about Connecticut Security Deposit Law In Connecticut, a tenant is not usually allowed to use the security deposit as last month's rent. However, if there is an agreement between the landlord and the tenant to use the security deposit for last month's rent, then the tenant can do so.

At the top of the bank reconciliation, enter the ending balance from the bank statement. Total the deposits in transit. Add up the deposits in transit, and enter the total on the reconciliation. Add the total deposits in transit to the bank balance to arrive at a subtotal.

Connecticut Security Deposit LawStandard Limit / Maximum Amount: Two months' rent or one month's rent for tenants aged 62 and older.What Can Be Deducted: Unpaid rent & cost of damages due to the tenant's fault (read more)More items...?16-Sept-2021

Deposits in transit are deposits that were made after the bank statement was issued, but have been recorded on the books. Outstanding checks are checks that have been written and recorded on the books, but have not yet been cashed or have not cleared the bank.

A deposit in transit is money that has been received by a company and recorded in the company's accounting system. The deposit has already been sent to the bank, but it has yet to be processed and posted to the bank account.

Your landlord or agent is only entitled to keep all or part of your deposit if they can show that they have lost out financially because of your actions, for example, if you have caused damage to the property or you owe rent.