Connecticut Daily Accounts Receivable

Description

How to fill out Daily Accounts Receivable?

If you need to thoroughly acquire or create legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site's user-friendly search to find the documents you require.

A wide range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, choose the Get now button. Select your preferred payment plan and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Use US Legal Forms to locate the Connecticut Daily Accounts Receivable in just a few clicks.

- If you are already a client of US Legal Forms, Log In to your account and click the Download button to obtain the Connecticut Daily Accounts Receivable.

- You can also access forms you previously acquired from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct state/location.

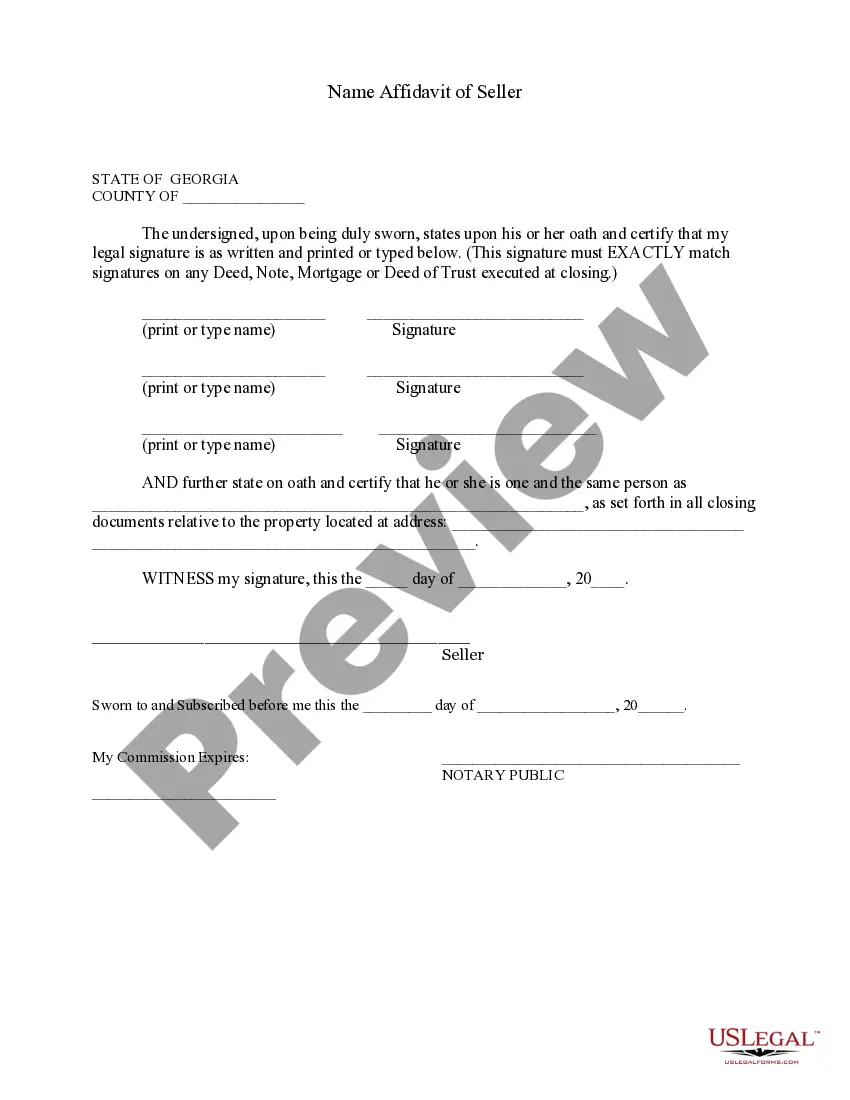

- Step 2. Utilize the Preview option to review the content of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative variations of the legal form template.

Form popularity

FAQ

To write off accounts receivable in Connecticut, you must first establish that the debt is uncollectible. You then make a journal entry to remove the amount from your books, debiting your bad debt expense and crediting your accounts receivable. By following this process, you reflect a more accurate picture of your finances, especially with Connecticut Daily Accounts Receivable.

Account Receivable is an account created by a company to record the journal entry of credit sales of goods and services, for which the amount has not yet been received by the company. The journal entry is passed by making a debit entry in Account Receivable and corresponding credit entry in Sales Account.

When calculated correctly, the Days in A/R formula yields a number that signifies a value for days. Use the following metrics as guideposts: A/R Less than 35 Good. A/R 35 to 50 Average.

To prepare an accounts receivable aging report, you need to have the customer's name, outstanding balance amount, and aging schedules.

Aging Report Cheat SheetLabel the following cells: A1: Customer. B1: Order # C1: Date. D1: Amount Due. Enter in the corresponding information for your customers and their orders underneath the headlines.Add additional headers for each column as: E1: Days Outstanding. F1: Not Due. G1: 0-30 Days. H1: 31-60 days.

On a trial balance, accounts receivable is a debit until the customer pays. Once the customer has paid, you'll credit accounts receivable and debit your cash account, since the money is now in your bank and no longer owed to you. The ending balance of accounts receivable on your trial balance is usually a debit.

Account receivables are classified as current assets assuming that they are due within one year. To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account. When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry.

The accounts receivable aging report will list each client's outstanding balance. It is then sorted into columns such as: Current, 1-30 days past due, 31-60 days past due, 61-90 days past due, 91-120 days past due, and 120+ days past due.

You can find your accounts receivable balance under the 'current assets' section on your balance sheet or general ledger. Accounts receivable are classified as an asset because they provide value to your company. (In this case, in the form of a future cash payment.)

How to create an accounts receivable aging reportStep 1: Review open invoices.Step 2: Categorize open invoices according to the aging schedule.Step 3: List the names of customers whose accounts are past due.Step 4: Organize customers based on the number of days outstanding and the total amount due.10-May-2021