Connecticut Sample Letter for Initial Probate Proceedings - Request to Execute Documents

Description

How to fill out Sample Letter For Initial Probate Proceedings - Request To Execute Documents?

Discovering the right legitimate document web template might be a struggle. Needless to say, there are a lot of web templates accessible on the Internet, but how do you get the legitimate form you want? Make use of the US Legal Forms website. The services provides a large number of web templates, including the Connecticut Sample Letter for Initial Probate Proceedings - Request to Execute Documents, which can be used for organization and private demands. All the forms are checked by pros and fulfill state and federal requirements.

Should you be currently listed, log in to the accounts and click on the Download button to get the Connecticut Sample Letter for Initial Probate Proceedings - Request to Execute Documents. Make use of accounts to look throughout the legitimate forms you may have acquired earlier. Visit the My Forms tab of your accounts and have an additional version from the document you want.

Should you be a whole new end user of US Legal Forms, allow me to share straightforward recommendations for you to adhere to:

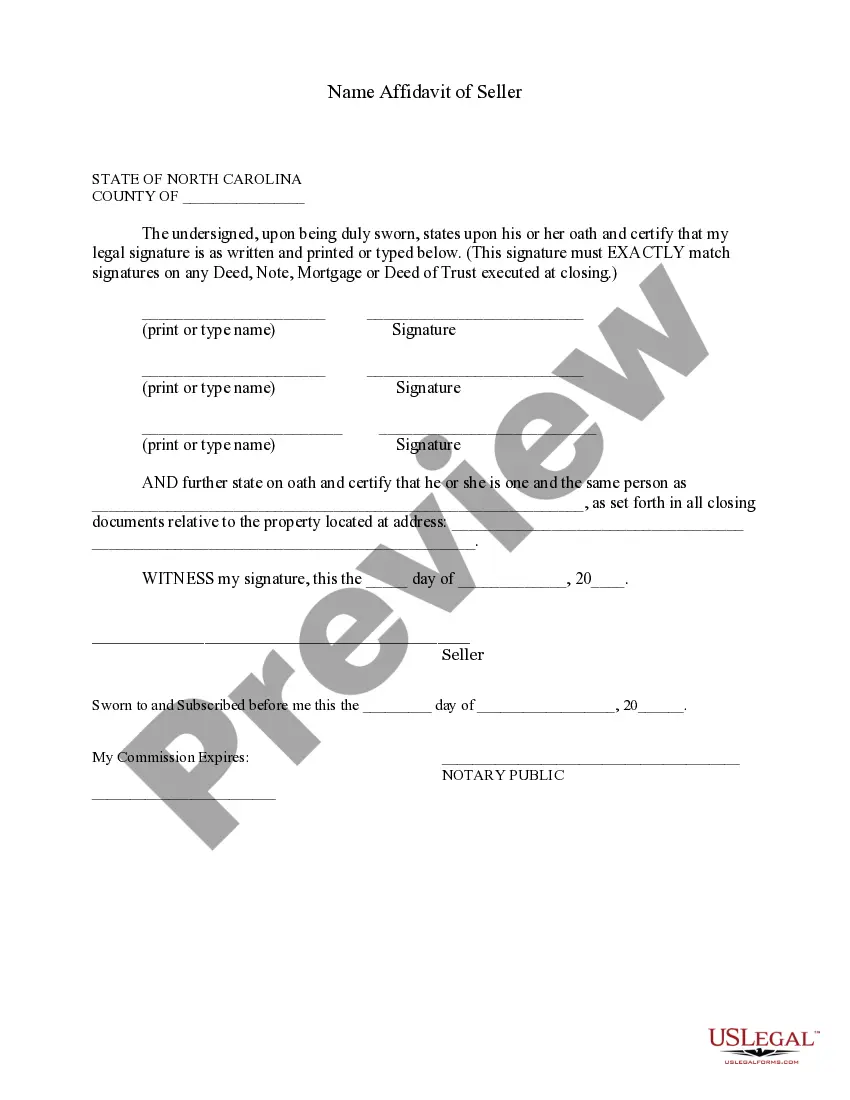

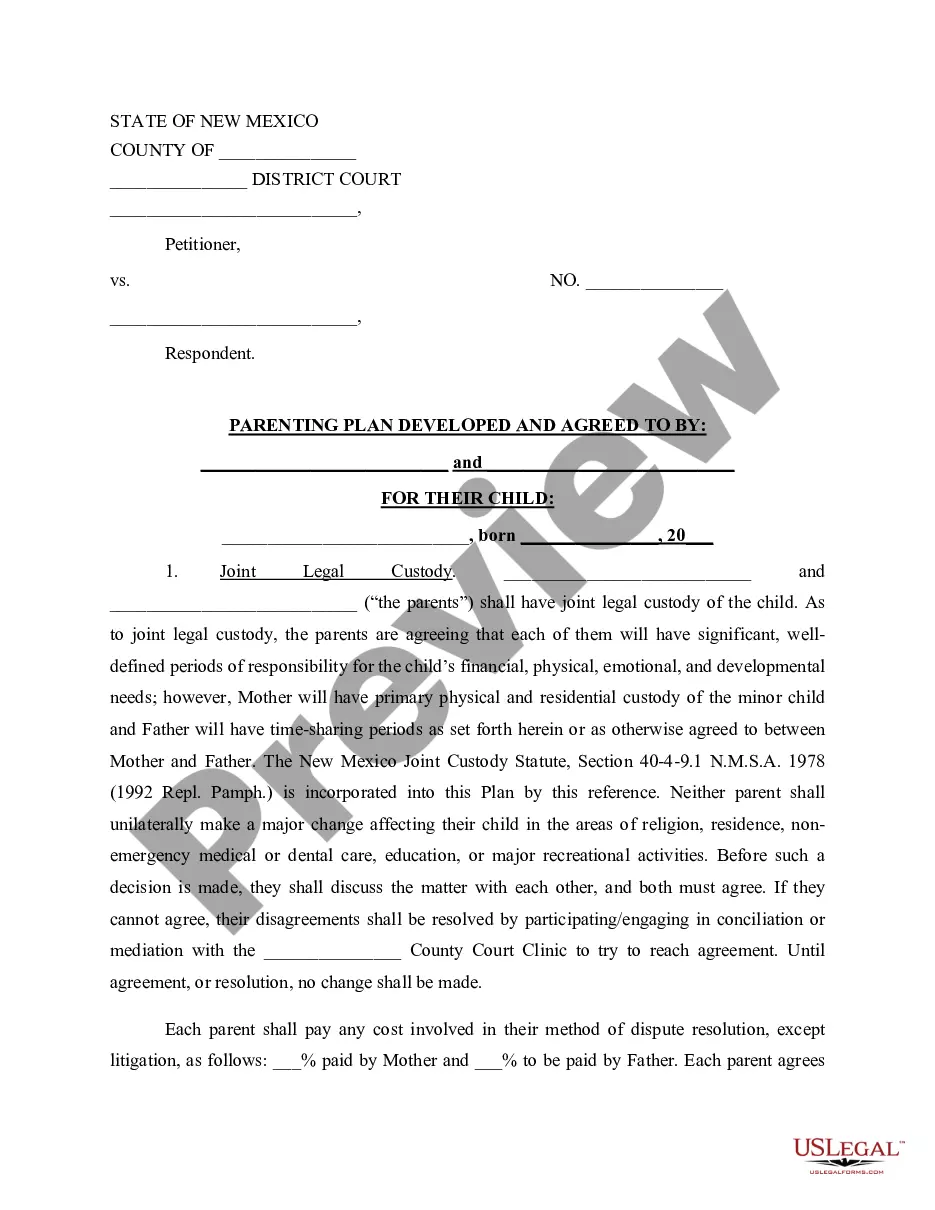

- First, make certain you have chosen the proper form for your metropolis/area. You can look over the shape utilizing the Review button and study the shape description to make certain it is the best for you.

- In the event the form is not going to fulfill your preferences, use the Seach discipline to discover the proper form.

- Once you are certain that the shape is suitable, select the Get now button to get the form.

- Select the pricing plan you would like and type in the needed info. Design your accounts and buy the transaction using your PayPal accounts or Visa or Mastercard.

- Pick the submit structure and download the legitimate document web template to the device.

- Complete, modify and produce and indication the obtained Connecticut Sample Letter for Initial Probate Proceedings - Request to Execute Documents.

US Legal Forms will be the biggest collection of legitimate forms for which you can see different document web templates. Make use of the service to download professionally-manufactured files that adhere to condition requirements.

Form popularity

FAQ

Once you're appointed as executor of an estate, you can take the next steps to get a letter of testamentary. To do that, you'll need to file a request with a probate court and provide certain documents, including: A copy of the will if the deceased person had one. A copy of the death certificate.

Section 5.5 Form of appearance (a) An appearance of an attorney shall: (1) list in the heading the name of the matter, the name of the Probate Court and the date of the appearance; (2) contain the name and mailing address of the client represented by the attorney; (3) be signed by the attorney making the appearance (4) ...

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

In Connecticut, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

Avoiding Probate In Connecticut If assets are jointly owned, they are not subject to probate. If assets pass by beneficiary designation, they are not subject to probate. Finally, if assets are in a Revocable Trust, they are not subject to probate.

The Estate Settlement Timeline: Although Connecticut law does not specify a particular deadline for this, it is generally advisable to do so within a month to avoid unnecessary delays in the probate process.

Making a Will in Connecticut Decide what property to include in your will. Decide who will inherit your property. Choose an executor to handle your estate. Choose a guardian for your children. Choose someone to manage children's property. Make your will. Sign your will in front of witnesses. Store your will safely.

1) A petitioner filing a PC-212, Affidavit in Lieu of Probate of Will/Administration, may use this form to request an order of distribution if (a) assets exceed expenses and claims or (b) a person who paid expenses or claims waives reimbursement for payment of the expense or claim.