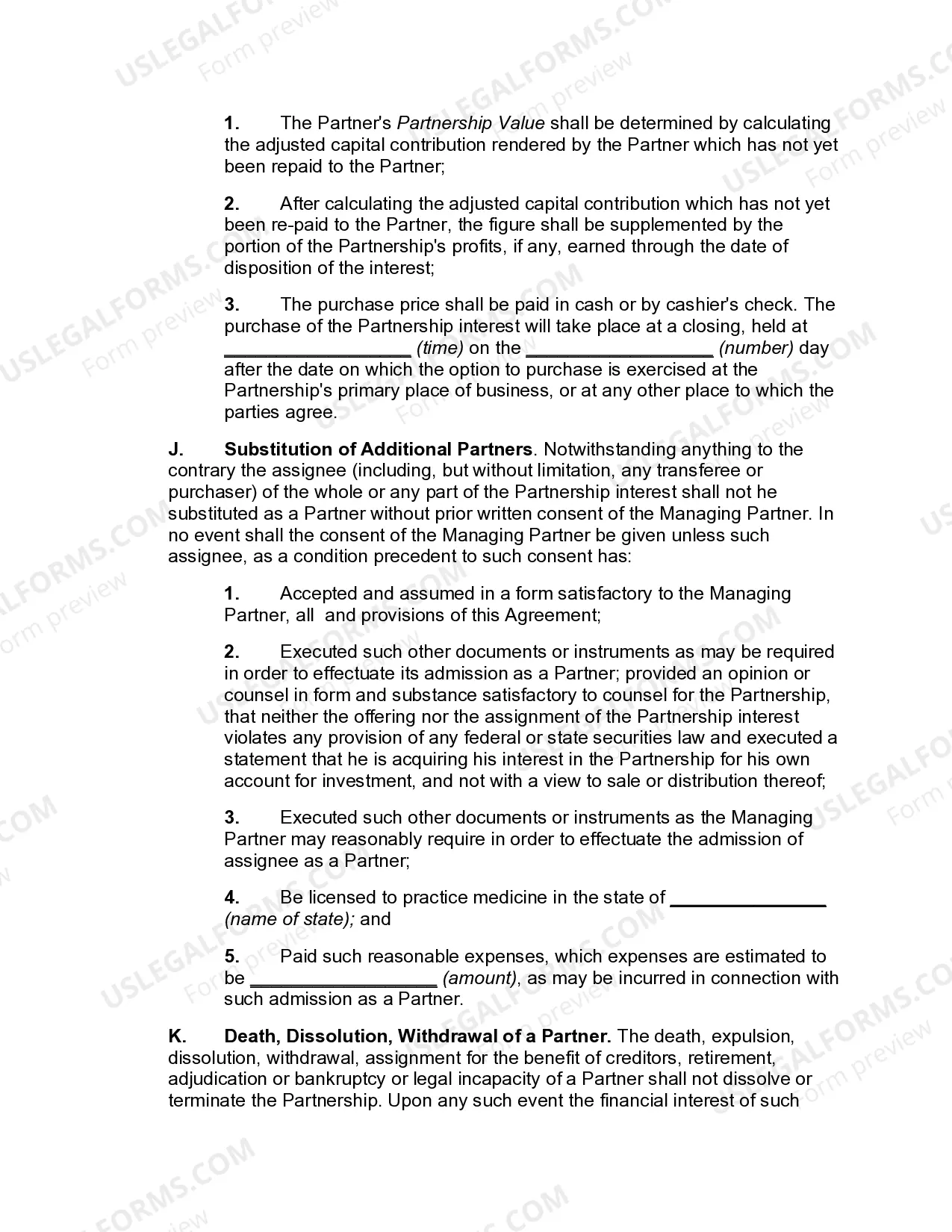

Connecticut Professional Limited Liability Partnership Agreement to Practice Medicine

Description

How to fill out Professional Limited Liability Partnership Agreement To Practice Medicine?

You may commit several hours on the Internet attempting to find the legal document template that suits the state and federal requirements you require. US Legal Forms gives a large number of legal varieties which are analyzed by specialists. You can easily obtain or print out the Connecticut Professional Limited Liability Partnership Agreement to Practice Medicine from your support.

If you already possess a US Legal Forms profile, you are able to log in and click on the Acquire switch. After that, you are able to comprehensive, revise, print out, or signal the Connecticut Professional Limited Liability Partnership Agreement to Practice Medicine. Each legal document template you buy is your own property permanently. To have another version of the obtained form, proceed to the My Forms tab and click on the related switch.

If you use the US Legal Forms web site the very first time, stick to the simple instructions listed below:

- Initially, make certain you have chosen the proper document template for that state/city of your choosing. Look at the form outline to make sure you have picked the appropriate form. If offered, take advantage of the Review switch to search from the document template too.

- In order to get another version of the form, take advantage of the Look for industry to get the template that fits your needs and requirements.

- After you have discovered the template you want, click on Buy now to carry on.

- Pick the rates program you want, key in your accreditations, and sign up for a free account on US Legal Forms.

- Full the deal. You can utilize your credit card or PayPal profile to pay for the legal form.

- Pick the formatting of the document and obtain it in your system.

- Make modifications in your document if required. You may comprehensive, revise and signal and print out Connecticut Professional Limited Liability Partnership Agreement to Practice Medicine.

Acquire and print out a large number of document templates utilizing the US Legal Forms web site, that provides the largest assortment of legal varieties. Use specialist and condition-certain templates to take on your company or specific demands.

Form popularity

FAQ

Start your Limited Liability Company (LLC) with CT Corporation | Wolters Kluwer.

Key takeaways. LLC stands for limited liability company, which means its members are not personally liable for the company's debts. LLCs are taxed on a ?pass-through? basis ? all profits and losses are filed through the member's personal tax return.

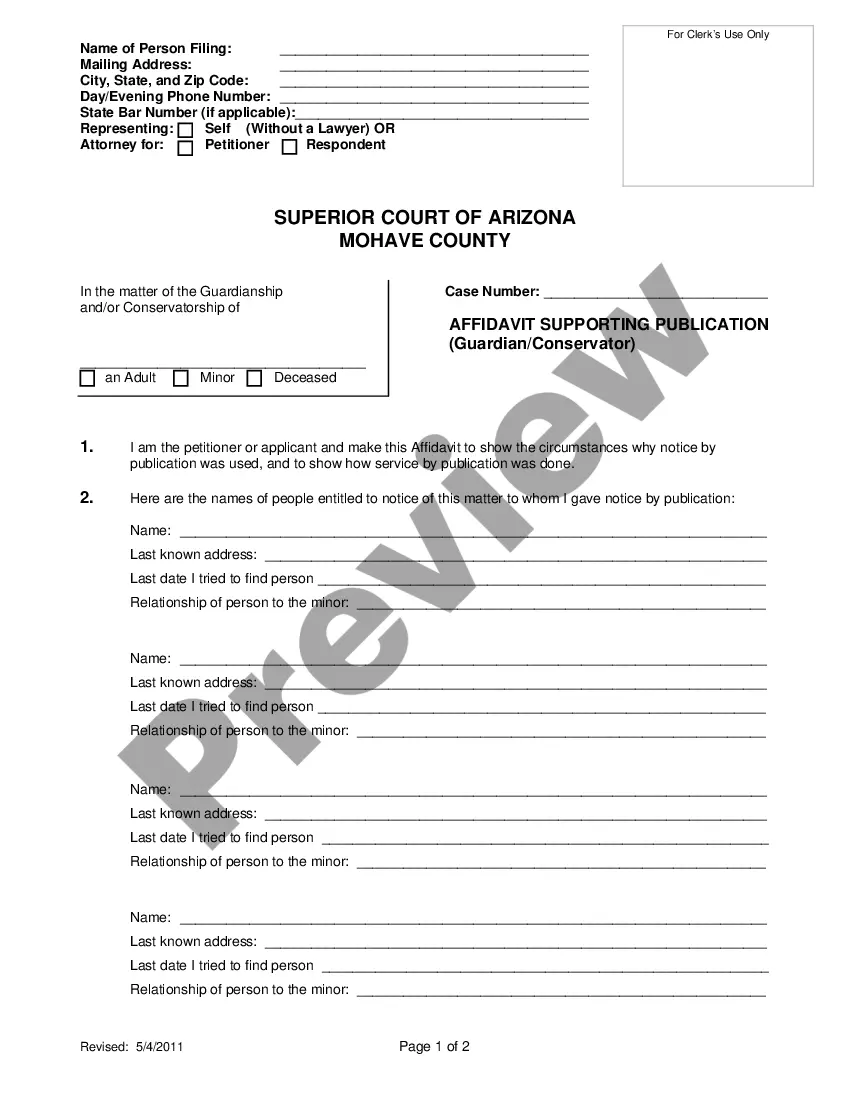

In the event that there is a dispute regarding your living will or appointment of a health care representative, the witnesses' affidavits support its validity. This affidavit requires the use of an attorney or notary public. No other form requires the use of a notary or an attorney.

Connecticut LLC Cost. Connecticut's state fee for LLC formation is $120. Connecticut LLCs also need to file an annual report every year, which costs $80. Depending on your industry and business needs, you might have additional expenses, such as licensing fees, business insurance, and registered agent fees.

A limited liability company (LLC) is a business structure in the U.S. that protects its owners from personal responsibility for its debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship.

Stat. § 25-3-103.7. Connecticut Yes.

Owners of LLCs enjoy limited liability protection. You do not have to maintain minutes of meetings or resolutions. You can select various ways of distributing the profits of the company. You can benefit from pass-through taxation, which prevents double taxation.