Connecticut Stock Option Agreement between Corporation and Officer or Key Employee

Description

How to fill out Stock Option Agreement Between Corporation And Officer Or Key Employee?

If you desire to finalize, obtain, or generate authentic document templates, utilize US Legal Forms, the largest repository of authentic forms available online.

Make use of the website's straightforward and convenient search to find the documents you need. Various templates for business and personal purposes are organized by categories and suggestions, or keywords.

Use US Legal Forms to locate the Connecticut Stock Option Agreement between Corporation and Officer or Key Employee in just a few clicks.

Every authentic document template you purchase is yours permanently. You have access to every form you obtained in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the Connecticut Stock Option Agreement between Corporation and Officer or Key Employee with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Acquire button to download the Connecticut Stock Option Agreement between Corporation and Officer or Key Employee.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

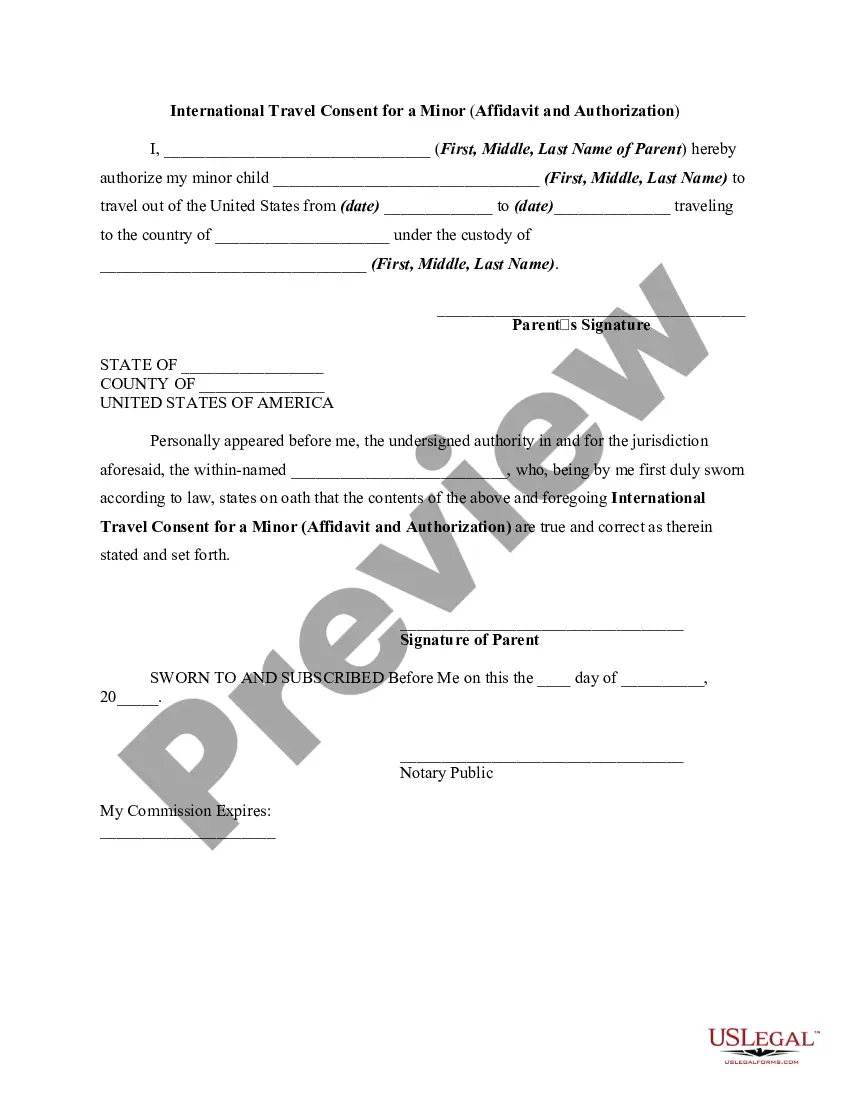

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Utilize the Preview option to review the form’s content. Don’t forget to check the details.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find alternative versions of the authentic form template.

- Step 4. Once you have located the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your credentials to register for your account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the authentic form and download it to your device.

- Step 7. Complete, modify, and print or sign the Connecticut Stock Option Agreement between Corporation and Officer or Key Employee.

Form popularity

FAQ

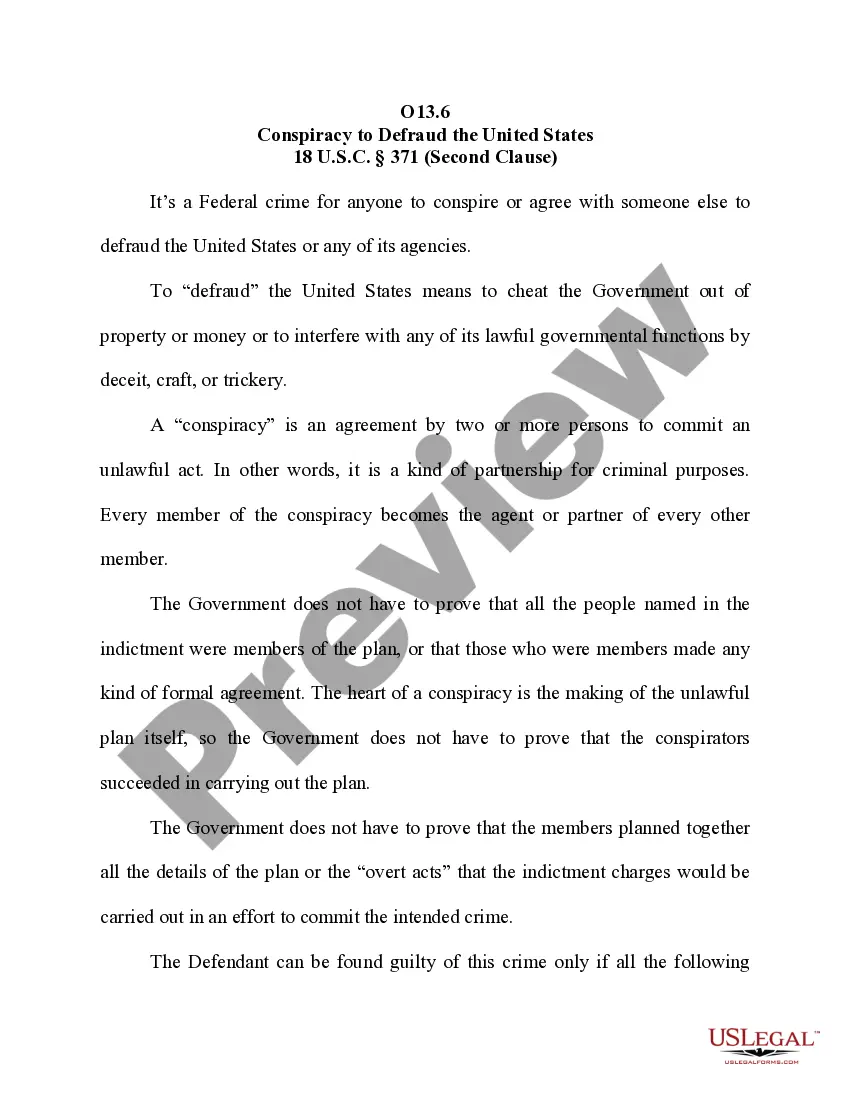

An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.

Setting Up Your Employee Stock Option PlanYour company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

The Employee Stock Option Plan (ESOP) is an employee benefit plan. It is issued by the company for its employees to encourage employee ownership in the company. The shares of the companies are given to the employees at discounted rates. Any company can issue ESOP.

This amount is shown in the employee's Form 16 and included as part of total income from salary in the tax return. Budget 2020 amendment From the FY 2020-21, an employee receiving ESOPs from an eligible start-up need not pay tax in the year of exercising the option.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

An ESOP is a qualified defined contribution retirement plan, so employees don't purchase shares with their own money. An ESPP, on the other hand, is a plan that allows employees to use their own money to buy company shares at a discount.

Stock options are a benefit often associated with startup companies, which may issue them in order to reward early employees when and if the company goes public. They are awarded by some fast-growing companies as an incentive for employees to work towards growing the value of the company's shares.

Multiply the number of the transferred shares by the price to get the total value of your share contribution to the ESOP. Debit this amount to the equity account and credit it to the ESOP account to capture the reduction of your capital and the increase of employees' capital.

Disclosures To Be Made While Issuing ESOPThe total number of stock options which is to be granted,The identified class of employees who can participate in the ESOP,Requirements of vesting period of ESOP,Maximum period within which the options can be vested,The exercise price and process of exercise,More items...?

Eligibility. Excluding directors and promoters of a company who have more than 10% equity in the company, every employee is eligible for ESOP. However, an employee should meet any of the following criteria. A full-time or part-time Director of the Company.