Connecticut Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Agreement To Form Partnership In Future To Conduct Business?

Selecting the appropriate legal document format can be quite challenging. It goes without saying that there are numerous templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This service offers an extensive array of templates, including the Connecticut Agreement to Form Partnership in Future to Conduct Business, that can be utilized for professional and personal purposes.

All forms are verified by experts and comply with federal and state regulations.

If the form does not fulfill your requirements, use the Search field to find the correct document. Once you are certain that the form is suitable, click on the Order now button to obtain it. Select the pricing plan you wish and input the required information. Create your account and process the payment using your PayPal account or credit card. Choose the document format and download the legal document to your device. Complete, modify, print, and sign the acquired Connecticut Agreement to Form Partnership in Future to Conduct Business. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Take advantage of the service to obtain properly crafted documents that adhere to state requirements.

- If you are already a registered user, Log In to your account and then click the Download button to locate the Connecticut Agreement to Form Partnership in Future to Conduct Business.

- Use your account to browse through the legal forms you have previously acquired.

- Visit the My documents section of your account to download another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

- First, ensure you have selected the correct form for your city/region.

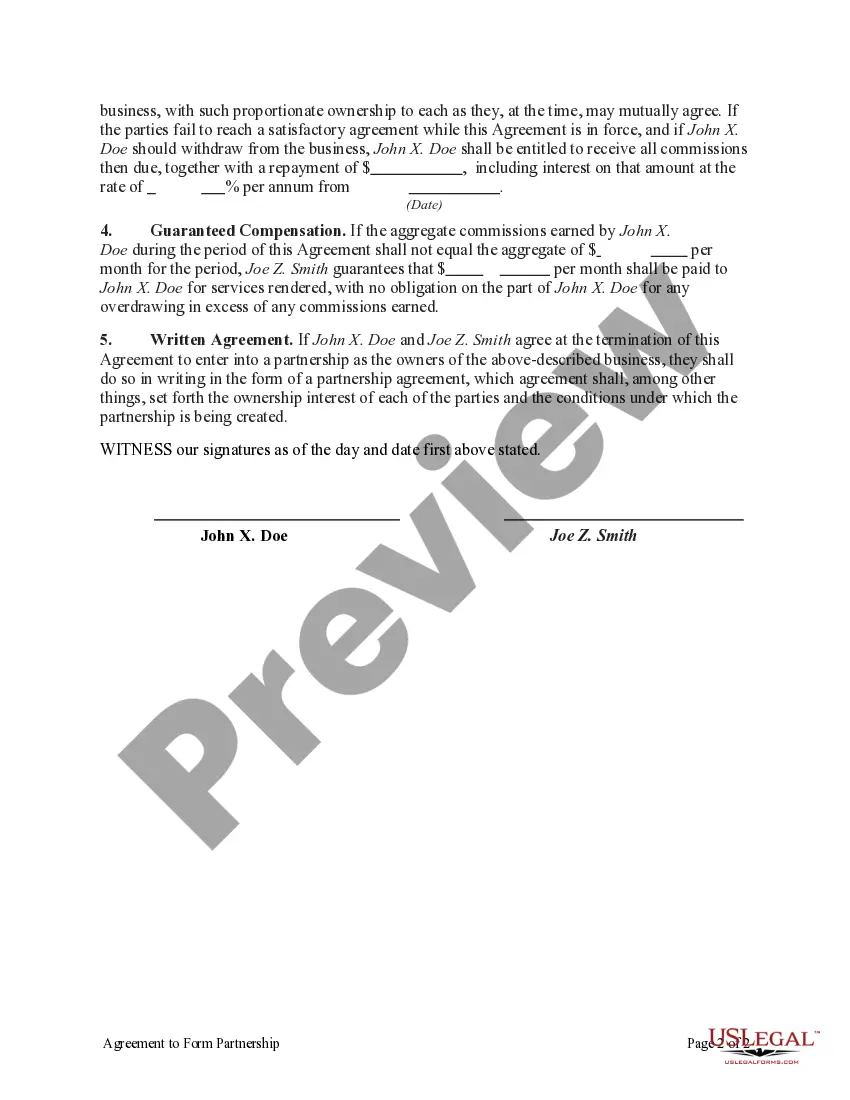

- You can review the form using the Preview button and read the form description to confirm that it is suitable for you.

Form popularity

FAQ

Understanding the four stages of partnership is essential when drafting a Connecticut Agreement to Form Partnership in Future to Conduct Business. The stages include forming, storming, norming, and performing. In the forming stage, partners establish their goals; during storming, they address differences; the norming stage focuses on building relationships; and finally, performing involves executing plans and achieving objectives. Recognizing these stages can enhance communication and collaboration, paving the way for your business success.

In the context of a Connecticut Agreement to Form Partnership in Future to Conduct Business, you'll find four primary types of business partnerships. These consist of general partnerships, limited partnerships, limited liability partnerships, and statutory partnerships. Each type varies in terms of liability and management, allowing you to select one that aligns best with your objectives. This choice is crucial for both legal protections and operational efficiency in your future endeavors.

When considering the Connecticut Agreement to Form Partnership in Future to Conduct Business, it’s important to recognize the four main types of key partnerships. These include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type serves a distinct purpose and offers unique benefits depending on your business goals. Understanding these categories can help you choose the right framework for your future business collaboration.

The Covered CT plan is a health insurance initiative designed to provide affordable coverage to residents of Connecticut. This plan aims to enhance access to healthcare services, catering to individuals and families who may struggle with insurance costs. When you enter into a joint venture through a Connecticut Agreement to Form Partnership in Future to Conduct Business, considering health benefits like the Covered CT plan can be an essential part of partnership discussions and employee welfare strategies.

A CT partnership refers to a business arrangement in Connecticut where two or more individuals collaborate to conduct business for profit. This partnership can take various forms, such as a general partnership or a limited partnership, each with its own advantages and responsibilities. Establishing a CT partnership often involves creating a Connecticut Agreement to Form Partnership in Future to Conduct Business, which can clarify roles, contributions, and profit-sharing among partners.

The Connecticut Plan, also known as the Connecticut Agreement to Form Partnership in Future to Conduct Business, is a framework that allows individuals to outline their intentions for a future partnership. This plan enables prospective partners to agree on terms and conditions ahead of time, minimizing misunderstandings later on. By documenting these arrangements in advance, participants can ensure a smoother transition into their joint business activities, thus fostering mutual trust and clarity.

Yes, having an agreement for a partnership is important for setting clear expectations and minimizing risks. An agreement acts as a roadmap, guiding partners on their roles and responsibilities. It also addresses profit-sharing and outlines procedures for resolving disputes. Crafting a Connecticut Agreement to Form Partnership in Future to Conduct Business enhances the likelihood of your partnership thriving.

The CT partnership plan typically refers to the structure and guidelines for forming a partnership under Connecticut law. It outlines responsibilities, profit distributions, and resolves potential disputes among partners. Establishing a well-defined plan is crucial for long-term success. A Connecticut Agreement to Form Partnership in Future to Conduct Business can help you create a solid foundation upon which to build your partnership.

To set up a business partnership agreement, start by discussing the roles and contributions of each partner. Draft a clear document that covers essential topics such as profit-sharing, responsibilities, and dispute resolution. Consider using templates available on platforms like USLegalForms to ensure that your Connecticut Agreement to Form Partnership in Future to Conduct Business meets legal requirements. Review the draft together and make any necessary adjustments.

A written agreement is not legally required to form a partnership in Connecticut; however, it is essential for clarity and protection. Having a written document outlines the expectations and duties of each partner, preventing potential conflicts. It serves as a reference that can be invaluable during disputes. Thus, creating a Connecticut Agreement to Form Partnership in Future to Conduct Business is a wise step.