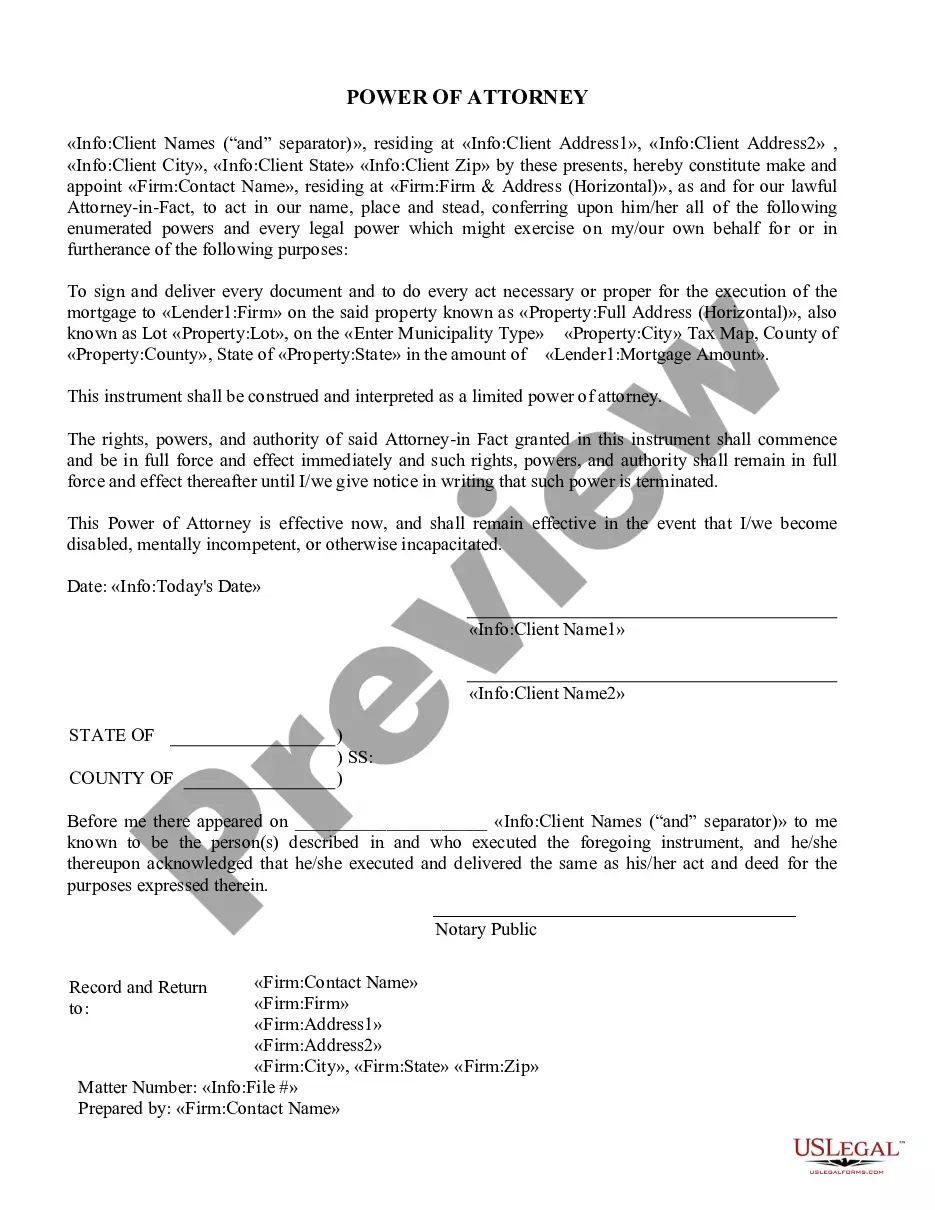

Not for use in Florida or other States that have excluded it from their laws. Instead use one of the State Specific forms.

A power of attorney is an instrument containing an authorization for one to act as the agent of the principal that terminates at some point in the future either by its terms or by operation of law such as death of the principal or agent. The person appointed is usually called an Attorney-in-Fact. In most cases, a power of attorney takes effect when signed. This may be troublesome for someone who wishes to provide for the management of his or her financial affairs in the event of a future disability but does not want to grant broad powers to a person who could act immediately. The solution is the springing power of attorney. The springing power of attorney becomes effective only at some specified future time or upon the occurrence of a specified event, such as incapacity. Thus the authority of the attorney-in-fact cannot be exercised until there is a need. Most, but not all, states allow a springing power of attorney.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.