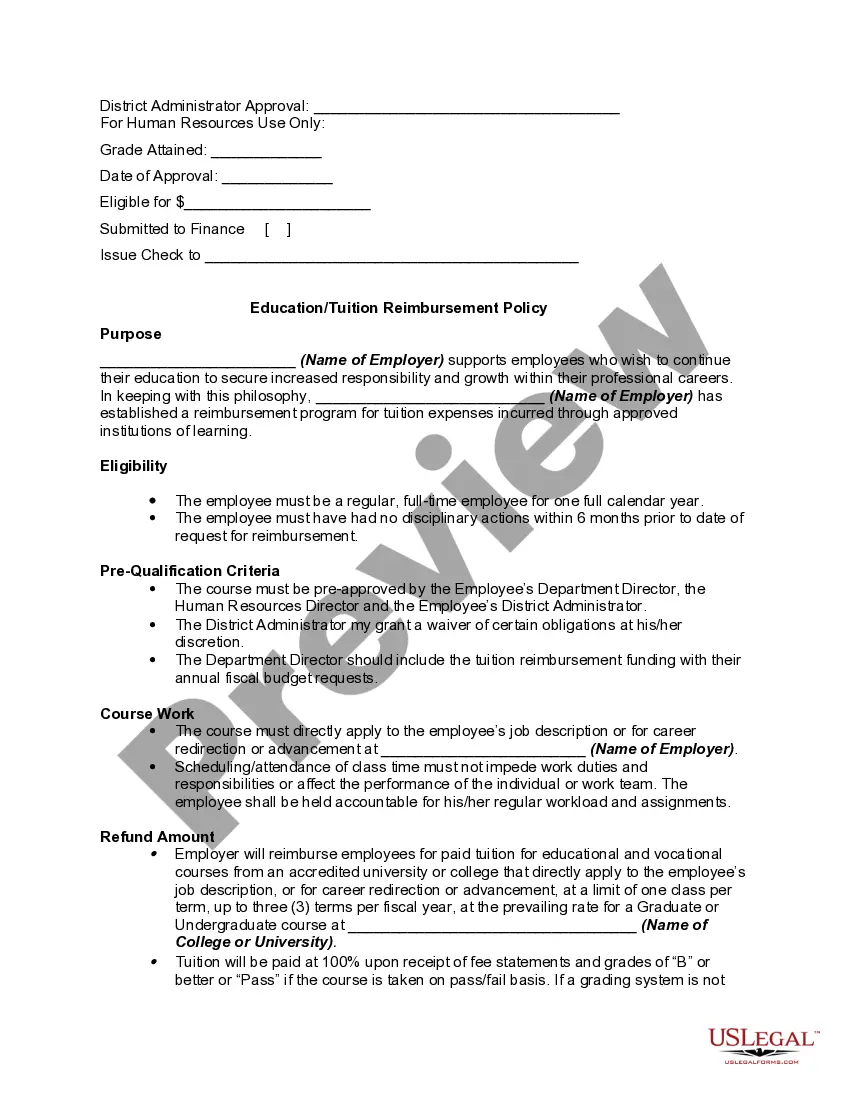

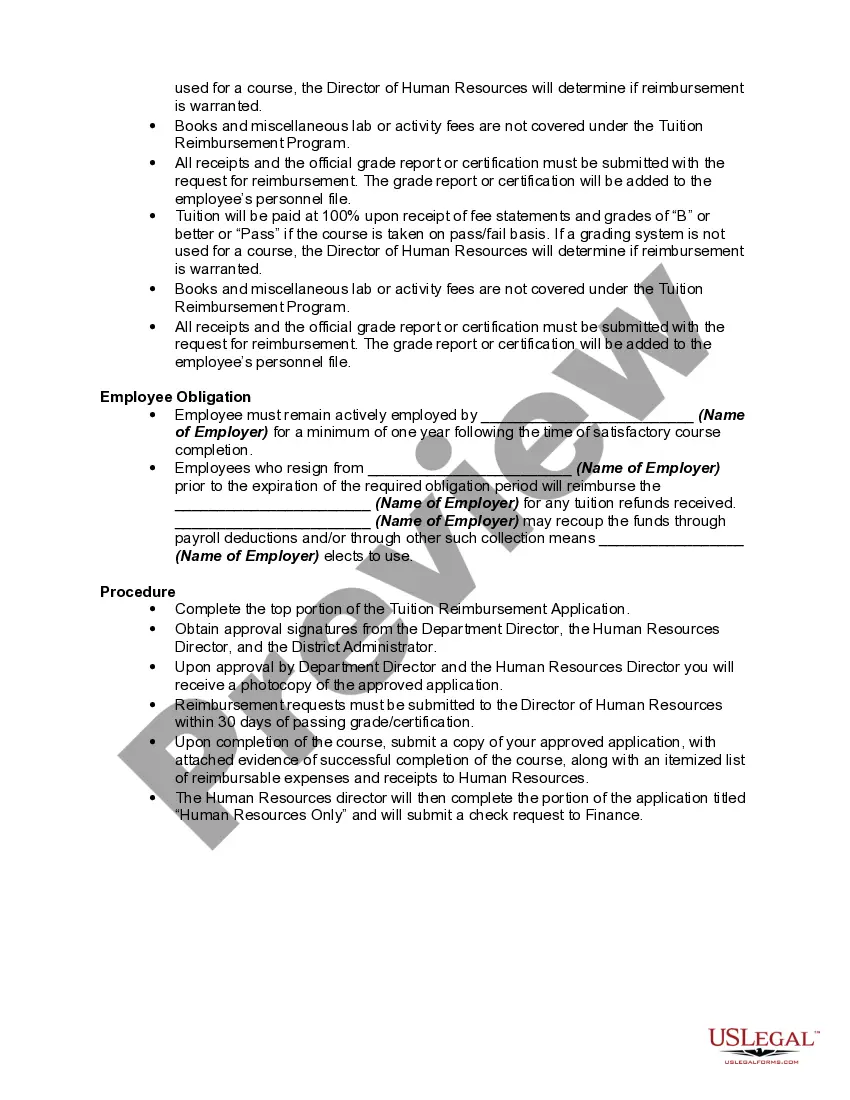

Many companies these days have a tuition reimbursement program. This is a program through which a company pays for part or all of an employee's tuition. In a company which has a tuition reimbursement program, the company generally wants to encourage employees to pursue professional development. Some companies limit the types of education they will pay for, expecting employees to take training and classes relevant to the type of work the company does, or to take classes which can lead to a higher position in the company. For example, a company might pay for someone to get an MBA with the goal of retaining that person and creating an opportunity for advancement.

Employees enrolled in a tuition reimbursement program usually need to make a certain grade point average, and they cannot drop out of school. If they fail to meet these standards, they will be expected to repay the company, and they may also be required to pay if they quit working while school is in session or if they quit shortly after school ends.

The Connecticut Application for Tuition Refund is an important form that students or their parents can submit to request a refund of tuition fees paid to an educational institution in the state of Connecticut. This application is specifically designed to assist students who may have faced unexpected circumstances or need to withdraw from school before completing their academic term. The purpose of the Connecticut Application for Tuition Refund is to provide financial relief to eligible students who are facing hardships and are unable to complete their courses for various reasons. By obtaining a refund, students can mitigate the financial burden they may have incurred due to unforeseen circumstances. There are several types of Connecticut Applications for Tuition Refund, which may vary depending on the educational institution or the specific circumstances of the student. Some common types include: 1. Medical Withdrawal: This application is applicable to students who are unable to continue their studies due to medical reasons. Medical documentation from a licensed healthcare provider is typically required to support the application. Examples of medical issues may include serious illnesses, physical injuries, or mental health conditions. 2. Financial Hardship: This application is for students who are facing severe financial constraints and cannot afford to continue their education. Proof of financial hardship, such as income statements, tax returns, or proof of unemployment, may be required to support the application. 3. Academic Dismissal/Withdrawal: This application is for students who have been academically dismissed or voluntarily withdrawn from their courses. They may be eligible for a tuition refund based on the institution's policies and deadlines. 4. Family Emergency: Students who have experienced a family emergency that prevents them from continuing their studies can submit this type of application. Valid documentation, such as a death certificate or legal documentation, may be required to support the application. It's important for students to carefully review the specific requirements and guidelines outlined in their educational institution's Connecticut Application for Tuition Refund. They should gather all necessary documentation and provide a detailed explanation of their situation to increase their chances of a successful refund application. By completing the Connecticut Application for Tuition Refund accurately and in a timely manner, students can potentially ease their financial burden and focus on pursuing their academic goals or addressing pressing matters that led to the need for withdrawal.