This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

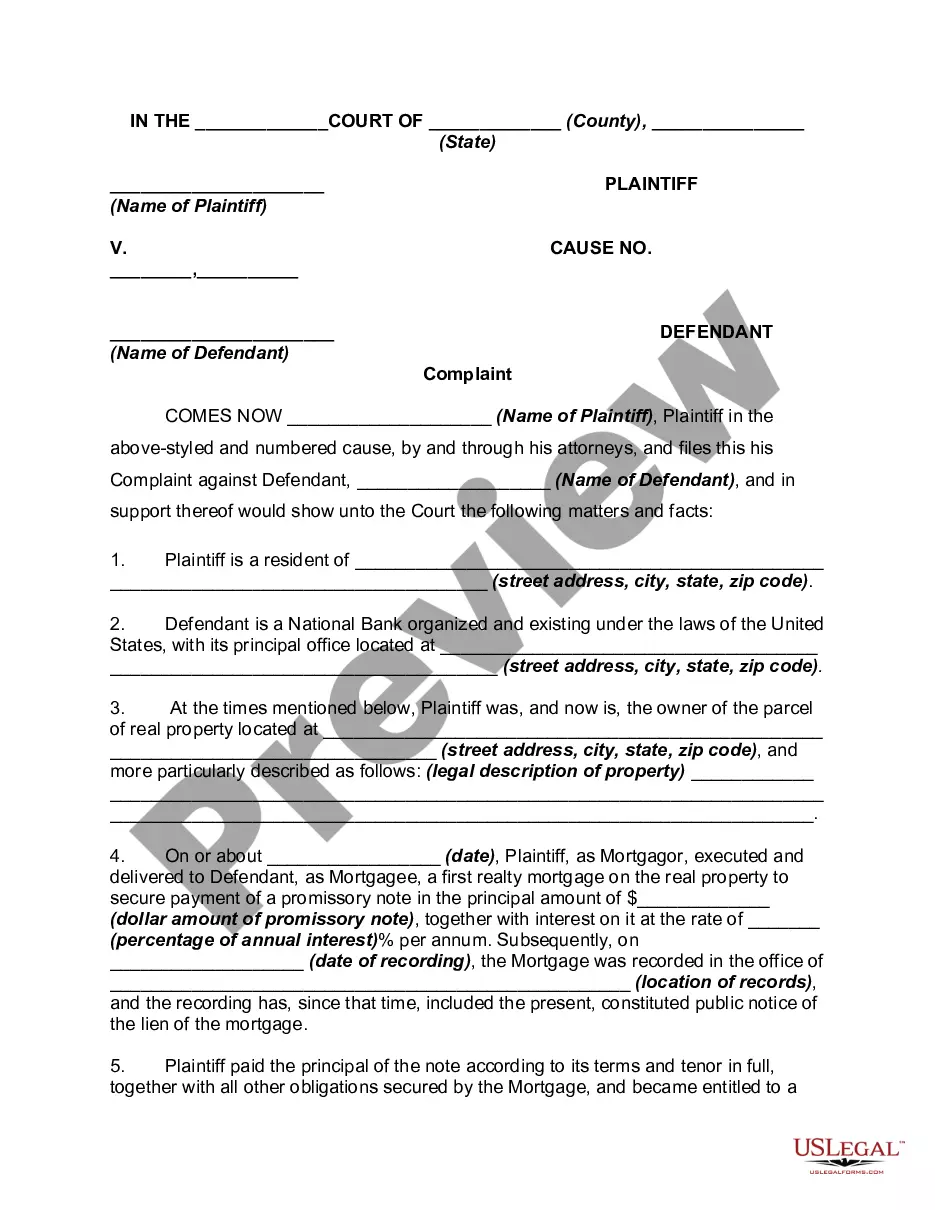

Connecticut Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage

Description

How to fill out Complaint To Compel Mortgagee To Execute And Record Satisfaction And Discharge Of Mortgage?

Are you in a placement that you require paperwork for both company or specific reasons just about every day? There are a lot of lawful record web templates available on the Internet, but locating types you can depend on is not simple. US Legal Forms gives a huge number of kind web templates, like the Connecticut Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage, which are published in order to meet federal and state specifications.

If you are previously acquainted with US Legal Forms web site and have a free account, just log in. Following that, you may download the Connecticut Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage template.

Unless you come with an accounts and want to begin to use US Legal Forms, follow these steps:

- Find the kind you require and make sure it is to the appropriate town/state.

- Utilize the Preview option to analyze the shape.

- Read the explanation to actually have selected the appropriate kind.

- If the kind is not what you are trying to find, utilize the Search discipline to find the kind that fits your needs and specifications.

- Once you get the appropriate kind, just click Acquire now.

- Choose the costs prepare you want, complete the desired info to produce your account, and purchase the transaction using your PayPal or Visa or Mastercard.

- Choose a hassle-free data file file format and download your backup.

Find all of the record web templates you possess purchased in the My Forms menus. You can obtain a further backup of Connecticut Complaint to Compel Mortgagee to Execute and Record Satisfaction and Discharge of Mortgage any time, if possible. Just click on the needed kind to download or print the record template.

Use US Legal Forms, by far the most extensive collection of lawful forms, to save lots of some time and prevent faults. The service gives professionally manufactured lawful record web templates that can be used for a selection of reasons. Create a free account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

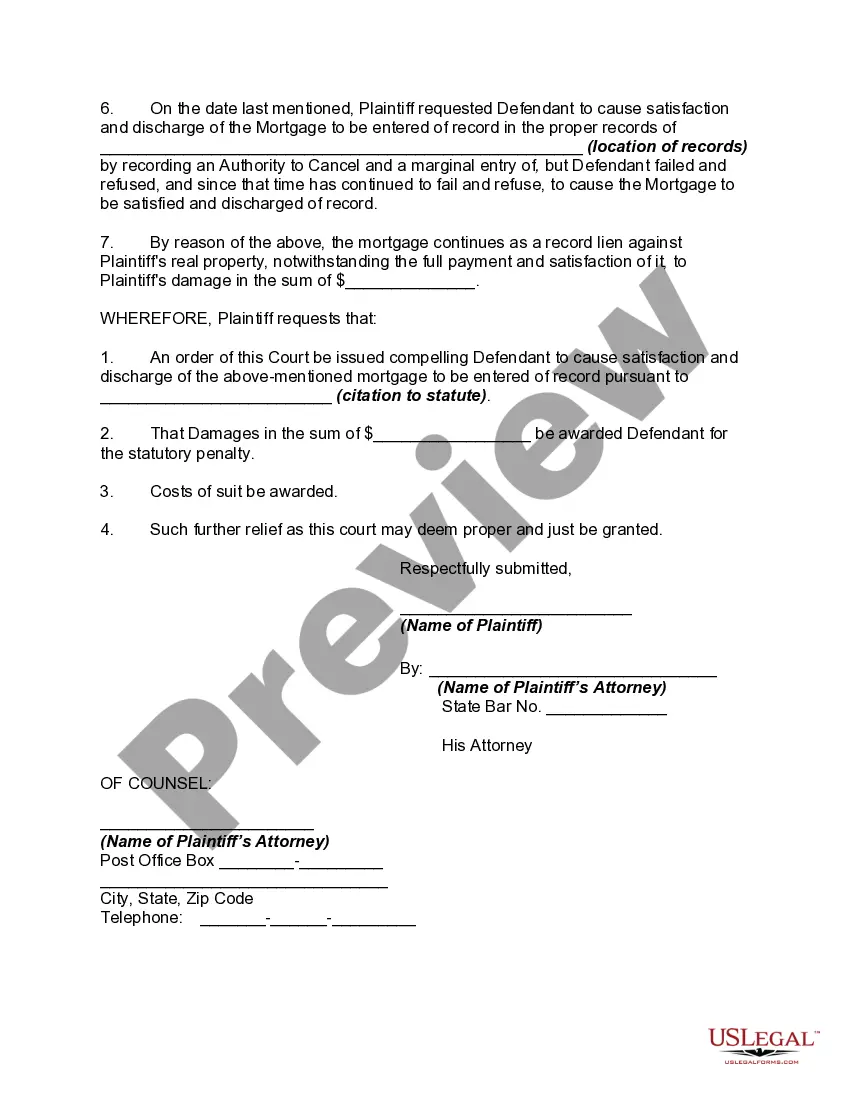

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.

If Mortgagee fails to satisfy of record, he is liable for damages, including attorney fees, if 20 days written notice is given by Mortgagor prior to suit. Acknowledgment: An assignment or satisfaction must contain a proper New Jersey acknowledgment, or other acknowledgment approved by Statute.

Poor communication, or a lack of responsiveness, is the most common complaint in the mortgage lending process.

(3) If the mortgage lender does not satisfy the net worth requirements within 120 days, the license of the mortgage lender shall be deemed to be relinquished and canceled and all servicing contracts shall be disposed of in a timely manner by the mortgage lender.

Section 49-2a - Interest on funds held in escrow for payment of taxes and insurance, Conn. Gen. Stat. § 49-2a | Casetext Search + Citator.

Ancient Mortgage - CGS 49-13a ? cites that a mortgage is invalid 20 years after a stated maturity date or 40 years after date of recording of mortgage if no due date is set forth in the mortgage. An affidavit must be recorded signed by owner of the property alleging these facts.

If the satisfaction isn't recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney's fees.

Suppose a mortgage lender fails to record a Satisfaction of Mortgage document within 60 days from the final payment date. In that case, you can file a lawsuit against the mortgagee. Contact a local law firm to speak with an intake specialist about your legal options.