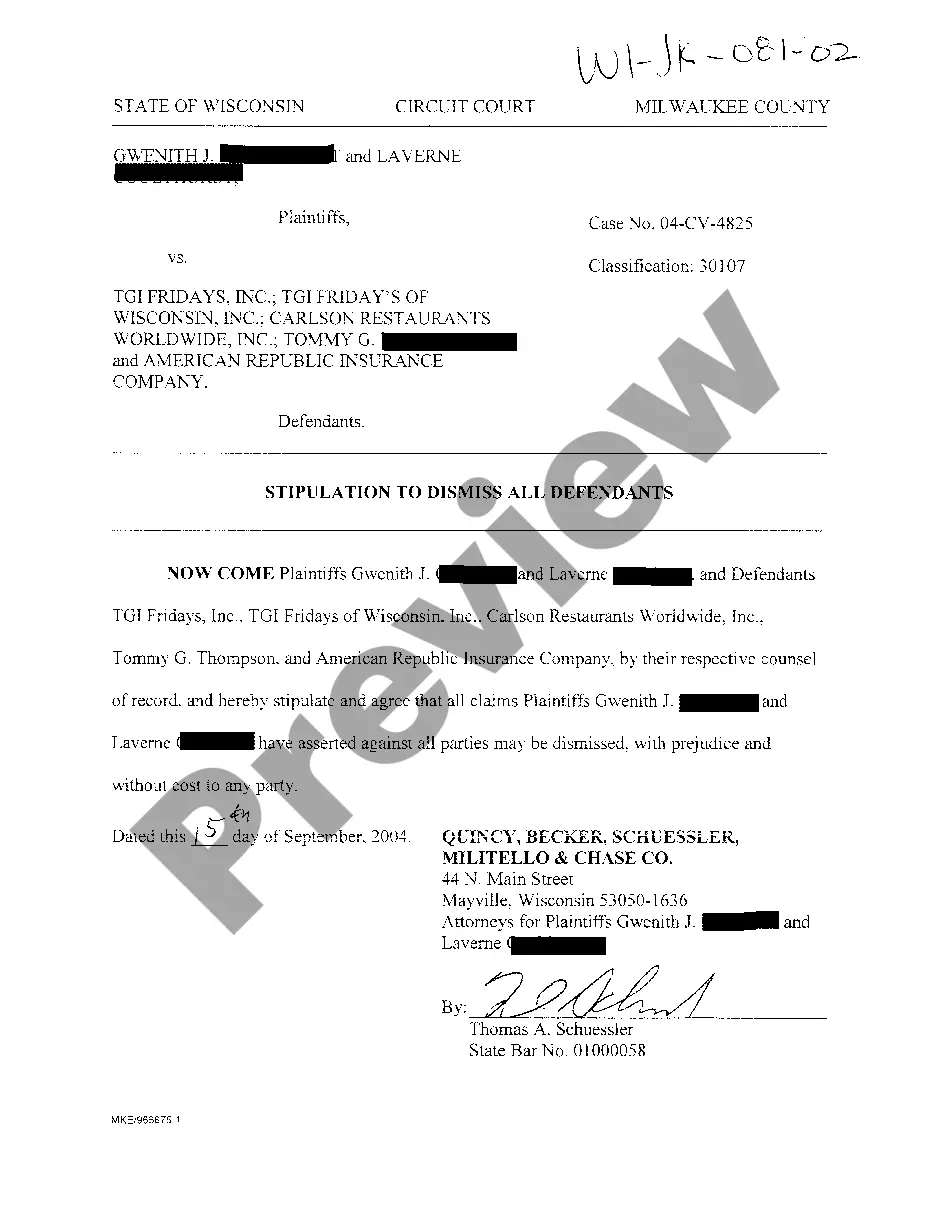

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Petition to Determine Distribution Rights of the Assets of a Decedent

Description

How to fill out Petition To Determine Distribution Rights Of The Assets Of A Decedent?

US Legal Forms - among the greatest libraries of authorized forms in America - gives a wide array of authorized file layouts you can obtain or produce. Utilizing the site, you may get a large number of forms for business and individual reasons, categorized by groups, states, or keywords.You can find the newest types of forms such as the Connecticut Petition to Determine Distribution Rights of the Assets of a Decedent in seconds.

If you already possess a monthly subscription, log in and obtain Connecticut Petition to Determine Distribution Rights of the Assets of a Decedent through the US Legal Forms collection. The Download button will appear on every develop you view. You gain access to all earlier downloaded forms within the My Forms tab of the account.

If you wish to use US Legal Forms for the first time, allow me to share basic guidelines to get you started:

- Be sure to have selected the best develop for your metropolis/county. Go through the Preview button to examine the form`s content. Read the develop information to ensure that you have chosen the right develop.

- In the event the develop doesn`t suit your needs, utilize the Look for field on top of the screen to find the one who does.

- When you are content with the form, confirm your choice by clicking the Get now button. Then, choose the pricing strategy you prefer and give your credentials to register for the account.

- Method the financial transaction. Use your charge card or PayPal account to accomplish the financial transaction.

- Pick the structure and obtain the form on your product.

- Make adjustments. Load, edit and produce and sign the downloaded Connecticut Petition to Determine Distribution Rights of the Assets of a Decedent .

Every web template you included in your bank account lacks an expiry date and is your own property permanently. So, if you wish to obtain or produce an additional version, just go to the My Forms segment and click about the develop you require.

Get access to the Connecticut Petition to Determine Distribution Rights of the Assets of a Decedent with US Legal Forms, the most extensive collection of authorized file layouts. Use a large number of professional and express-certain layouts that fulfill your small business or individual demands and needs.

Form popularity

FAQ

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

1) A petitioner filing a PC-212, Affidavit in Lieu of Probate of Will/Administration, may use this form to request an order of distribution if (a) assets exceed expenses and claims or (b) a person who paid expenses or claims waives reimbursement for payment of the expense or claim.

Avoiding Probate In Connecticut If assets are jointly owned, they are not subject to probate. If assets pass by beneficiary designation, they are not subject to probate. Finally, if assets are in a Revocable Trust, they are not subject to probate.

In Connecticut, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

45a-318 in 1991; P.A. 93-407 added provision permitting decedent, in a duly acknowledged writing, to designate person other than next of kin to have custody and control of his remains; P.A. 94-25 deleted phrase ?for the time being? in Subsec. (a); P.A.

The Estate Settlement Timeline: Although Connecticut law does not specify a particular deadline for this, it is generally advisable to do so within a month to avoid unnecessary delays in the probate process.

Probate is when the court supervises the processes that transfer legal title of property from the estate of the person who has died (the "decedent") to his or her beneficiaries.

Probate court is a specialized type of court that deals with the property and debts of a person who has died. The basic role of the probate court judge is to assure that the deceased person's creditors are paid, and that any remaining assets are distributed to the proper beneficiaries.