Connecticut Receipt of Payment for Obligation

Description

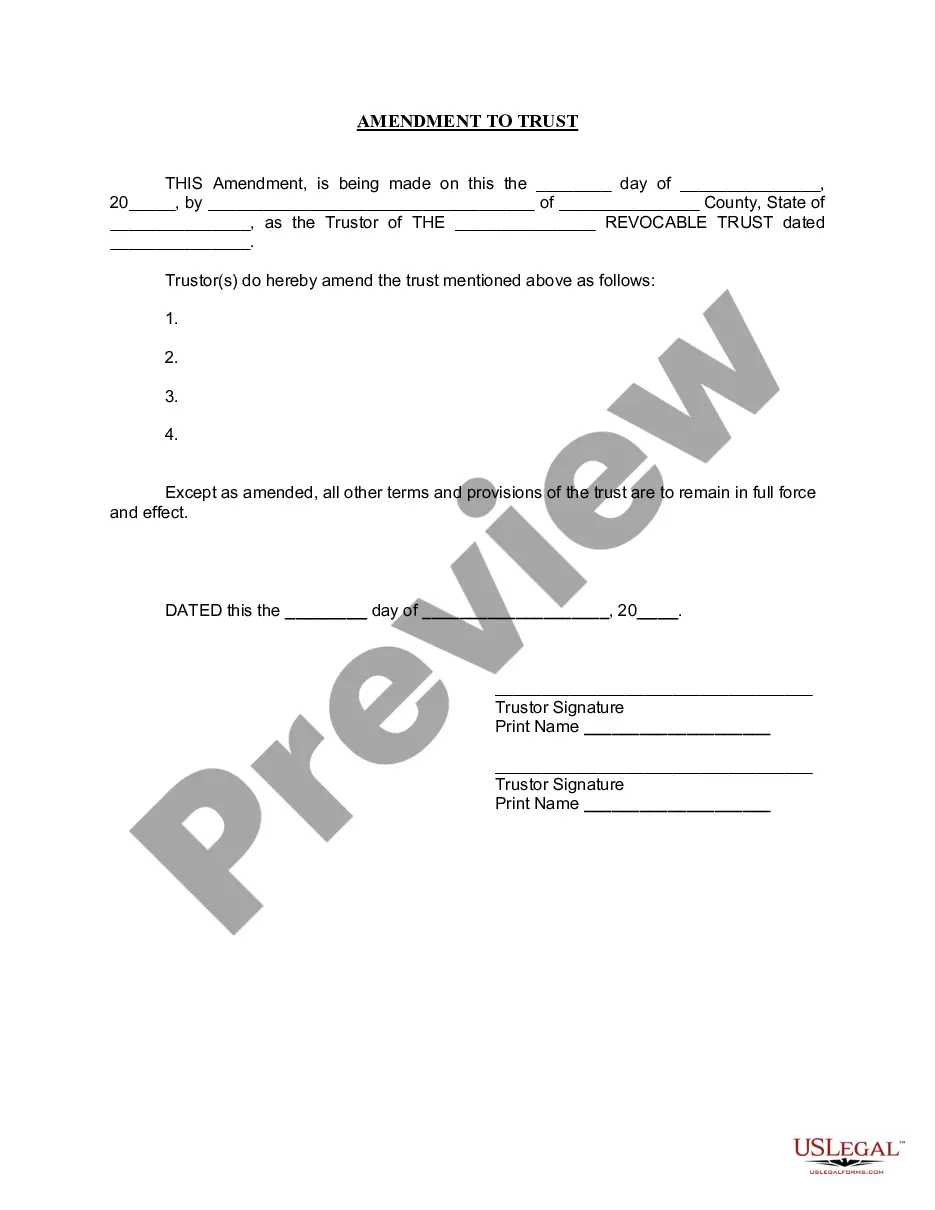

How to fill out Receipt Of Payment For Obligation?

If you want to complete, obtain, or print legal record web templates, use US Legal Forms, the most important assortment of legal kinds, which can be found online. Make use of the site`s basic and practical research to obtain the paperwork you require. A variety of web templates for business and personal purposes are categorized by groups and suggests, or keywords. Use US Legal Forms to obtain the Connecticut Receipt of Payment for Obligation within a few clicks.

In case you are presently a US Legal Forms buyer, log in to the profile and click on the Acquire option to find the Connecticut Receipt of Payment for Obligation. You can also accessibility kinds you formerly acquired within the My Forms tab of your respective profile.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form to the correct metropolis/nation.

- Step 2. Take advantage of the Review solution to look over the form`s content. Never neglect to read through the information.

- Step 3. In case you are unsatisfied together with the type, make use of the Lookup discipline on top of the display to locate other variations of the legal type web template.

- Step 4. After you have found the form you require, go through the Buy now option. Opt for the rates strategy you prefer and put your qualifications to register on an profile.

- Step 5. Process the deal. You may use your credit card or PayPal profile to perform the deal.

- Step 6. Pick the structure of the legal type and obtain it in your gadget.

- Step 7. Full, revise and print or signal the Connecticut Receipt of Payment for Obligation.

Each and every legal record web template you buy is your own eternally. You may have acces to each and every type you acquired inside your acccount. Select the My Forms area and select a type to print or obtain once more.

Remain competitive and obtain, and print the Connecticut Receipt of Payment for Obligation with US Legal Forms. There are millions of expert and status-particular kinds you can use to your business or personal requires.

Form popularity

FAQ

If the invoice is generated internally, the invoice date should be the date the invoice was prepared and approved. Receipt date refers to the date goods or services were received or contractually due. If multiple dates or billing periods are included on a single invoice, use the latest date.

The date on the top of the invoice should be the date the invoice was generated. The dates under the 'description' should be when the product was delivered or the service was performed.

Invoices must always include the invoice date as well as the due date. Setting a due date encourages the client to pay you within a certain time frame. The general rule is 30 days from the invoice date. However, you can discuss this with your customer and either make it shorter or longer than 30 days.

Definition: Invoice Effective Date. The Invoice Effective Date is based on the: Policy Transaction Date for invoices billed as full pay. Installment Date for invoices billed on an installment plan.

Invoice Date This is especially crucial for entities offering credit, such as net 30, which means payment is due in 30 days. Likewise, companies that offer customers the option to return items typically have a deadline based on a specific number of days from proof of purchase, as indicated on the invoice.

For example, if the total net weekly income is $1,000, the basic child support amount for one child would be $229 ing to the schedule (as of 2023). Next, to find each parent's share of the support amount ($229) you'll divide each parent's income by the total combined income.

As a result, and to answer our initial question: Yes, it is essential and obligatory to include the two dates (issue and delivery) on an invoice when they don't coincide.