Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Connecticut Demand for Accounting from a Fiduciary

Description

How to fill out Demand For Accounting From A Fiduciary?

You can spend time online trying to locate the official document template that meets the federal and state standards you require.

US Legal Forms offers thousands of legal templates which can be reviewed by experts.

You can obtain or print the Connecticut Demand for Accounting from a Fiduciary through the service.

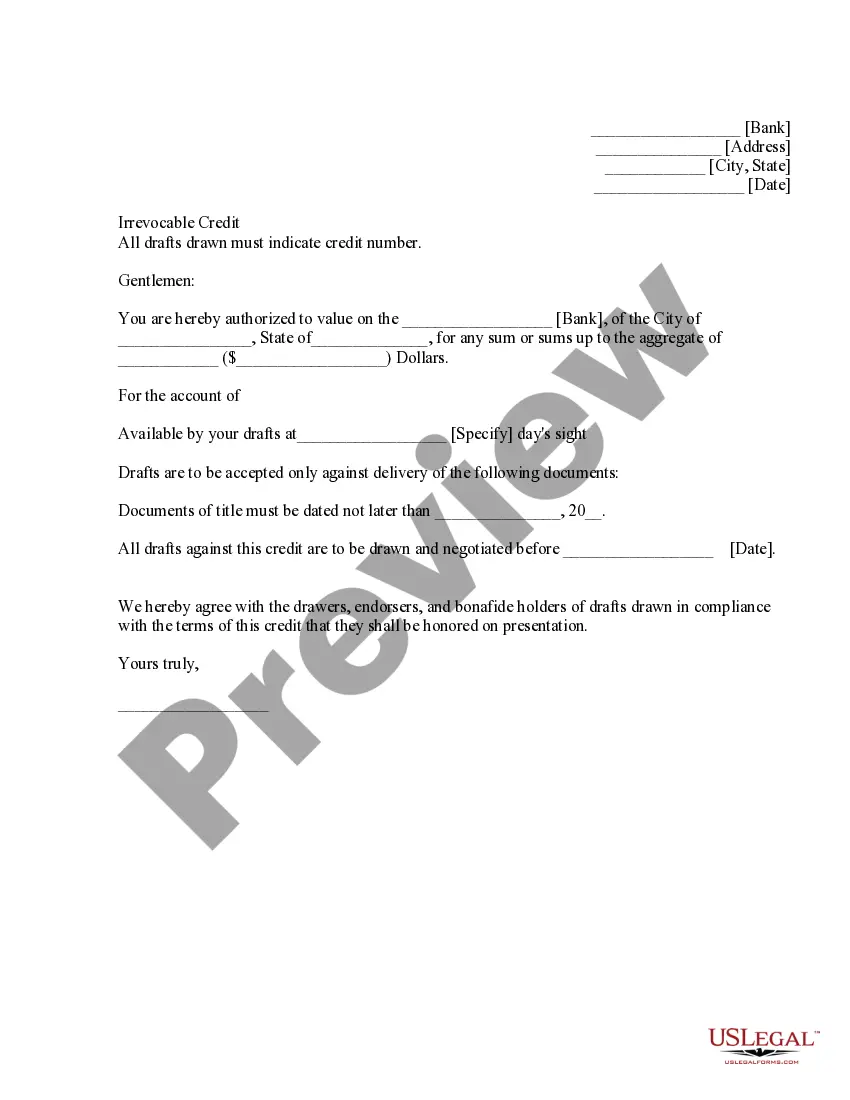

If available, use the Preview button to look over the document format as well. If you wish to find another version of your form, utilize the Search field to locate the template that fits your specifications.

- If you possess a US Legal Forms account, you can Log In and then click the Acquire button.

- Following that, you can complete, modify, print, or sign the Connecticut Demand for Accounting from a Fiduciary.

- Every legal document template you purchase is yours indefinitely.

- To receive another copy of the bought form, visit the My documents section and click the corresponding button.

- If you're accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/city of your choice.

- Review the form description to confirm you have picked the right document.

Form popularity

FAQ

To demand an accounting of a trust, start by sending a clear, formal request to the trustee. Provide specifics on what information you require and the timeline involved. If the trustee continues to withhold this information, you may want to escalate the matter through legal channels. For clarity and support on making your Connecticut Demand for Accounting from a Fiduciary, consider using resources available at US Legal Forms.

If a trustee is reluctant to provide an accounting, consider sending a formal written request outlining your rights as a beneficiary. If this approach fails, you may need to file a petition with the court to compel the trustee to comply. Engaging legal counsel can bolster your case and ensure your interests are protected. Resources from US Legal Forms can assist you in preparing for your Connecticut Demand for Accounting from a Fiduciary.

To request an accounting of a trust, you should communicate directly with the trustee in writing. Clearly outline your request and specify the period covered by the accounting. If the trustee is unresponsive, you may need to pursue legal avenues to ensure compliance. For detailed steps and guidance, utilize US Legal Forms to facilitate your Connecticut Demand for Accounting from a Fiduciary.

Yes, an executor is legally obligated to present an accounting to beneficiaries. This accounting details the financial transactions related to the estate, ensuring transparency and accountability. If you are a beneficiary and have not received this information, you may need to ask the executor directly or consider formal requests. Seeking help through US Legal Forms can simplify your Connecticut Demand for Accounting from a Fiduciary.

If a trustee fails to provide an accounting, beneficiaries may face uncertainty over the trust's financial status. In such cases, beneficiaries can initiate legal action to compel the trustee to fulfill their fiduciary duties. This ensures proper oversight and helps resolve any conflicts related to asset management. To understand your rights better, you can reference US Legal Forms and learn more about making a Connecticut Demand for Accounting from a Fiduciary.

In Connecticut, beneficiaries of a trust or an estate have the right to demand an accounting. This includes anyone who has a financial interest in the trust or is a potential heir to the estate. This right ensures that fiduciaries manage assets transparently and act in the beneficiaries' best interests. If you need assistance, consider exploring US Legal Forms for guidance on your Connecticut Demand for Accounting from a Fiduciary.

The purpose of fiduciary accounting is to provide a transparent, detailed overview of how a fiduciary manages and allocates assets for the benefit of the beneficiaries. This accounting helps ensure all parties understand financial transactions, distributions, and the overall status of the trust's assets. When beneficiaries file a Connecticut Demand for Accounting from a Fiduciary, they are seeking this detailed insight to ensure their interests are protected and properly managed.

The fiduciary adjustment in Connecticut refers to a method used to calculate income taxes for fiduciaries, often involving specific deductions and inclusions relevant to the trust's income. This adjustment ensures that the taxes owed accurately reflect the financial activities of the fiduciary during a given period. This process is often scrutinized during a Connecticut Demand for Accounting from a Fiduciary to clarify tax-related concerns for beneficiaries.

In Connecticut, trust beneficiaries have several rights, including the right to receive information regarding the trust, its assets, and the fiduciary's actions. Beneficiaries can request accountings and can take legal action if they believe the fiduciary is not fulfilling their obligations. Understanding these rights is vital, especially in the context of a Connecticut Demand for Accounting from a Fiduciary, as it empowers beneficiaries to ensure proper management of their interests.

Fiduciary accounting involves preparing financial statements and records that a fiduciary must maintain to account for the assets they manage on behalf of others. This process ensures proper documentation of transactions, asset evaluations, and distributions to beneficiaries. When you request a Connecticut Demand for Accounting from a Fiduciary, you essentially seek this detailed financial reporting to ensure transparency and accountability in the fiduciary’s management practices.