Connecticut Affidavit of Domicile for Deceased

Description

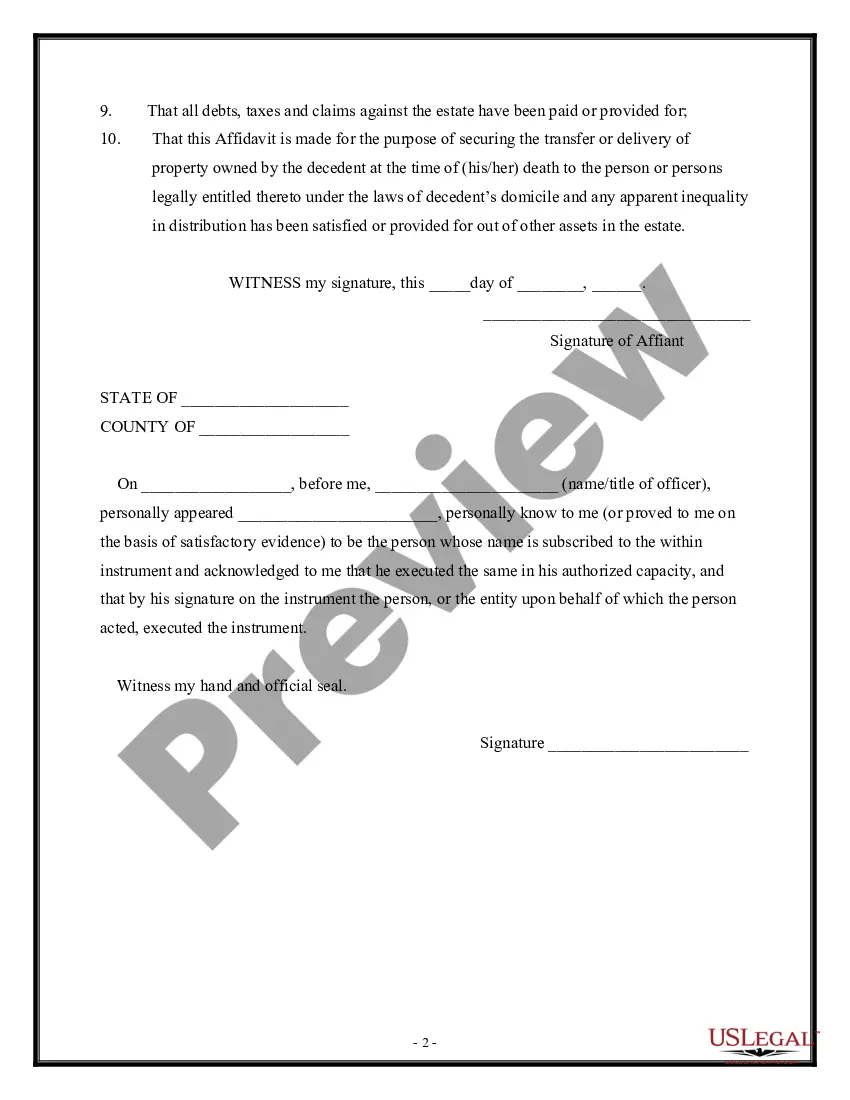

How to fill out Affidavit Of Domicile For Deceased?

You are able to invest several hours on the Internet trying to find the legal file design which fits the federal and state needs you will need. US Legal Forms gives 1000s of legal kinds that are reviewed by specialists. It is simple to download or print out the Connecticut Affidavit of Domicile for Deceased from the assistance.

If you currently have a US Legal Forms account, you may log in and click on the Acquire key. Following that, you may comprehensive, modify, print out, or signal the Connecticut Affidavit of Domicile for Deceased. Each legal file design you buy is your own eternally. To acquire another version for any purchased form, go to the My Forms tab and click on the related key.

If you use the US Legal Forms web site the first time, adhere to the basic instructions beneath:

- Initial, be sure that you have chosen the right file design for your area/town of your choosing. Browse the form outline to make sure you have selected the correct form. If readily available, take advantage of the Preview key to appear throughout the file design also.

- In order to get another edition of the form, take advantage of the Search field to get the design that fits your needs and needs.

- After you have identified the design you want, click Buy now to move forward.

- Find the prices program you want, type in your accreditations, and register for an account on US Legal Forms.

- Complete the deal. You can use your charge card or PayPal account to cover the legal form.

- Find the format of the file and download it to your gadget.

- Make modifications to your file if needed. You are able to comprehensive, modify and signal and print out Connecticut Affidavit of Domicile for Deceased.

Acquire and print out 1000s of file templates using the US Legal Forms website, which provides the greatest collection of legal kinds. Use expert and condition-distinct templates to tackle your company or specific requirements.

Form popularity

FAQ

You are a resident for the current taxable year if: Connecticut was your domicile (permanent legal residence) for the entire taxable year; or. You maintained a permanent place of abode in Connecticut during the entire taxable year and spent a total of more than 183 days in Connecticut during the taxable year.

Rules for Determining Days Within and Outside of Connecticut An individual is considered a Connecticut resident for income tax purposes if he or she maintained a permanent place of abode here during the tax year and spent more than 183 days here (i.e., Connecticut days).

The executor or administrator of the decedent's estate must sign and file Form CT?706 NT. If there is no executor or administrator, then each person in actual or constructive possession of any property of the decedent must file Form CT?706 NT.

Connecticut Estate Tax Return (for Nontaxable Estates) For estates of decedents dying during calendar year 2022 (Read instructions before completing this form.)

A Connecticut Resident is an individual that is domiciled in Connecticut for the entire tax year. If you maintained a permanent place of abode in Connecticut and spent more than 183 days in the state, you are also considered to be a resident.

For estates of decedents dying during 2023, the Connecticut estate tax exemption amount is $12.92 million. Therefore, Connecticut estate tax is due from a decedent's estate if the Connecticut taxable estate is more than $12.92 million.

General Instructions: Generally, whenever a decedent is claimed to be a nonresident of Connecticut, the fiduciary of the decedent's estate must file Form C-3 UGE, State of Connecticut Domicile Declaration. All questions must be answered fully for the declaration to be considered complete.