Vermont Agreement between Sales Agent and Manufacturer - Distributor

Description

How to fill out Agreement Between Sales Agent And Manufacturer - Distributor?

If you intend to finalize, download, or print legal document themes, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's straightforward and efficient search functionality to find the documents you need.

Various themes for business and personal uses are organized by categories and regions, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the payment. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Vermont Agreement between Sales Agent and Manufacturer - Distributor.

- Use US Legal Forms to obtain the Vermont Agreement between Sales Agent and Manufacturer - Distributor within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Vermont Agreement between Sales Agent and Manufacturer - Distributor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

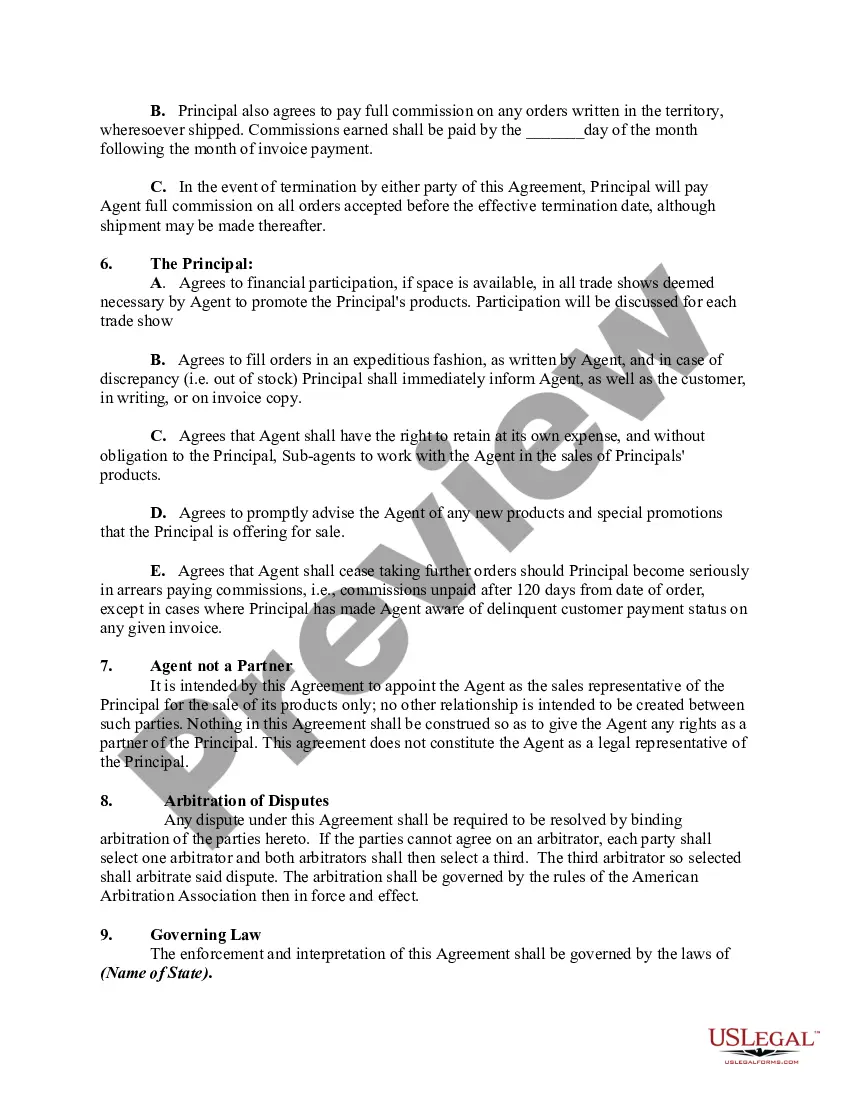

- Step 2. Use the Review option to inspect the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Vermont is not a no tax state; it has various types of taxes, including sales tax, income tax, and property tax. This means that individuals and businesses should be aware of their tax obligations when entering agreements, such as a Vermont Agreement between Sales Agent and Manufacturer - Distributor. Staying compliant with tax regulations is crucial for business integrity and successful operations.

Vermont does not tax certain items, which may include groceries, prescription medications, and some medical supplies. Understanding these exemptions can benefit businesses and consumers alike, particularly those engaged in a Vermont Agreement between Sales Agent and Manufacturer - Distributor. Familiarizing yourself with these tax laws can optimize your business operations and improve customer satisfaction.

Yes, Vermont does impose a state sales tax on various goods and services. The standard sales tax rate is 6%, but specific categories, like meals and alcohol, have a higher rate. If you are entering into a Vermont Agreement between Sales Agent and Manufacturer - Distributor, it's essential to understand how this sales tax impacts your transactions. This knowledge will help you navigate your financial responsibilities effectively.

The main difference between a distributor and a sales rep lies in their roles and responsibilities. A distributor purchases products from manufacturers to resell them directly to retailers or customers, while a sales rep acts as a representative for the manufacturer to promote and sell products without holding inventory. In the context of a Vermont Agreement between Sales Agent and Manufacturer - Distributor, understanding these distinctions can help clarify the expectations and obligations of each party. Whether you need guidance on drafting this agreement or want to navigate the complexities of sales relationships, our platform can provide valuable resources.

To create a sales agreement, start by identifying the parties involved, including the sales agent and the manufacturer- distributor. Next, outline the specific terms of the agreement, such as commission rates, payment terms, and product delivery expectations. Ensure that you include clauses for termination, confidentiality, and dispute resolution to protect both parties. You can utilize US Legal Forms to guide you through the process of drafting a comprehensive Vermont Agreement between Sales Agent and Manufacturer - Distributor that meets your needs.

The right of way in Vermont pertains to the legal right granted to pass through a property owned by another party. This concept is crucial for infrastructure development, as it enables access to roads, utilities, and other essential services. In the context of a Vermont Agreement between Sales Agent and Manufacturer - Distributor, addressing right of way considerations can help prevent complications and ensure that logistics flow smoothly, benefiting all parties.

The first right of refusal in Vermont refers to a contractual agreement which allows a party to have the first opportunity to acquire property or rights before other interested parties. When a Vermont Agreement between Sales Agent and Manufacturer - Distributor includes this provision, it supports collaboration and strengthens trust among parties involved. It can lead to better business strategies and smoother transactions while keeping both parties informed.

While the right of first refusal can be beneficial, it also has downsides. For instance, it may limit the seller's ability to negotiate freely, as they need to inform the ROFR holder of any offers they receive. Additionally, if the initial party does not act on the opportunity, they may miss out on other potential benefits. Deciding to include a ROFR in the Vermont Agreement between Sales Agent and Manufacturer - Distributor requires careful consideration of these factors.