US Legal Forms - among the biggest libraries of authorized kinds in the USA - delivers a wide range of authorized file web templates it is possible to down load or print. Making use of the internet site, you may get 1000s of kinds for company and individual uses, sorted by categories, says, or key phrases.You will find the most up-to-date models of kinds just like the Connecticut Homestead Declaration following Decree of Legal Separation or Divorce in seconds.

If you have a subscription, log in and down load Connecticut Homestead Declaration following Decree of Legal Separation or Divorce from the US Legal Forms catalogue. The Acquire key will show up on each develop you see. You have access to all formerly acquired kinds in the My Forms tab of your own accounts.

In order to use US Legal Forms for the first time, listed below are easy recommendations to obtain started out:

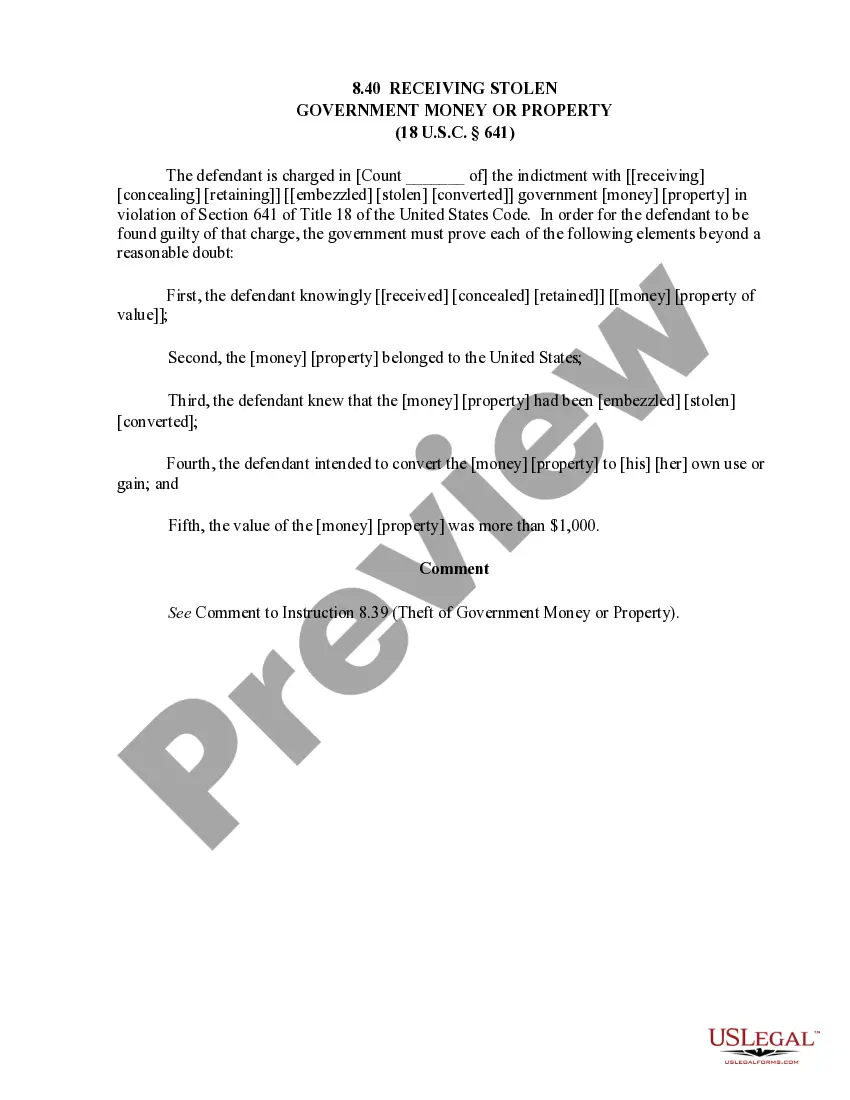

- Be sure to have picked out the correct develop for your town/county. Click on the Preview key to review the form`s content material. Look at the develop outline to ensure that you have selected the appropriate develop.

- When the develop does not match your needs, make use of the Search field on top of the display to get the one who does.

- When you are pleased with the shape, affirm your selection by simply clicking the Get now key. Then, pick the costs prepare you want and offer your accreditations to register for an accounts.

- Process the transaction. Make use of your bank card or PayPal accounts to accomplish the transaction.

- Select the structure and down load the shape on the system.

- Make alterations. Load, revise and print and indicator the acquired Connecticut Homestead Declaration following Decree of Legal Separation or Divorce.

Each and every web template you put into your money does not have an expiration day and is your own property eternally. So, if you would like down load or print one more copy, just go to the My Forms segment and click on about the develop you need.

Gain access to the Connecticut Homestead Declaration following Decree of Legal Separation or Divorce with US Legal Forms, by far the most comprehensive catalogue of authorized file web templates. Use 1000s of professional and status-distinct web templates that meet your small business or individual needs and needs.