Connecticut Sample Letter for Checks for Settlement

Description

How to fill out Sample Letter For Checks For Settlement?

If you need to compile, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Be proactive and acquire, and print the Connecticut Sample Letter for Checks for Settlement with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to locate the Connecticut Sample Letter for Checks for Settlement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to obtain the Connecticut Sample Letter for Checks for Settlement.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Ensure you have selected the form for your correct city/state.

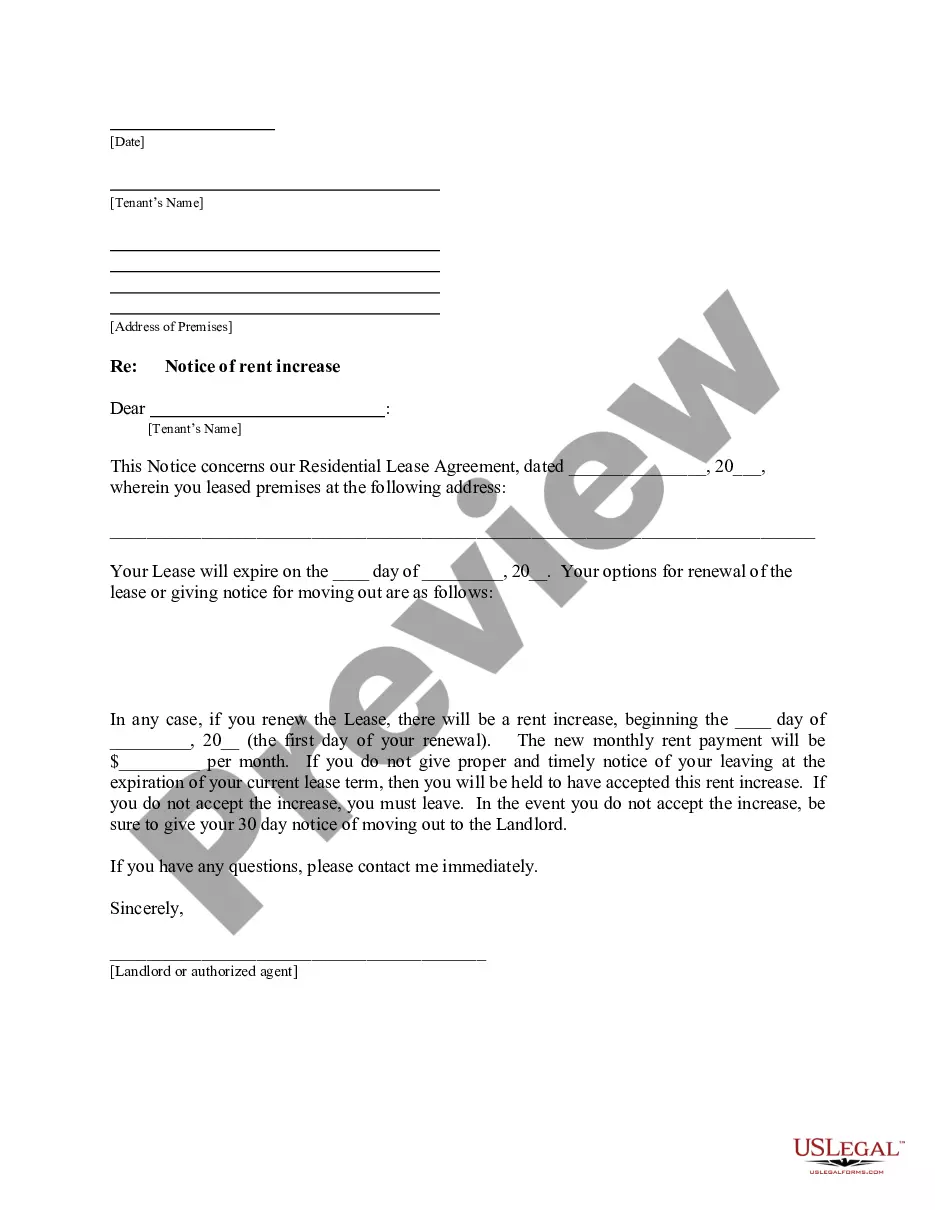

- Use the Preview option to review the form's content. Don't forget to read the details.

- If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form format.

- Once you have found the form you need, click the Acquire now button. Choose the payment plan you prefer and enter your information to register for the account.

- Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the transaction.

- Select the format of the legal form and download it to your device.

- Complete, modify, and print or sign the Connecticut Sample Letter for Checks for Settlement.

Form popularity

FAQ

A settlement offer typically consists of a formal letter outlining the terms proposed by one party to resolve a dispute. It includes the offer amount, the context of the case, and any conditions attached to the offer. You can refer to a Connecticut Sample Letter for Checks for Settlement for a clear format and to ensure all essential elements are included.

A bank settlement letter is a document issued by a bank confirming that a debt has been settled. It usually includes details such as the amount settled and any remaining balance. If you need guidance on creating such documents, a Connecticut Sample Letter for Checks for Settlement can provide useful templates and examples.

An acceptable settlement offer typically depends on the specifics of the case, including the damages incurred and the likelihood of winning in court. It's important to make your offer reasonable yet fair, taking into account the other party's position. Utilizing a Connecticut Sample Letter for Checks for Settlement can help you structure your offer effectively, leading to a more favorable negotiation.

To write a settlement offer letter, start by clearly stating your intention to settle the dispute. Include the details of the case, the amount you propose for the settlement, and any relevant deadlines. Using a Connecticut Sample Letter for Checks for Settlement can guide you in formatting your letter correctly and ensuring you include all necessary information.

Common mistakes in settlement letters include being vague about the terms, failing to provide supporting documentation, and not clearly stating the desired outcome. Additionally, overly emotional language or threats can undermine your position. To avoid these pitfalls, refer to a Connecticut Sample Letter for Checks for Settlement, which can guide you in maintaining a professional tone and clear structure.

When writing a letter for a settlement amount, be clear and specific about the figure you are proposing. Explain your rationale behind this amount and reference any documentation that supports your claim. Using a Connecticut Sample Letter for Checks for Settlement can help you present this information clearly and professionally.

To write a strong settlement letter, you should begin with a clear statement of your position, followed by a detailed explanation of relevant facts. Include any supporting evidence that reinforces your case and clearly state your desired outcome. A Connecticut Sample Letter for Checks for Settlement can serve as an excellent template to ensure your letter is persuasive and well-organized.

A good sentence for settlement might be, 'I believe a fair resolution to our dispute can be achieved with a settlement of amount.' This statement is straightforward and conveys your willingness to resolve the issue amicably. Incorporating a Connecticut Sample Letter for Checks for Settlement will provide additional context and professionalism to your communication.

When writing a letter asking for a full and final settlement, start by clearly stating your intent. Include details about the dispute, your proposed settlement amount, and any conditions for acceptance. A well-crafted Connecticut Sample Letter for Checks for Settlement can guide you in ensuring your request is professional and compelling.

An example of a settlement offer letter includes a detailed explanation of the circumstances surrounding the dispute, followed by a proposed settlement amount. You should clearly outline the reasons for your offer and any relevant documentation that supports your position. Utilizing a Connecticut Sample Letter for Checks for Settlement can help structure your offer effectively.